This post includes an excerpt from the Timberland Investment chapter in the Q1 2018 Forisk Research Quarterly.

The timberland market continues to generate a steady diet of deals to review. Through year-end 2017, there were nearly 1.8 million acres of publicly announced, completed timberland transactions in the United States exceeding 1,000 acres in size. Regionally, most of the volume in both acres and deal count occurred in the South. While deals accounting for 538,000 of these acres were “multi-region” packages, 32% of the 1.8 million acres were “South only.” TIMOs accounted for 55% of the acres sold and 69% of total acres acquired in 2017. Of this volume, over 1.4 million acres of institutional timberlands changed hands in deals exceeding 20,000 acres each.

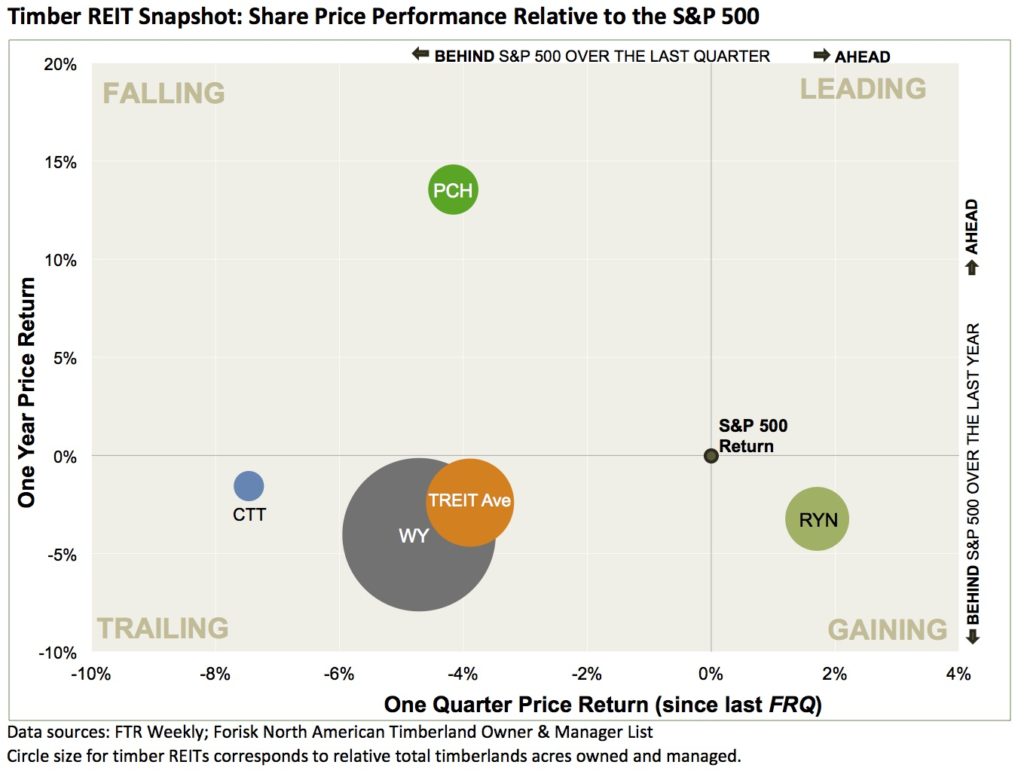

For timber REITs, Potlatch (PCH) led the sector and S&P 500 over the past year, while Rayonier (RYN) led the sector and S&P 500 over the past quarter. The figure below summarizes the performance of timber REIT share prices relative to each other and to the S&P 500 over the past year (since the Q1 2017 FRQ) and over the past quarter (since the Q4 2017 FRQ) prior to the recent market correction. The sector leading performance by Potlatch includes a positive market response to its announced, pending acquisition of Deltic, along with other moves to rebalance its timberland portfolio away from the Western Interior and towards the South. All four public timber REITs exhibited strong, positive returns over the past twelve months (as did the S&P 500), even accounting for recent market corrections.

Forest Finance Refresher: “How do we account for the original timberland investment (capital) when evaluating new projects for the same forest?”

Answer: We don’t. We evaluate new projects or investments “on the margin” and ignore sunk costs. We evaluate forest investments based on their ability to generate income and returns moving forward. Consider the following example:

You paid $2,000 per acre for a pine plantation during a peak in the market. A recent timberland appraisal indicates that the market now values this plantation at $1,500 per acre, putting the investment “under water” when compared to what you paid for it. Ugh.

Then your forest manager calls asking for $100 per acre to fertilize the plantation. His analysis indicates you would realize the benefit of the fertilization in the next five years earning an IRR of 20% on the $100 per acre. Do we approve the forest manager’s request and invest? We can think about this two ways. One, the fertilization is trying to “catch a falling knife” and simply throwing good money after bad. Or, two, our forester’s analysis of this investment on the margin looks attractive and we ignore the sunk costs.

We can’t do anything about the $2,000 original investment. We have complete control over the $100 investment request. Does this look like a good use of capital moving forward? Yes.

These topics and others related to the financial analysis of timberland investments and forest management decisions will be covered in “Applied Forest Finance” on March 6th in Atlanta. Click here to learn more and register.

Leave a Reply