This is the second in a series related to Forisk’s Q1 2019 forest industry analysis and timber price forecasts for the United States.

Though U.S. housing slowed in the latter half of 2018, housing starts improved year-over-year in all market segments and look to surpass the modest growth of 2.5% in 2017. Through November 2018, housing starts advanced 5.1% year-over-year; single-family starts increased 3.9%, while multifamily starts rose 8.0%. The housing market’s shift back to higher-levels of single-family home construction has stalled; single-family starts represented 70% of total starts through November 2018. Single-family starts, as a percentage of total starts, had increased every year since 2016.

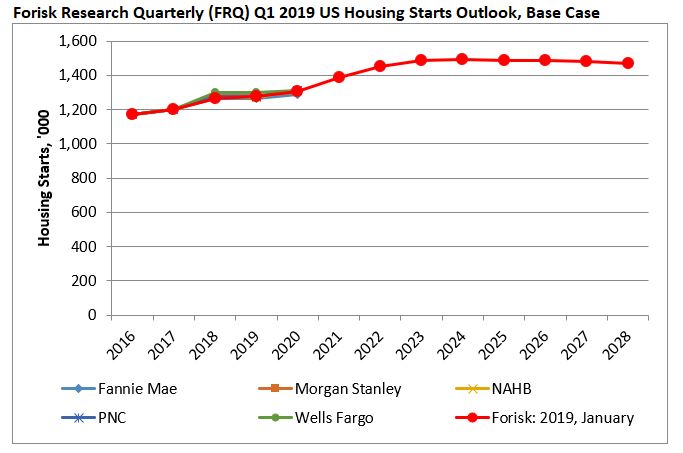

When updating our Forisk Research Quarterly (FRQ) forecast models, we revisit prior projections and review applied research on business and economic forecasting. Forisk’s Housing Starts Outlook combines independent forecasts from professionals in the housing industry. Currently, these include Fannie Mae, Morgan Stanley, the National Association of Home Builders (NAHB), PNC, and Wells Fargo. Forisk applies long-term assumptions from the U.S. Energy Information Administration (EIA) and Harvard’s Joint Center for Housing Studies to establish the peak and trend over the next ten years (Figure).

Forisk projects 2019 housing starts of 1.279 million, which represents a downward revision of our previous expectations. We are mindful of the impact of the continued government shutdown on the economy. Of key interest is how the resulting decline in GDP may impact housing and, subsequently, timber markets going forward. Forisk’s 2019 Base Case peaks in 2024 before returning to a long-term trend approaching 1.50 million.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Leave a Reply