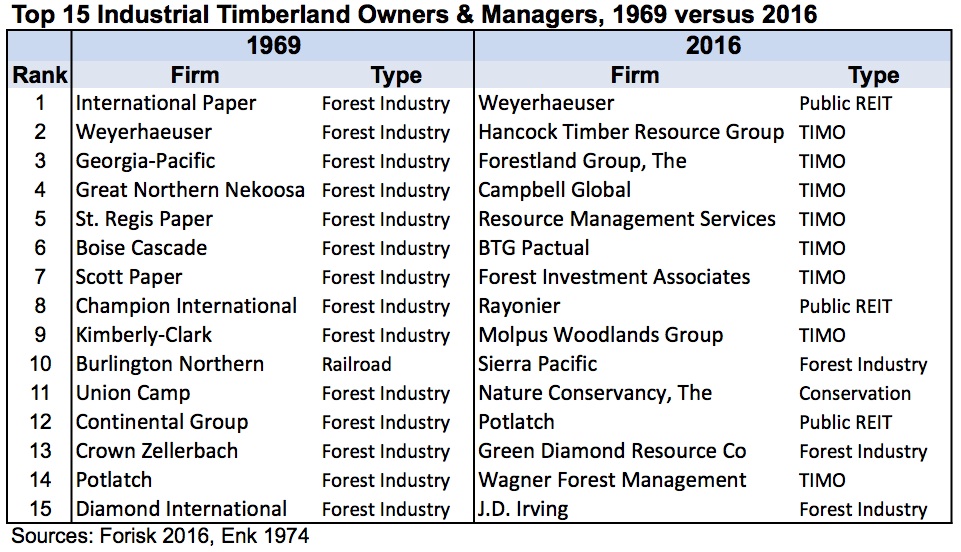

In 1969, Joe Namath led the New York Jets over the Baltimore Colts in the Super Bowl, Neil Armstrong became the first person to walk on the moon, and 14 of the 15 largest U.S. timberland owners were vertically-integrated, mill-owning forest industry firms.

In 2016, we use ‘text’ as a verb and carry phones in our pockets. Joe Namath remains the only quarterback to win a Super Bowl for the Jets and the Colts now play in Indianapolis. And only two of the top timberland owners from 1969 hold places on the list in 2016.

We studied the concentration and conversion among the largest timberland owners and managers over the past five decades. The table below compares the top U.S. owners and managers, in order by acreage, from 1969 to 2016. What started as a sector dominated by integrated forest industry firms now features timberland specialists (in the form of REITs) and asset managers.

While the institutional timberland investment sector came of age in the 1980s, timber REITs hit the market in 1999 beginning with the conversion of Plum Creek from a master limited partnership (MLP) to a real estate investment trust (REIT). Between 1999 and 2006, four publicly-traded forest products firms converted over 12 million acres of industrial timberlands into REITs. In addition to Plum Creek, these firms included Rayonier, Potlatch, and, for less than one year, Longview Fiber. Weyerhaeuser made the conversion in 2010. In December 2013, CatchMark Timber Trust, formerly the private REIT known as Wells Timber, became the sixth public timber REIT.

While six timber REITs have traded publicly since 1999, we are left with four today. Timberland investors looking to acquire assets and timber REITs seeking to grow their asset bases both made big moves over the past 18 months. Firms in Forisk’s North American Timberland Owner & Manager List were among those that conducted at least 92 publicly known timberland transactions totaling over 9.8 million acres, including 29 transactions that exceeded 20,000 acres each.

The presence of TIMOs and REITs as both buyers and sellers continues to speak to the relative maturity of the sector, as investors continue to grapple with the reality of a constrained “solution set” of opportunities. Moving forward, the world of timberland investing will continue to struggle with within-industry maturity and outside-of-industry demand for returns.

Forisk intern Chantal Tumpach supported the research for this blog post. This post also includes excerpts from the forthcoming book “Liquid Trees: Forests as Financial Assets” by Brooks Mendell.

Leave a Reply