This post introduces research covered in the Q1 2020 Forisk Research Quarterly (FRQ).

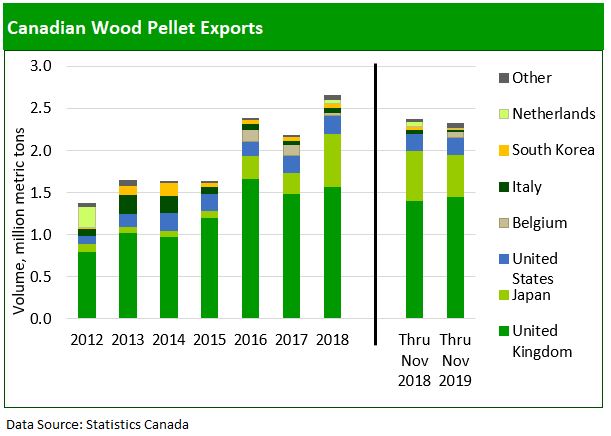

Canadian wood pellet exports declined 2.0% year-over-year through November 2019.

Increased Canadian wood pellet export growth to Belgium and the UK offset a 16% year-over-year decline to Japan. As with the U.S., the UK remains the largest importer of Canadian wood pellets with a 63% market share. South Korea represented the largest year-over-year decline, dropping 73%. Pinnacle, Canada’s largest pellet producer by capacity, noted Q3 production was down 14% year-over-year, despite increased production capacity, due to fiber supply challenges.

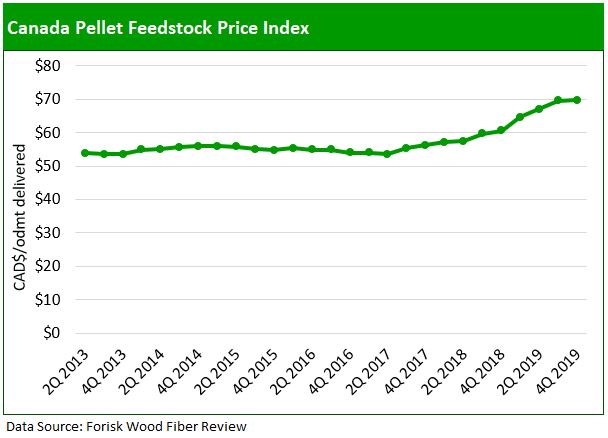

Increasing wood fiber costs continue to challenge Western Canada’s export pellet sector.

Canadian pellet producers continue to struggle with fiber availability and quality as a result of sawmill curtailments in British Columbia, which surpassed 2.7 billion board feet of capacity in 2019 alone. The reduction in supply of sawmill residuals, a primary feedstock for many BC pellet mills, put upward pressure on fiber prices. In 2019, Pellet Feedstock Price Index for Canada increased 15% year-over-year and is up 30% since Q2 2017. The pace of rising fiber costs slowed in Q4 2019 to CAD$69.70 per oven-dry metric ton, as mills reduced their operating rates and diversified their feedstocks.

To learn more about the Forisk Wood Fiber Review, please contact Heather Clark, hclark@forisk.com or 770.725.8447.

Leave a Reply