This post introduces research covered in the Q1 2020 Forisk Research Quarterly (FRQ) and during the upcoming March 19th “Applied Forest Finance” course in Atlanta.

Recent news in timberland markets centered on the acquisition of Pope Resources by Rayonier. Part of the excitement from this deal resulted from it running counter to a perceived slowdown in timberland transactions. In 2019, one of the most common questions I heard from timberland investors was some version of, “what does a normal timberland deal flow look like in the U.S.?”

As part of tracking North American forest ownership, we maintain a database of “institutional” timberland transactions that includes over 600 deals back into the 1990s. We looked at the data and highlight three findings.

- First, U.S. timberlands have a limited universe of investment opportunities. For institutional investors like TIMOs, REITs and large family offices, we estimate approximately 87 million acres of investable, private timberlands in the U.S.

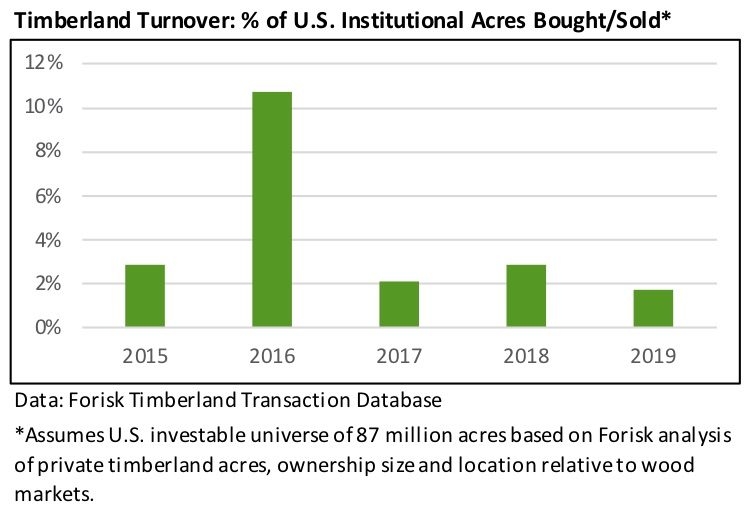

- Second, timberland deal flow is “chunky.” Unlike the buying and selling of homes or office buildings, timberland acres usually trade in small parcels occasionally overshadowed by massive transactions. The figure below summarizes the percentage of the “investable universe” that traded annually over the past five years. The Weyerhaeuser/Plum Creek merger in 2016 spiked the trend, while typically 2 to 3% of the acres trade. On average, 4 to 5% of the investable acres turn over.

Third, this rate of turnover aligns with other asset classes such as residential housing. In a typical year, we sell just over 6 million existing and new homes in the United States on an inventory of homes approaching 140 million in total. That means we “turn over” 4 to 5% of U.S. homes each year. Similar numbers appear in commercial real estate.

In sum, while 2019 proved a little light on timberland deal flow, it was not unusual. Timberland markets, over the past three decades, average ownership periods of 20 years or longer, falling in line with other hard assets. Timberland deal flows just tends to be a bit chunkier.

Click here to learn about and register for “Applied Forest Finance” on March 19th in Atlanta, Georgia. The course details necessary skills and common errors associated with the financial analysis of timberland and other forestry-related investments. We will also evaluate recent transactions, such as Rayonier’s acquisition of Pope Resources.

Leave a Reply