This post includes data from the Q2 2019 Forisk Research Quarterly and the 2019 Multi-Client Study: North American Forest Market & Industry Rankings.

Despite recent declines in production, several pulp and paper producers announced investments and conversions to expand containerboard capacity. Firms expect continued demand for containerboard and packaging materials from e-commerce, exports, and population growth. The U.S. South, with over 80% of U.S. packaging capacity from wood raw materials, is the target region for some of these investments. How might these expansions affect pulpwood use and stumpage prices in the region?

Mills have choices for feedstocks. In the case of containerboard, often the choices are between recycled material, roundwood, or wood chips (from a chip mill or sawmill). The type and volume of feedstocks desired by particular mills in conversion will affect pulpwood use and stumpage prices.

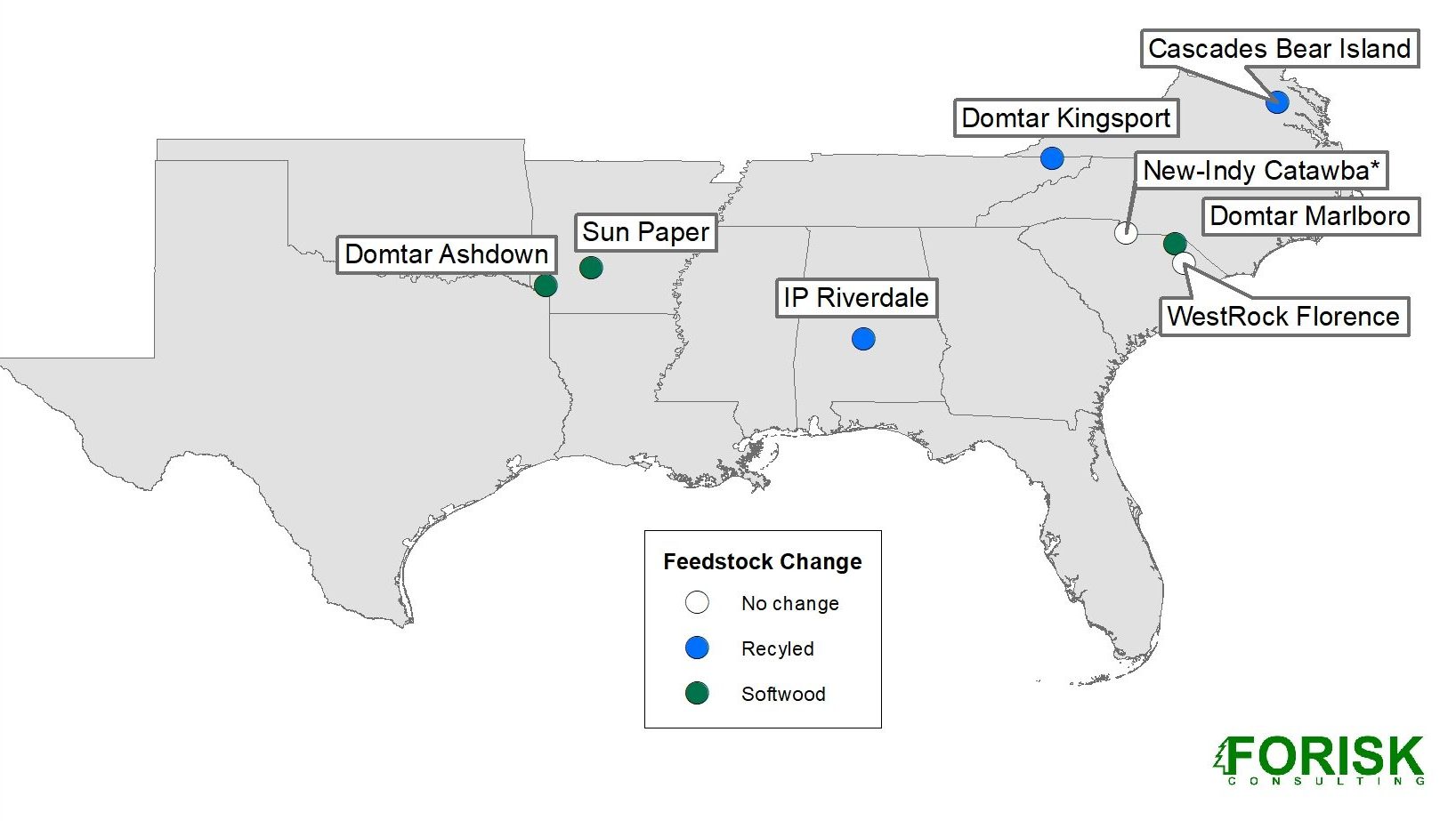

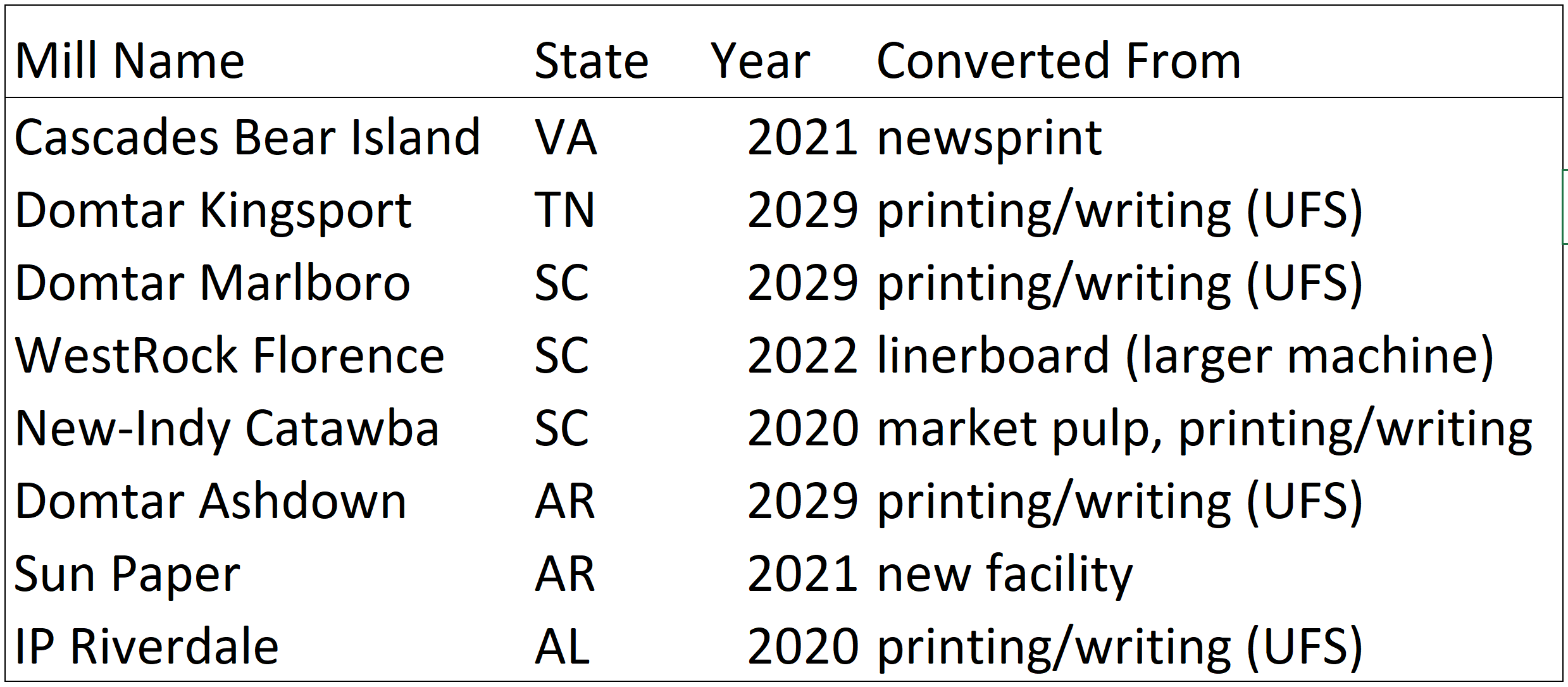

Let’s look at some of the planned projects. Of the eight announcements included in the map below, three will use recycled containerboard as all or part of their mix: Cascades Bear Island, Domtar Kingsport, and IP Riverdale. This could shift wood use away from softwood roundwood and hardwood chips at these facilities. WestRock Florence will likely have no or a limited change to wood use. Domtar’s Marlboro and Ashdown facilities and Sun Paper could have an increase in softwood use, with some decrease in hardwood use. Bottom line: impacts will be localized and highly dependent on the procurement strategies of the particular mills.

Figure 1. Potential Feedstocks of Containerboard Conversions, Post-Conversion

*The potential feedstock change is unknown; we assume no change from the conversion.

Sources: Company filings, Forisk estimates

As with most plans, these are subject to change. IP pushed back its Riverdale mill conversion into 2020 at the earliest, Sun Paper changed the technology and pushed back timelines, and Domtar’s plans have a ten-year time horizon subject to market dynamics. Given the above, if the mill conversions happen as stated, South Carolina and Arkansas could see increased softwood pulpwood demand from mill investments. As these projects are in the early stages, it remains “wait and see.”

For more information about Forisk’s analysis (Study) of North American timber markets and wood-using mills, please click here.

Amanda – not sure the status but it was announced that the former MWV / Verso mill at Wickliffe, KY will be converted to producing linerboard. The mill had been idle for a few years

Thanks, Gary. Also, Domtar has announced a potential conversion to linerboard at the Hawesville, KY mill. We focused on the core Southern states for this analysis, but it is helpful to remember that these conversions are happening in other states and regions. Thank you for your comment.