This is the third in a series related to Forisk’s Q4 2019 forest industry analysis and timber price forecasts for the United States. It contains an excerpt from our feature article on timber supply in the U.S. South co-authored by Amanda Lang, Alec Roach, and Shawn Baker.

Examining the forest industry in the South today highlights the disruptive, long-term effect of the Recession. Supplies of pine grade products (chip-n-saw and sawtimber-sized trees) have ballooned, materially altering the supply-demand balance. The lack of clearcutting during the Recession meant fewer acres were planted, which is having an impact on pulpwood-sized trees as we approach 12 years since the Recession started. The supply story appears out of balance, but for how long? Pulpwood supply is an echo of planting activity 10-20 years ago. Grade inventories are a combination of removals and growth on acres planted 15+ years ago. In forestry, it takes time to change the trajectory of supply without a catastrophe (fire, wind, bugs, bell-bottom pants, etc.).

As part of our annual exercise to estimate forest inventory changes by product in the South, Forisk combines state-by-state analysis of wood demand, forest industry capacity and capital investments with current forest supply data from the U.S. Forest Service and modeling by Dr. Bob Abt with SOFAC. The analysis of timber supplies and wood demand matches the location of wood sources to forest industry manufacturers.

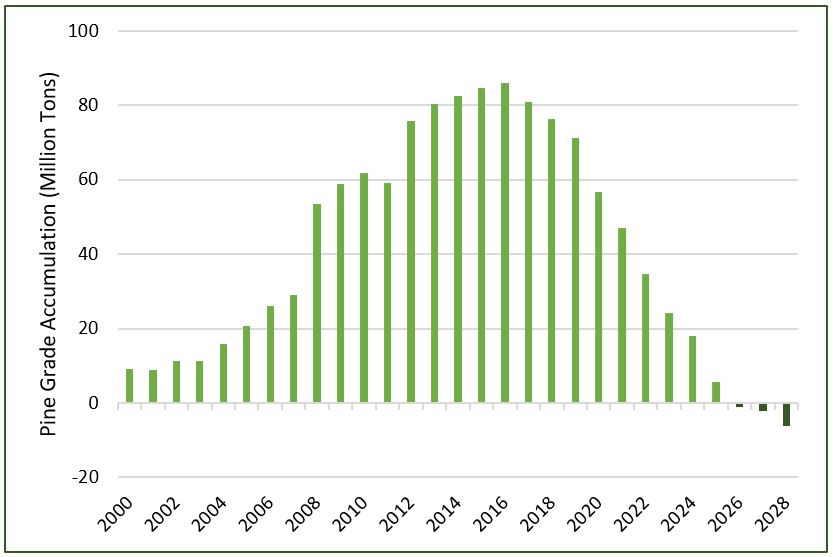

Our 2019 pine grade projections, suggest that the pendulum may be poised to swing back in the near future (Figure 1). The graph below shows the annual change in grade inventory for the U.S. South, by year. The last three bars on the chart indicate a decline in grade inventories South-wide starting in 2026. Assuming grade demand continues apace (i.e. no recessions that hinder housing growth), we believe sawtimber inventories will peak in 2025 at a level 70% higher than in 2007.

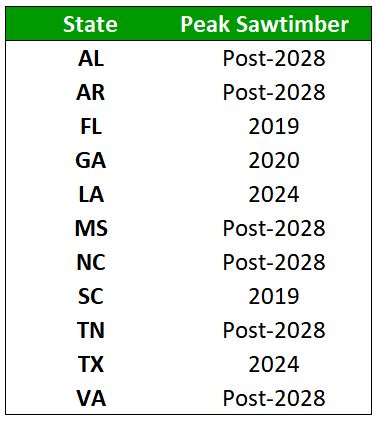

The supply story varies across the region, as each state has a unique profile of mills and existing forest inventory. Some states will continue to accumulate additional volume while others will begin to see contraction much earlier. Figure 2 shows that Florida and South Carolina grade inventories are forecast to peak this year, followed by Georgia next year. Other states we have noted in the past have significant supply and demand imbalance, such as Mississippi and Alabama, and will continue to accumulate volume beyond 2028.

Forisk thanks Dr. Bob Abt with SOFAC for his assistance with this research.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Leave a Reply