This post introduces research covered in the Q1 2020 Forisk Research Quarterly (FRQ) and during the upcoming March 19th “Applied Forest Finance” course in Atlanta.

Any story about returns getting back to normal or reverting to the mean presumes that an average return on investment exists. One year ago, we wrote:

“…outperformance thrives on the upside of undervalued securities, such as cash-generating hard asset businesses that lag the market…..prime candidates from 2018 (for 2019) include publicly-traded, timberland-owning real estate investment trusts (TREITs)…”

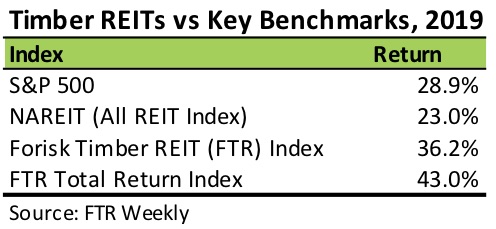

What happened in 2019? Public timber REITs, along with the balance of the stock market, delivered truckloads of cash and returns to investors. After a horrible 2018 (-34.6%), the public timber REIT sector outperformed the S&P 500 and returned 36.2% on share appreciation alone.

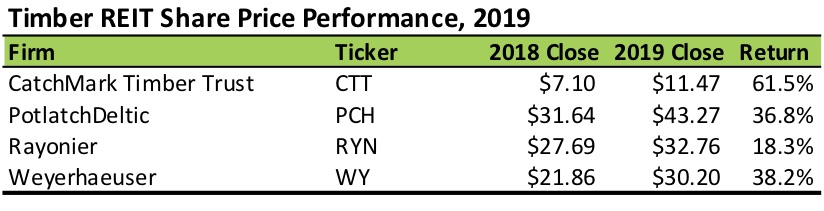

At the individual firm level, three of the four public timber REITs generated returns superior to those of the S&P 500 in 2019. CatchMark Timber Trust led the sector by posting a 61.5% gain (not including dividends paid). Dilly dilly.

Where does that leave us for 2020? Investors want to understand whether or not the recovery in share prices implies that timber REITs are now fairly, or dearly, valued relative to the assets and future prospects. Timberland and timberland-owning REIT values are a function of estimating and, ultimately, discounting cash flows. Timber REITs that strengthen cash flows over time create expectations of higher distributions, high values and higher share prices.

Click here to learn about and register for “Applied Forest Finance” on March 19th in Atlanta, Georgia. The course details necessary skills and common errors associated with the financial analysis of timberland and other forestry-related investments.

Leave a Reply