This post summarizes Forisk research from 2015 assessing pulpwood markets and the relative competitiveness of the pulp and paper sector in the U.S. South.

Phone rings. Timberland investor asks, “Hey, is the pulp sector in the U.S. South at risk?”

I pause to thank the gods for an easy question before responding. “No.” [Deep breath.] “Let’s review the situation together….”

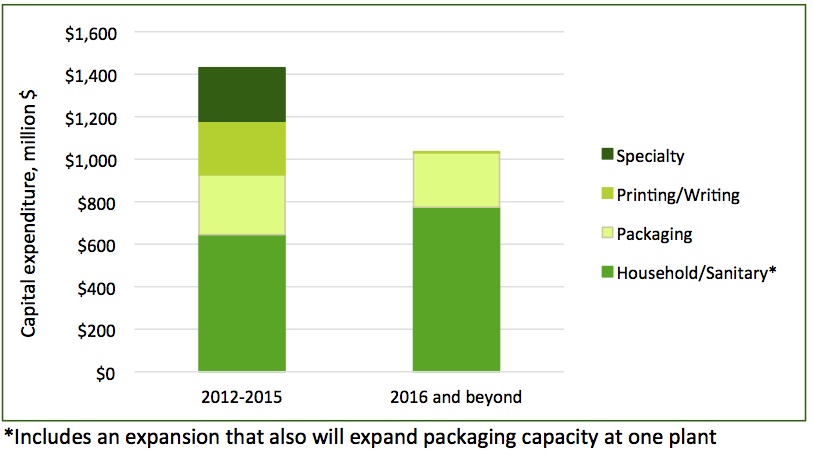

Few “weak” pulp mills exist in the U.S. South. While paper and paperboard production in the U.S. declined ~19% since 1997, the industry rationalized accordingly, pruning the weakest players. Overall, domestic production stabilized and the sector in the South has invested over $1.5 billion over the past three years (Figure 1), with $1 billion plus of investment activity announced moving forward.

Figure 1. Capital Investments in the Pulp/Paper Sector by Completion Date

Source: Q3 2015 Forisk Research Quarterly (FRQ)

Pine pulpwood prices in the South will hold or fall in many markets as residual chips return with housing markets. With housing starts expected to increase another 30 to 40% over the next five years, from ~1.1 million to over 1.5 million, and the U.S. South capturing an increasing share of U.S. softwood lumber production, residual chips from sawmills become a significant, needle-moving force in many local markets. Previous research into the effects of pellet markets and residual chips in the U.S. South finds that improved housing provides ~$1.40 per ton relief on pine pulpwood prices, on average. In addition, the South has the most competitive raw material prices for pulp mills in the United States.

Question: how many pulp mills “reallocated” capacity from the South to other parts of the country because of raw material supplies or prices?

Answer: somewhere between zero and zero.

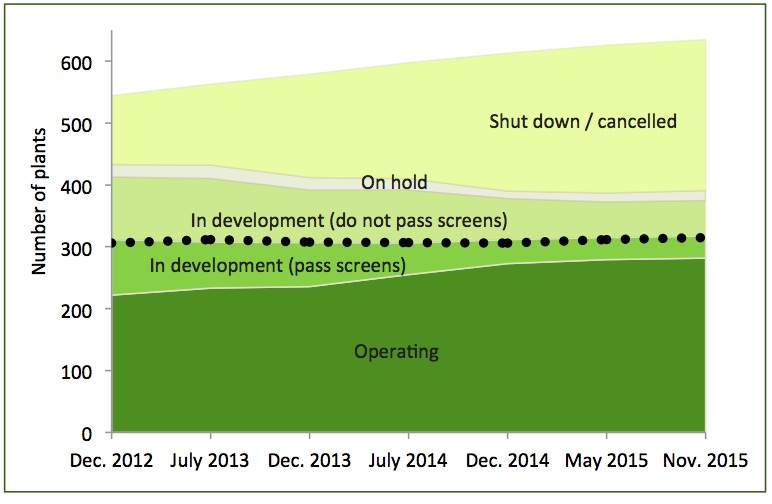

Forest industry economics reinforce the competitive positive of pulp mills versus bioenergy and OSB. Ongoing research into the forest product industry’s “ability-to-pay” for wood raw materials reinforces the economic realities of pulpwood markets in the South. While currently low OSB and softwood lumber prices skew the results relative to historic norms, the analysis confirms the supremacy of pulp mills relative to pellet facilities and other pulpwood users. In fact, the continuing struggles associated with the bioenergy sector reinforce this. Since 2012, the fastest growing category of wood bioenergy projects in the U.S. is “Shut down/Cancelled” (Figure 2).

Figure 2. Wood Bioenergy Plant Progress, December 2012 – November 2015

Source: Q4 2015 Forisk Research Quarterly (FRQ)

Overall wood supplies remain plentiful. In addition to increasing residual chip flows, the South boasts abundant pine inventories. While analysis tends to focus on how most of this growth has been in grade (sawtimber), local analysis of wood procurement activity shows the “flexible nature” of markets that, based on stumpage prices and wood specs, simply reallocate volume across the product spectrum. Who wouldn’t buy a better cut of meat if there were plenty to go around? While pulpwood supplies, in some local markets, have tightened, total wood supplies have not and continue to increase.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Leave a Reply