This is the fourth in a series related to Forisk’s Q3 2018 forest industry analysis and timber price forecasts for the United States and Canada. The post includes an excerpt from the Regional Summary: U.S. South chapter.

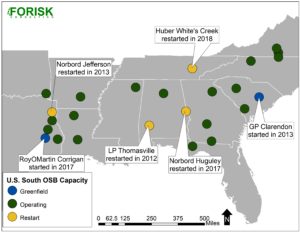

Twenty-five (25) OSB mills operate in the U.S. South (Figure). These mills use 16% of the pine pulpwood and 4% of the hardwood moved in the South today. The U.S. South has 82% of the OSB capacity in the country; the remaining 18% is located in the Lake States and Northeast. In the past five years, four OSB mills resumed operations in the South and two greenfield mills were established. Mill restarts added 2.0 billion square feet of open OSB production capacity, and the two greenfield mills added 1.3 billion square feet of capacity. Combined, restarts and greenfield mills increased the sector’s capacity by 25% over the past 10 years. As of 2018, there are no idled OSB mills in the South; previously idled mills are operating or have been permanently shuttered.

As housing markets increase demand for building products, how will the OSB sector respond with respect to mills in the U.S. South? The sector has gained market share from plywood, growing U.S. market share of structural panels from 57% in 2001 to 67% in 2017, and the trend is unlikely to reverse. The OSB sector in the South has a utilization rate of 91% (past four quarters), including mills ramping up production from recent starts. Southern OSB production in H1 2018 is up 5% from H1 2017. Forisk’s projections indicate that OSB production in the South will increase by 25% to 14.7 billion square feet in the next five years. To meet these projections, 1.5 to 2.0 billion square feet of OSB capacity is needed in the South; this would support 3-4 new mills in the region on top of recent restarts.

The data for this post was pulled from Forisk’s comprehensive analysis of North American wood-using current and historic capacity by firm and sector across North America, along with projected capacities by sector and region for the next two years. For more information, click, here.

If OSB demand is up 5% in 2018 vs. 2017, then why are pine pulpwood prices rising at least 5% as well. I have 100 acre Loblolly pine plantation in NW alabama but can’t get a reasonable price for pine pulp or chip/saw pine. Demand is up but not prices. Why not?