This post is the first in a series related to the Q4 2025 Forisk Research Quarterly (FRQ), which includes forest industry analysis and timber price forecasts for North America. To learn more or to subscribe to the FRQ, please contact Nick DiLuzio (ndiluzio@forisk.com).

YTD Housing Activity

The U.S. housing market kept pace with last year’s activity, as housing starts through August totaled 935 thousand units (up 6 thousand units from last year’s pace through August). Housing completions totaled 1.0 million units through August, down 7% from last year’s pace. Authorized building permits declined 6% over last year’s pace, signaling limited growth in housing starts for the year ahead.

Year-end expectations and Near-term Housing Outlook

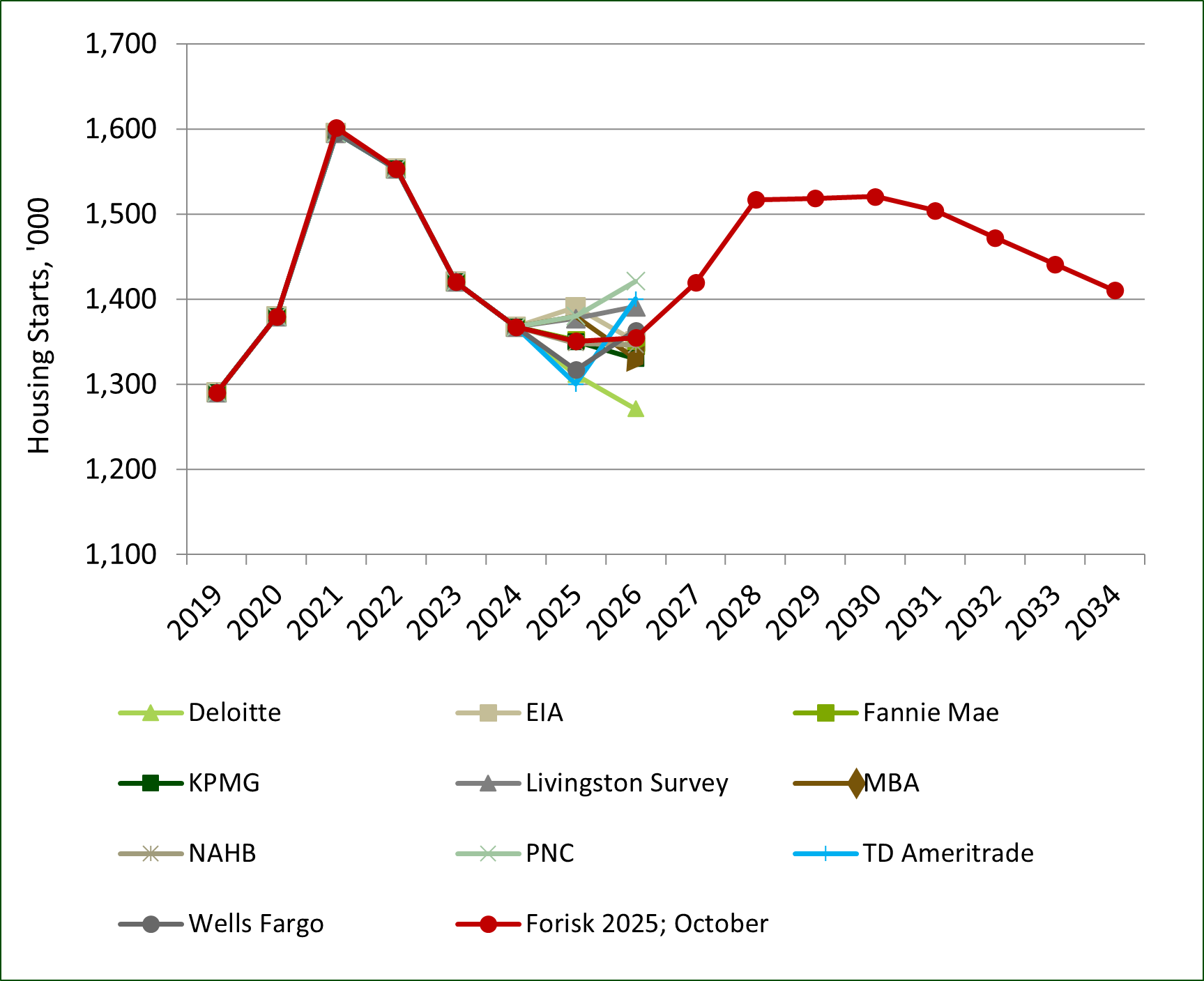

Forisk forecasts housing starts total 1.351 million units in 2025, with a similar total of 1.355 million units expected for 2026. A combination of stagflationary pressures and elevated mortgage rates are expected to contribute to limited growth in housing starts over the near-term. An average of mortgage rate forecasts reported by Fannie Mae, the MBA, the NAHB, the NAR, PNC Bank, Deloitte, and Wells Fargo suggest 30-year fixed rates will remain above 6% in 2026. Forisk projects a recovery to 1.419 million units in 2027.

Data Sources: Deloitte, EIA, Fannie Mae, KPMG, Livingston Survey, Mortgage Bankers Association (MBA), National Association of Home Builders (NAHB), PNC Bank, TD Ameritrade, Wells Fargo.

Expectations of Repair and Remodeling Expenditures

While near-term growth in housing starts is expected to be slow, repair and remodeling activity may stabilize or further support wood demand. The U.S. housing stock is aging, with one estimate suggesting that 350 thousand units are in need of replacement each year. Harvard’s JCHS forecasts homeowner expenditures on improvements and repairs in 2026 will total $520 billion, representing a 2.2% increase over 2025 forecasts and a 3.2% increase over observed expenditures in 2024.

Leave a Reply