This post is the second in a series related to the Q4 2025 Forisk Research Quarterly (FRQ), which includes forest industry analysis and timber price forecasts for North America. To learn more or to subscribe to the FRQ, please contact Nick DiLuzio (ndiluzio@forisk.com).

As part of this quarter’s featured research in the FRQ, Amanda Lang is leading a deep dive into the driver’s of the current contraction in domestic pulp capacity. One of the common questions we hear from clients regards the impact of international trade on the U.S. domestic pulp industry. So who are the largest consumers of wood pulp? And who produces the world’s pulp?

Pulp Consumption and Production

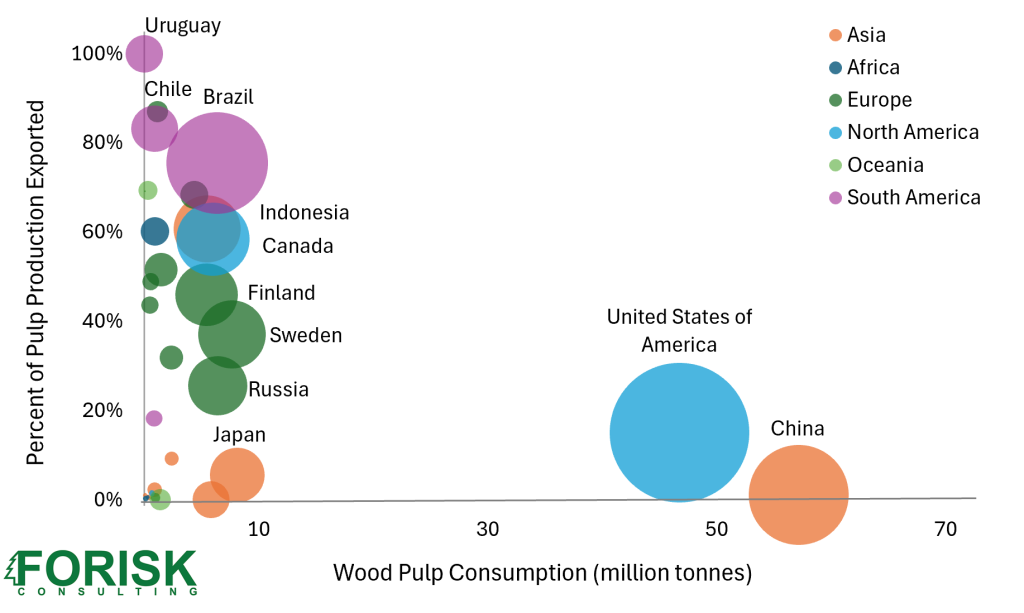

The top consumers are, not surprisingly, the top two economies. The U.S. and China are by far the largest wood pulp consumers, each consuming over 40 million tonnes per year, with no other country consuming more than 10 million tonnes as of 2023 (Figure).

The production to support all that consumption is more widely distributed. The U.S., as the largest pulp producer (48 million tonnes), is effectively self-sufficient. The U.S. exports about 15% of their pulp production and imports close to the same volume. While U.S. exports are almost entirely softwood pulp, imports are split between hardwood and softwood. China is the third largest pulp producer (25 million tonnes) but is a net importer of 33 million tonnes, nearly 17% of the world’s total wood pulp production.

Almost all the other large producers in the world are exporting some portion of their production…and China is a major destination for much of that volume. South America is a clear example. Brazil is the second largest pulp producer in the world (25 million tonnes), yet Brazil exports 75% of their pulp production. Chile and Uruguay both export 80% or more of their pulp production. Most of Europe’s major producers export over 25% of their pulp. In Asia, only Indonesia is a major pulp exporter, with other Asian nations importing to support their consumption.

Historical Context

To provide some context on the shifts in the industry, it is helpful to compare these data to 30 years ago. In 1993, neither Brazil nor China were among the five largest wood pulp producers or consumers. Only the U.S. (57 million tonnes) consumed more than 15 million tonnes of pulp, and it remained a net pulp exporter. With Canada as the second largest pulp-producing country, North America represented over 50% of the world’s wood pulp production. Combined, the U.S. and Canada lost 20 million tonnes of annual wood pulp production over the last 30 years. In 2023, the two countries represented just over 30% of the world’s wood pulp. The U.S. remains self-sufficient, and the largest pulp producer, but growth in production and consumption overseas continues to alter the international dynamics of the pulp industry.

It would also be interesting to see which companies are the largest producers and how that affects strategies. For example, in the USA International Paper Company and Smurfit WestRock are major international producers and their accumulation of mills has allowed them to shut down several and consolidate production in remaining mills. In Brazil, Suzanno is the world’s largest producer of bleached pulp, Arauco is building the largest pulp mill in the world, and Fibria is a major producer. It would be interesting to see the largest 20 or 25 producers to see how they fall among USA, Brazil, Scandinavia, Asia, etc.