This is the second in a series related to Forisk’s Q4 2017 forest industry analysis and timber price forecasts for the United States and Canada.

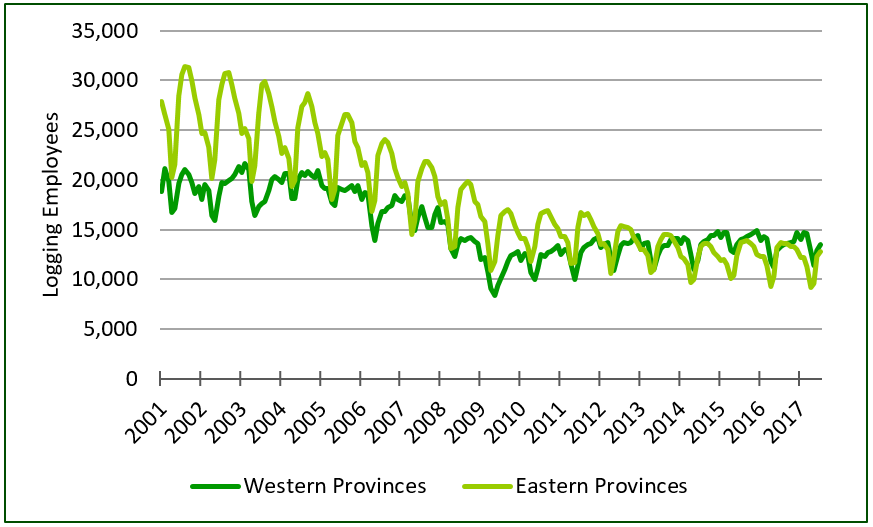

A cartoon from my youth, the Rocky and Bullwinkle show, sometimes featured Dudley Do-Right, a dim-witted, do-gooder roaming Canada’s wilderness for the Royal Canadian Mounted Police. The forest industry’s regional importance occasionally featured in the plot as Dudley would need to save his love interest, Nell, from a whirring sawblade (though an oncoming train was a far more common threat). Sadly, more Canadian sawmills may be left unattended for such dastardly deeds as the glut of beetle-killed wood degrades further, depriving the industry of the raw material it needs. Declines in any part of the forest industry affect the entire supply chain, and the logging industry will certainly suffer as well. Since the recession, logging employment increased in British Columbia and Alberta (the Western provinces in this analysis) and declined in the rest of the country. Western employment leveled off the last three years, matching relatively level sawmill production in the region. In the Eastern provinces, the pulp and paper industry is dragging down logging employment as the industry is geared more towards newsprint and writing papers, which are in decline. In 2013, Western employment surpassed the logging employment in the rest of the country.

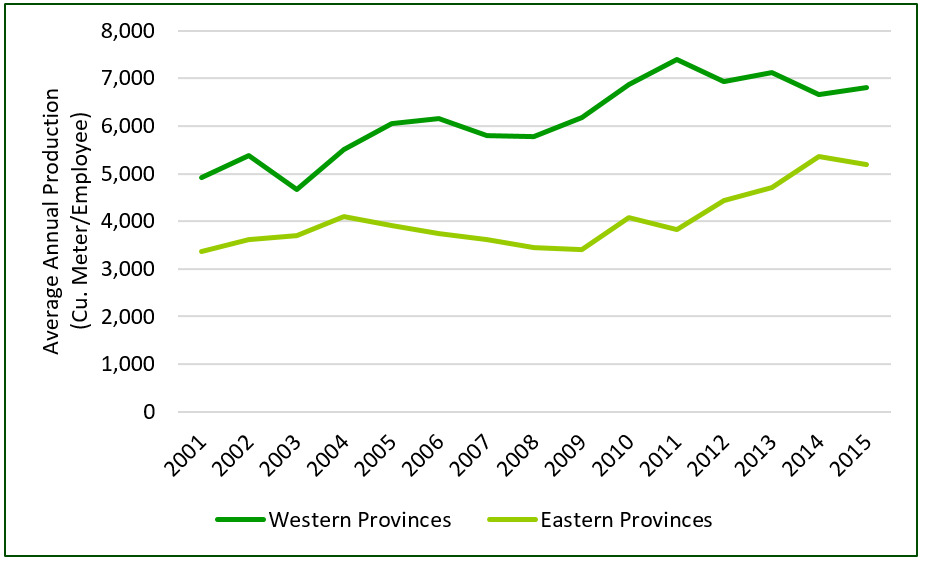

Periods of declining logging productivity also represent reasons for concern. From 2004 through 2009, average output per logging employee in the East dropped consistently as companies trimmed payroll to match declining demand for wood during the recession. Growing productivity coincided with slower declines in employment following 2011 as the industry strategically trimmed less productive operations, raising the average productivity of the remaining workforce. Western productivity dipped slightly in 2007, but increased for the next four years. Declining western productivity since 2011 is not in line with lumber production from the region (which has been relatively consistent), but could be the first sign of the decline in beetle-killed wood affecting the logging industry. While employment levels increased in the West through 2015, they were effectively level the last two years. As production data become available, it will be interesting to see if new steep terrain harvesting methods provide a boost to average productivity. While efforts are underway to help the forest industry deal with these challenges, if the industry is headed for a crash it will require more than a bumbling Mountie to save it.

To learn more about our coverage of forest operations in the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Leave a Reply