This is the second in a series related to Forisk’s Q3 2016 forest industry analysis and timber price forecasts for North America

Some markets are more important than others for timberland investors and forest managers. While timberland owners sell logs to mills that make poles, paper, and panels, the markets and manufacturers that drive the forest cash flows and returns to needed to justify reforestation and investment produce lumber. Softwood sawmills consume more grade logs than all other North American grade markets combined, and the value of these logs exceed any other market for stumpage or chips. U.S. markets alone consumed over 44 billion board feet of softwood lumber in 2015; the question for 2016 is “how close will we get to 50 billion?”

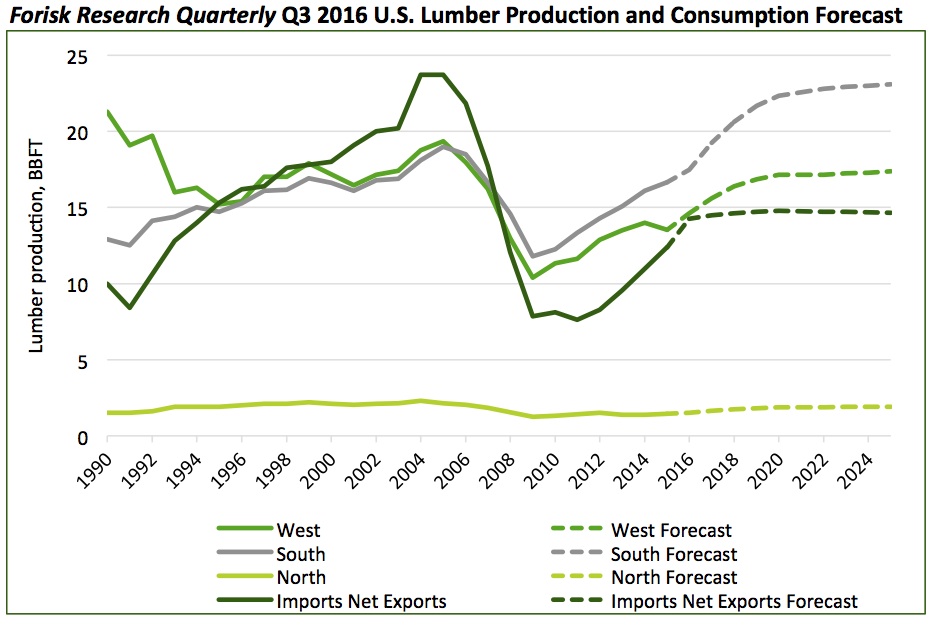

Localizing the capacity of softwood sawmills to consume wood translates into robust estimates of regional and national capacity. Regardless of the macroeconomic assumptions for housing starts, specific mills in specific markets must produce the boards. Are they out there and ready to go? Where? For softwood grade markets in the US South, US North, US Pacific Northwest and Canada, we aggregate mill-by-mill analysis with assessments of announced capacity changes to estimate total available lumber capacity. These estimates rely on the “physical facts” associated with actual mill capacities. These capacities also become constraints in local timber price models, forcing us to take positions on where new mills might be built or existing mills expanded. In quarterly work sessions, our team tests and agrees on viable pathways for projected softwood lumber production (Figure). The thinking prioritizes (1) operable closed capacity that could reopen; (2) markets with well-established infrastructures that can better absorb new demand; and (3) well-supplied markets that remain far below their historic production levels.

For North America, critical analysis includes Canada’s softwood lumber industry. What is Canada’s ability to manufacture and export softwood lumber to the United States? And what is the status of Canada’s domestic housing markets? Critically for 2016 YTD, Canada housing starts softened, building homes at the lowest rate since 2013. This freed up softwood lumber volumes for export to the U.S. Still, the physical facts of Canada’s softwood sawmill industry have changed, capping its ability to produce and export softwood lumber. Unless Canada reopens old mills or builds new ones, Forisk’s ongoing research indicate that Canada’s maximum softwood lumber production, assuming all open and idled mills operate at 100%, barely hits 30 billion board feet, or nearly 20% less than ten years ago.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Leave a Reply