“Reality is frequently inaccurate”

– Douglas Adams, The Hitchhiker’s Guide to the Galaxy

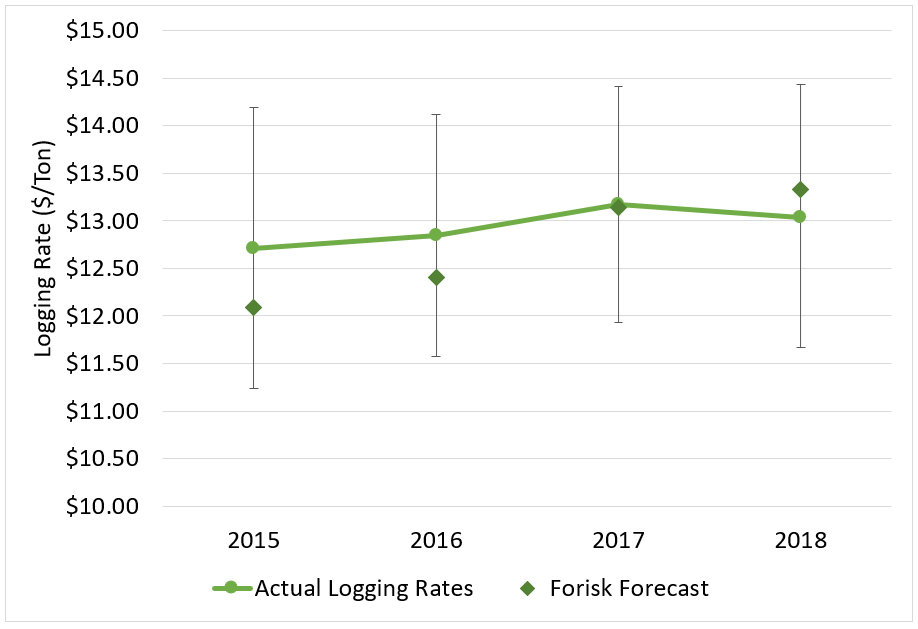

It has been a couple of years since we last discussed the performance (and drivers) of our logging cost forecasts. At that time, we were seeing increased margins as diesel prices declined and rates increased. We continue to forecast logging costs for the U.S. West, North and South every quarter and revisit our forecasts annually to see how we’ve done. Over the last two years, our January prediction for year-end logging costs has been reasonably accurate, hitting the year-end 2017 cost within a couple cents and roughly 2% higher than actual costs in 2018*. In an industry as fragmented and volatile as logging, accurately accounting for market realities can be challenging. What’s the story behind the numbers?

Forisk Forecast of Southern Logging Rates Compared to Actual Annual Averages. Data source: TimberMart-South

We forecast logging rates (what loggers are paid for their services) based on expected increases in operating costs. Fluctuations in profit margin, unforeseen changes in technology, or unusual market events (like widespread flooding that increases operating costs for a large portion of a region) will inject volatility in rates that our cost-based forecast might miss. Logging in the “real world” rarely conforms to a scripted plan. We typically look to three major levers to inform our view:

- Labor – Workers are the largest component of operating cost and rapid increases in compensation have the greatest pull on rates. We are always looking for sings of a capacity crunch that might necessitate higher wages.

- Inflation – Equipment, tires, and repair parts all affect logging costs. While the past ten years have seen low inflation (excluding fuel), significant increases will flow through to operations.

- Diesel – Surprisingly, diesel doesn’t represent a huge proportion of total operating cost, but it is by far the most variable component. Extended high prices will erode profit margins and ultimately spur inflation.

True to form, diesel costs increased 38% over the last two years, driving most of the volatility, while logging wages increased 7% nationally. How did this play out in our forecasts? After accurately forecasting cost impacts in 2017, we saw diesel increase 20% in 2018 and wages grew 4%, yet logging rates declined. With a trucking shortage exerting pressure on hauling rates, in-woods logging capacity remains abundant in much of the South and strong competition is likely pushing logging rates lower in the face of higher costs. Continued productivity improvements remain the logging industry’s main defense against growing marginal costs.

*Published logging rates in the U.S. South are used to evaluate forecast performance.

This is the sixth in a series related to Forisk’s Q1 2019 forest industry analysis and timber price forecasts for the United States. To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Leave a Reply