This post contains an excerpt from the Q1 2019 Forisk Research Quarterly. This is the fifth in a series related to Forisk’s Q1 2019 forest industry analysis and timber price forecasts for the United States. Jack Lutz, Justin Tyson, and Shawn Baker contributed to this research.

Chinese paper companies have been investing in U.S.-based paper assets for the past decade. One of the first acquisitions in the past 10 years was the purchase of Domtar’s Woodland hardwood pulp mill in Baileyville, Maine in October 2010. The most recent was the acquisition of the idled pulp mill in Old Town, Maine in late 2018. In between, there have been announcements for acquisitions and projects in Maine, Kentucky, Wisconsin, Virginia and Arkansas. In all, Chinese companies announced investments of nearly $5 billion—though one large project seems to have fallen through and another has been delayed for over a year.

Tight fiber supplies in China spurred the investments, especially since they implemented controls on waste imports in 2017. Difficulty getting recycled paper and OCC into China from the U.S. encouraged companies to look for ways to turn “dirty” paper into “clean” pulp in the U.S. The trade war between China and the U.S. has worked both ways. It has been blamed for the delay in Sun Paper’s Arkadelphia mill, as tariffs would increase the cost of sending paper to China. It also encouraged U.S.-based manufacturing by Chinese companies to avoid tariffs on products shipped into the U.S. market.

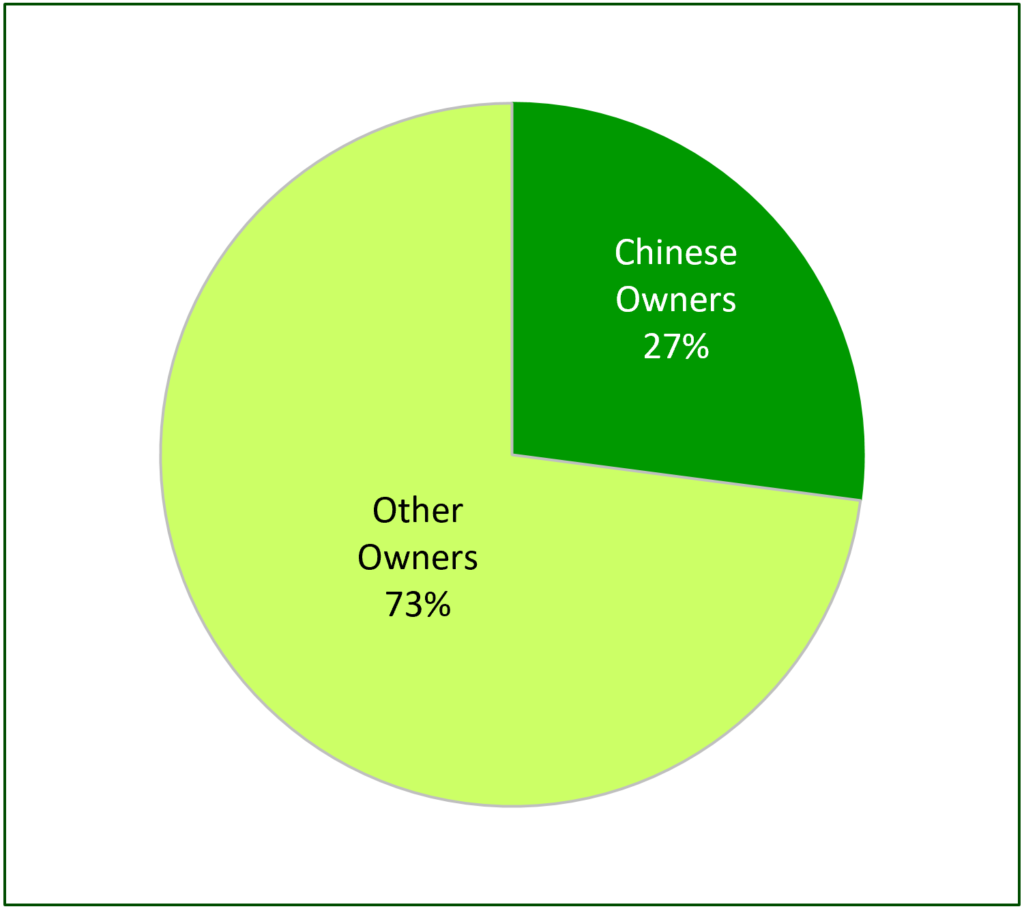

Most Chinese investments in the sector to date have been in the U.S. North. As of 2018, Chinese-based companies owned 27% of the pulp mill capacity in the region (Figure). Market share is expected to increase to 35% this year with the expansion of the Nine Dragons facilities.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Leave a Reply