This is the fifth in a series related to Forisk’s 2014 mid-year forecast of U.S. timber prices.

For the first time since 2006, U.S. hardwood lumber consumption will likely exceed 10 billion board feet in 2014. The top three hardwood lumber consuming sectors are pallets and crating; export markets; and railroad ties. As of August 2014, all three sectors remain on pace to hit their highest volumes since at least 2005. According to Hardwood Review, home-related (residential) applications alone – including flooring, furniture, cabinets, etc. – account for nearly 30% of the U.S. total.

To feed this sector, the U.S. has a vibrant and diverse hardwood forestland owning and investing sector. For example, The Forestland Group consistently ranks as one of the three largest timberland investment managers in the United States, with 3.2 million acres under management as of March 2014 (Forisk Timberland Owner List).

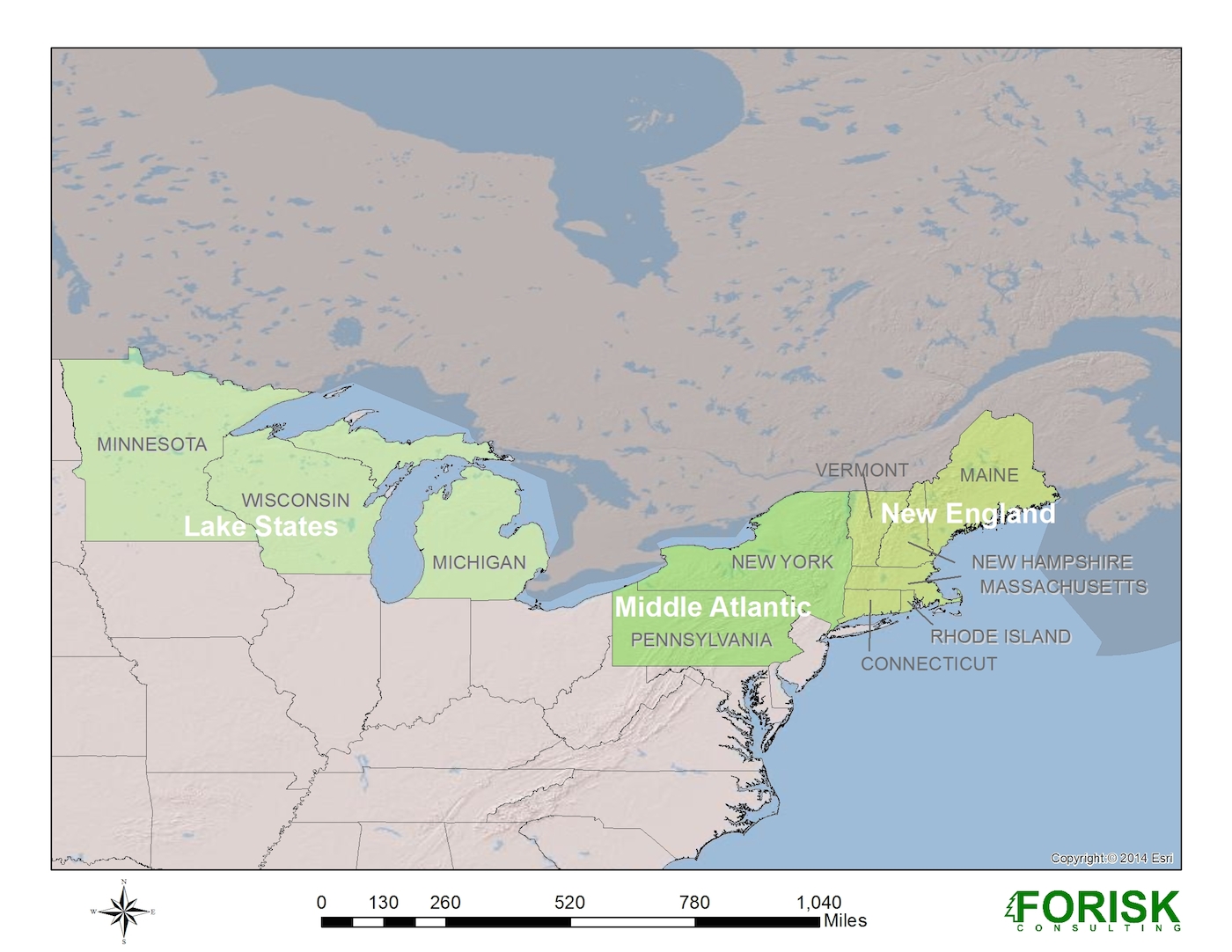

Over the past two year, Forisk has developed hardwood log forecasts that incorporate client feedback. The current U.S. Forisk Forecast, in addition to softwood prices for the U.S. South and Pacific Northwest, includes hardwood log prices for three regional markets in the U.S. North: the Lake States, the Middle Atlantic and New England (see map). To date, prices covered in the hardwood log forecast include Black Cherry; Hard Maple; Soft Maple; Red Oak; and White Ash.

Forisk Forecast Coverage for U.S. North

To test macroeconomic and regional market assumptions, we apply three scenarios for hardwood log prices:

- Base: assumes Forisk’s baseline housing and lumber projections. Key drivers include the relationships between U.S. manufacturing indices and housings starts, and softwood versus hardwood lumber demand.

- High: assumes stronger pricing resulting from higher levels of construction/manufacturing demand and increased hardwood exports. We compare projections to what the market has been able to pay in the past, as hardwood log markets actively substitute across species to help mitigate high raw material costs and low specie-specific supplies.

- Slow: applies Forisk’s “Slow” housing scenario and assumes reduced demand from industrial and export markets. We compare projections to market troughs to estimate the extent to which demand would shrink to reduce prices over the ten-year period.

Hardwood prices have unique challenges as compared to markets for pine, Douglas fir or hemlock. For example, the use of differing log scales – such as Scribner, Doyle and International ¼ – remains persistent and common across local markets. Appraisers and investors typically report pricing in the local scale rather than convert to a common scale. In the end, hardwood log markets represent the ultimate in localized analysis.

To learn more about the 2014 Mid-Year Forisk Forecast or Forisk’s market-specific forecasts of stumpage (timber) and delivered wood prices for individual wood-using facilities or timberland ownerships in the US, contact Brooks Mendell at bmendell@forisk.com, 770.725.8447.

Leave a Reply