This post is an excerpt from the Southeast chapter in the Q3 2025 Forisk Wood Fiber Review (WFR), which provides a quarterly review of pulpwood, chips, biomass markets and trade in the U.S. and Canada.

Mill News and Market Impacts

As the Southeast region was still digesting the wood flow implications of the closure of Georgia-Pacific’s Cedar Springs mill earlier this year, the announced closure of two facilities on the coast brought more change. International Paper closed the Savannah and Riceboro, GA packaging mills in addition to their Riceboro, GA sawmill in September 2025. These closures will remove more than 4.6 million tons of wood demand. The closure of the IP mills in South Georgia means that residual chips will continue to gain “fibershare” at the remaining facilities. American Industrial Partners (AIP) agreed to purchase the Global Cellulose business from International Paper for $1.5 billion. Facilities in this transaction are in NC, MS, GA, and VA. Additionally, Packaging Corporation of America purchased the packaging business from Greif for $1.8 billion. This purchase includes the Riverville, VA pulp and paper facility.

Other updates for the Southeast region include:

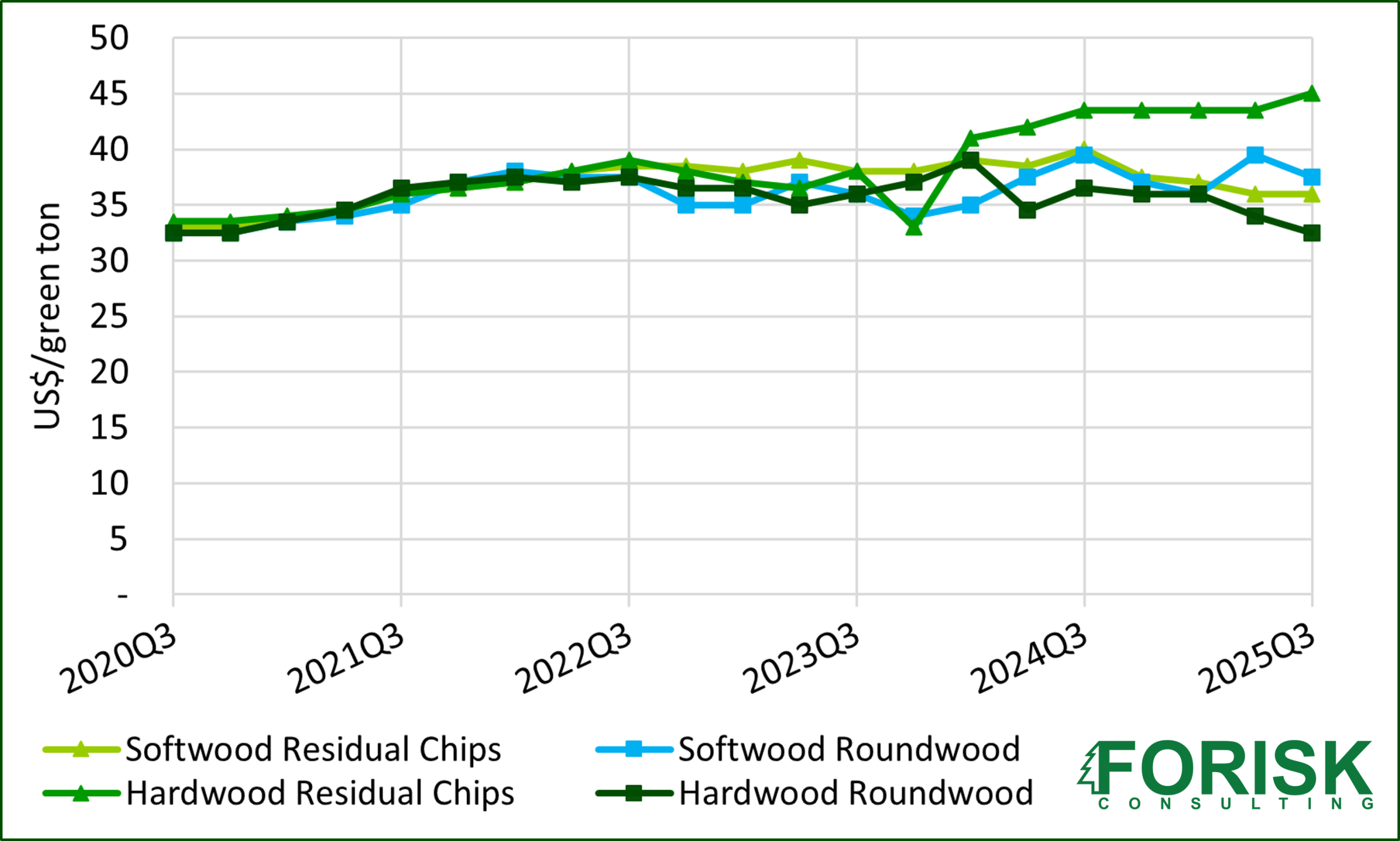

- Softwood roundwood and hardwood roundwood prices decreased 5% and 4%, respectively this quarter. Softwood residual chip prices were flat and hardwood chips increased 3% (Figure).

- Most fiber consuming facilities are carrying sufficient inventory with tight quotas, though suppliers should experience some relief as mills prepare for the winter wet season. Many buyers are also pushing the post-Hurricane Helene roundwood price decreases as the new “normal” for the region.

- Fiber consuming facilities with stumpage crews are re-evaluating the need to carry that cost and risk.

- MDF, OSB and lumber facilities within larger manufacturing portfolios continue to take “rotating market related downtime” in the region.

- Some softwood lumber producers are carrying less log inventory to preserve liquidity and focus on incoming log quality.

Data Source: Forisk Wood Fiber Review (All Prices in US$/green ton)

To learn more about the Wood Fiber Review, click here or email Nick DiLuzio at ndiluzio@forisk.com.

Leave a Reply