This post is the first in a series related to the Q1 2026 Forisk Research Quarterly (FRQ), which includes forest industry analysis and timber price forecasts for North America. To learn more or to subscribe to the FRQ, please contact Nick DiLuzio (ndiluzio@forisk.com).

2025 Housing Activity

Economic data delays continue following the extended Q4 2025 government shutdown, with housing start data two months behind typical reporting schedules. Initial data through October 2025 suggests the U.S. housing market slowed materially heading into the second half of the year. Between August and October, 23,000 fewer housing starts were reported in 2025 than the same period in 2024. Total starts now lag 2024 volume by 0.7% (8,000 fewer starts from January through October). Single-family starts are down 7% year-to-date relative to 2024, while multi-family starts are up nearly 18%. Housing completions totaled 1.2 million units through October, down 9% from last year’s pace.

Near-term Housing Outlook

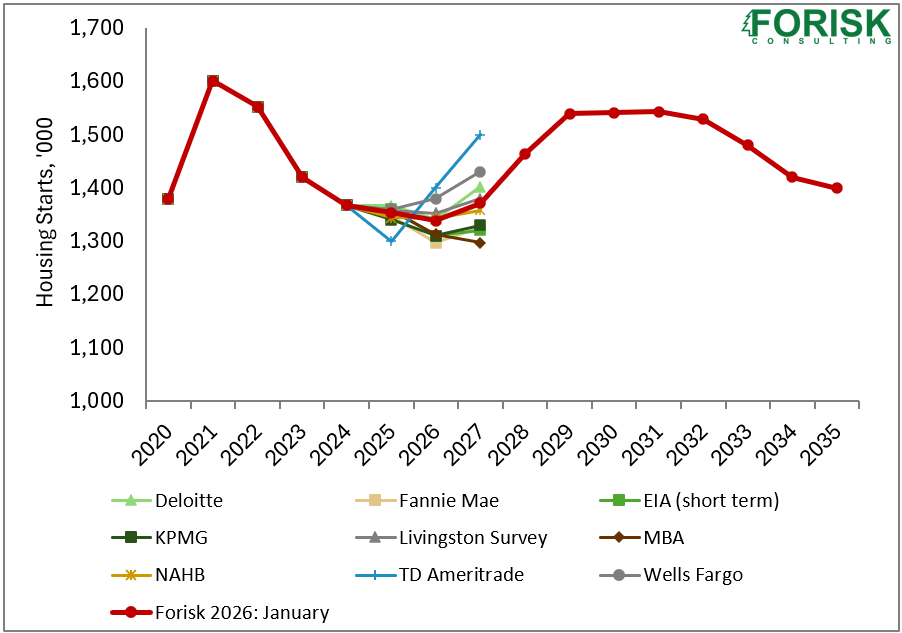

Forisk forecasts housing starts totaled 1.35 million units in 2025. We project a 1% decline to 1.34 million units in 2026, followed by a recovery to 1.37 million units in 2027 (Figure 1). The outlook for 2027 housing starts fell 10% compared to our Q1 2025 forecast, though the compilation of independent forecasts in our 2027 outlook vary by 200 thousand starts. One forecast anticipates a further decline in housing starts from 2026 to 2027, while two anticipate growth over 4%. The majority predict 2% or less growth from 2026 to 2027. Mortgage rate forecasts reported by Fannie Mae, the MBA, the NAHB, the NAR, PNC Bank, Deloitte, and Wells Fargo anticipate 30-year fixed rates remain above 6% beyond 2027, contributing to sluggish growth in housing construction.

Data Sources: Deloitte, EIA, Fannie Mae, KPMG, Livingston Survey, Mortgage Bankers Association (MBA), National Association of Home Builders (NAHB), TD Ameritrade, Wells Fargo.

Starts and Completions Returning to Balance

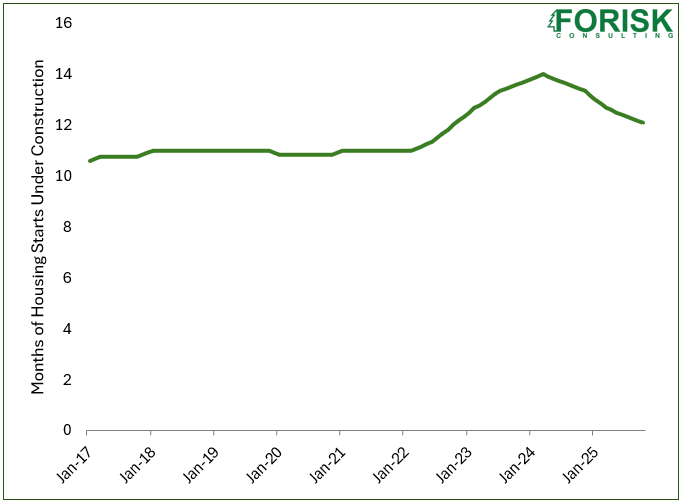

A surge in housing starts during the pandemic created a significant backlog of units under construction as supply chains and builders struggled to keep pace with demand. From 2017 through 2021, the number of housing units under construction typically aligned with an eleven-month rolling sum of housing starts (Figure 2). However, as demand peaked in 2023, completions lagged and units under construction ballooned to the equivalent of 14 months of housing starts. Over the last 27 months, the trend reversed, with completions exceeding starts in all but three months. The backlog of units under construction returned to a twelve-month rolling sum of starts in 2025 and continues to trend toward the pre-pandemic average.

Data Source: U.S. Census Bureau

Leave a Reply