This is the third in a series related to Forisk’s Q1 2018 forest industry analysis and timber price forecasts for the United States and Canada. The following is an excerpt from the Forisk Facts & Figures column, Forisk’s quarterly “story in three slides.”

With the post-recession U.S. South featuring (so far) unresponsive timber prices, Forisk revisited the financial returns of forest management (silviculture) to ask, “how sensitive are forestland values to changes in reforestation costs, timber prices and management intensity?”

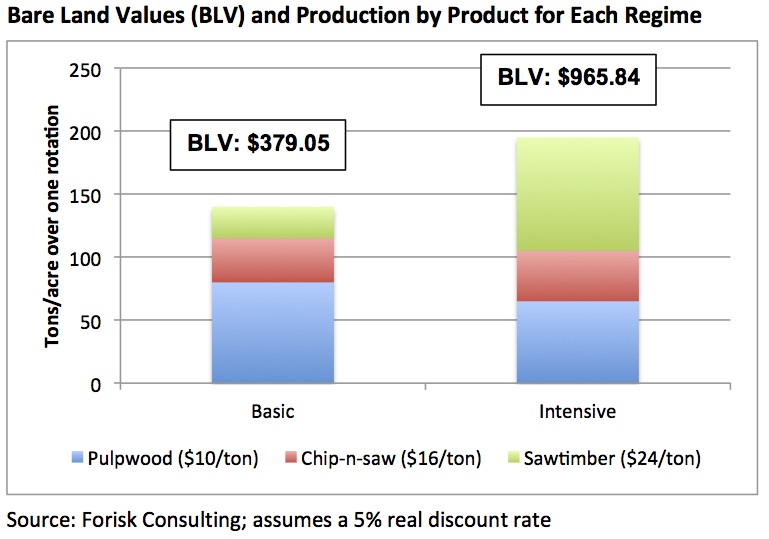

Published research (listed at the end) indicates common forest management activities and improved seedlings can increase incremental volumes by 10% to 60+%. To evaluate the financial implications, we outlined two forest management plans with approximate costs. “Basic” is a simple plant-thin-harvest strategy on a typical Piedmont site. “Intensive” includes added silviculture investments on the same site.

“On the margin,” active forest management consistently and materially outperforms passive forest management in biologic and economic returns. For example, while lower-valued pulpwood accounted for 57% of the “Basic” production, the highest valued sawtimber accounted for 46% of the “Intensive” volume. Financially, we compared bare land values (BLV), a measure of the per acre value of “bare” dirt given these forest management plans. BLV estimates incorporate the assumed costs and per unit product values at a 5% real discount rate. In this example, the Intensive plan creates nearly $600 per acre of additional value to the forest owner, or 155% more BLV.

An additional sensitivity analysis indicates that forest investments can endure large swings in management costs and volumes or prices of lower grade products; however, forest management ROIs are highly sensitive to discount rates, realized sawtimber volumes, and sawtimber prices. The findings highlight the dependence of timberland returns on the local markets for wood, assumptions related to future stumpage prices, and the ability to implement site-appropriate forest management plans.

Click here to learn about and register for “Applied Forest Finance” on March 6th in Atlanta, Georgia. The course includes this case study and details necessary skills and common errors associated with the financial analysis of timberland and other forestry-related investments.

Useful References

These published papers informed Forisk’s analysis and summarize the results of dozens of forest management studies from decades of research in the U.S. South.

- Allen, H.L., T.R. Fox, R.G. Campbell. 2005. What is ahead for intensive pine plantation silviculture in the South? SJAF 29(2) 62-69.

- Fox, T.R., E.J. Jokela, and H.L. Allen. 2007. The development of pine plantation silviculture in the Southern United States. JOF 105(7) 337-347.

- Jokela, E.J., T.A. Martin, and J.G. Vogel. 2010. Twenty-five years of intensive forest management with southern pines: important lessons learned. JOF 108(7) 338-347.

- McKeand, S.E., R.C. Abt, H.L. Allen, B. Li, and G.P. Catts. 2006. What are the best loblolly pine genotypes worth to landowners? JOF 104(7) 352-358.

- Vance, E.D., D.A. Maguire, and R.S. Zalesny Jr. 2010. Research strategies for increasing productivity of intensively managed forest plantations. JOF 108(4) 183-192.

- Zhao, D., M. Kane, B. Borders, M. Harrison. 2009. Long-term effects of site preparation treatments, complete competition control, and repeated fertilization on growth of slash pine plantations in the flatwoods of the southeastern United States. Forest Science 55(5) 403-410.

It would be nice if Forisk would do a report on why the Forest Sector was not included in the revised NAFTA agreement. The current tarrifs are literally killing small resource dependent communities in British Columbia. People are losing their homes and assets because of this tarrif. Is the US comfortable with having this kind of impact on their neighours or do they even care? As there is no tarrif on wood coming from other countries the current situation is extremely unfair to what we thought were allies.