This post is an excerpt from the Q2 2025 Forisk Research Quarterly (FRQ), which includes forest industry analysis and timber price forecasts for North America.

In the wood pellet industry, labor costs are often one of the top three expenses during the production process. In general, manufacturers try to optimize labor costs to achieve the highest output of a given product with the least amount of labor, thus increasing margins. Using Energy Information Administration pellet production and full-time employee equivalent data, we can analyze labor trends at pellet manufacturing facilities on a “ton per full-time employee” basis. Conventional wisdom would suggest that newer, larger and more capitalized facilities would generally have higher production levels per employee and improve those levels as time progresses.

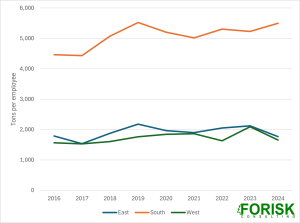

For the East and West Regions, non-utility grade facilities are considered while in the South, only utility (export) grade facilities are considered between 2016 and 2024. In general, the theory discussed above is borne out in the data. In the East, the tons produced per employee actually decreased 1%, from 1,786 tons to 1,764 tons per employee. The West region did improve its productivity, going from 1,561 tons per employee to 1,652 tons per employee, a 6% gain. The South, the region with the largest and newest pellet manufacturing facilities, saw double-digit productivity gains. In 2016, the utility grade pellet producers were producing 4,465 tons per employee and that increased to 5,496 tons per employee in 2024, a 23% gain in productivity.

To learn more about the Forisk Research Quarterly (FRQ), click here or email Nick DiLuzio at ndiluzio@forisk.com.

Leave a Reply