This post includes data from the Forisk Wood Fiber Review. To learn more about the Forisk Wood Fiber Review, please contact Nick DiLuzio (ndiluzio@forisk.com).

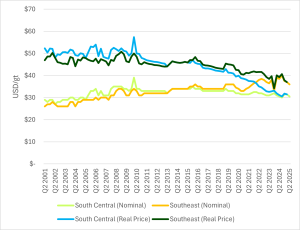

In nominal terms (not adjusted for inflation), delivered softwood residual chip prices increased by $1.50 per green ton in the South Central U.S. and by $10.00 per green ton in the Southeast between Q2 2001 and Q2 2025, according to price data from the Forisk Wood Fiber Review. These nominal gains lag consumer price inflation, effectively reducing the real value of chips in both regions over time.

The data highlights two major periods of divergence between nominal chip prices and inflation (Figure 1). From 2001 to 2010, softwood residual chip prices generally tracked inflation (flat real prices). The first significant divergence began after the Great Recession, a period marked by the closure of numerous pulp and paper mills across the South due to broader economic conditions. Falling demand for chips kept nominal prices flat while inflation slowly lowered the “real” value of chips. A second inflection occurred during the COVID-19 pandemic and the subsequent surge in inflation, which did not increase nominal chip prices at the same pace.

Adjusted using the Q1 2025 Consumer Price Index (PCI), Q2 2001 prices would be approximately $52.00 per green ton (gt) in today’s dollars in the South Central region and $47.00/gt in the Southeast. This represents a real value decline of $21.00/gt and $10.00/gt, respectively, compared to the nominal price increases. While comparing chip price growth to consumer price inflation may not capture its growth over other industrial feedstocks or the cost of wood processing, it highlights the change in chip value relative to the U.S. dollar over time.

Data Sources: Forisk Wood Fiber Review

The Forisk Wood Fiber Review maintains a region and product specific price database (available for purchase) dating back to Q2 of 2001.

Leave a Reply