This is the fifth in a series related to Forisk’s Q2 2018 forest industry analysis and timber price forecasts for the United States and Canada. The post includes an excerpt from the Forest Operations chapter.

I had the opportunity to attend the recent Forest Resources Association Annual Meeting and the subsequent Wood Supply Research Institute meeting in New Orleans. Not surprisingly, topics on trucking challenges featured in many of the sessions. While discussing how higher insurance costs could eliminate any profit margin for independent trucking contractors, someone pointed out this was true only if drivers were constrained by the legal maximum weight. Though the comment alluded to the propensity of some contractors to run overweight in an effort to make money, it hints at an important topic. We spend time every quarter evaluating the role of future diesel prices on hauling costs, but it can be difficult to envision the sensitivity of haul costs to an array of factors, including variable payload.

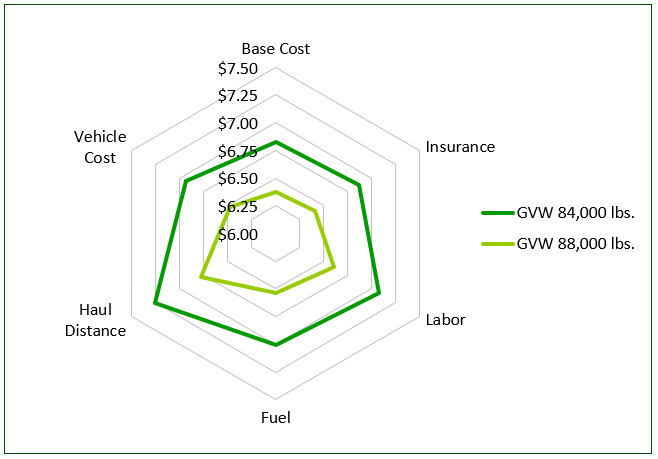

Median log truck driver wages in the U.S. increased 14% between 2012 and 2017. Mercifully, diesel prices dropped 33% over the same timeframe (though they are increasing in early 2018). Insurance costs, while difficult to ascertain, reportedly increased up to 50% (in many cases, much greater). New truck prices are up around 10%. If we start with basic assumptions about truck operating costs per ton for a 50-mile haul and examine the effect of increasing the cost of each of these components by 10%, labor and diesel have the greatest impact (Figure). Not surprisingly, increasing haul distance 10% raises per ton cost more than any individual cost component. If we put two more tons of payload on the truck, increasing the gross vehicle weight from 84,000 lbs. to 88,000 lbs., operating costs for our sample truck drop by $0.45 per ton. The extra payload more than compensates for a 10% increase in other truck costs and even covers the cost of increasing from a 50-mile to a 55-mile haul distance.

This type of sensitivity analysis clarifies the scale of the incentive higher payloads offer at all levels of the industry. With operating costs trending upwards, hauling more weight widens razor thin margins for truck owners. Increasing the legal payload at the state level can immediately lower wood costs. With truck driver shortages across the country, higher payloads also move more wood with fewer drivers. While it is far from a silver bullet, it is easy to see why so many people exposed to risk from the trucking sector (i.e. all of us) focus on payload as a key issue.

Are you suggesting that the avg weight (truck and trailer weight + payload) of a timber hauling truck is 84,000 lbs? If so, how much of that is payload vs truck and trailer?

I was under the understanding that trucks carrying more than about 40,000 lbs of payload were fined. Can anyone shed any light on this issue?

On the interstate system, the legal maximum is 80,000 pounds, but legal gross vehicle weights on non-interstate highways vary by state. The example of 84,000 pounds is typical in a number of states. The weight of a specific truck and trailer can vary widely, so the payload on an 84,000 pound gross weight could easily range from 26-30 tons. Trucks can get fined for being overweight for the full vehicle (truck, trailer, and payload) or if an individual axle is over the legal limit, but not based on just the payload.

Shawn – Thank you for that information. So, if a typical acre of mature southern softwood yields about 120 tons of timber per acre, and a truck hauls an avg of 28 tons, then it takes about 4.3 truckloads (120/28) from stand to mill, to clear off that acre?

Had always wondered how many times, on average, the trucks had to do a round trip from timber stand to mill in a typical harvest. Around my area, timber consultants tell me that 40 acres is an avg final harvest. Seems small. But, in trucking terms, that’s 171 round-trips (4.3 x 40) to/from the mill. That’s a good bit. And, that makes it easier to see why its so important to understand the role transportation costs play in this economic activity of harvesting timber.

Thanks.