As management teams across the forest industry position themselves for ‘post-COVID’ markets, many pulp and paper mills chose downtime for now. SAPPI Cloquet, UPM Blandon at Grand Rapid, and Domtar’s Dryden mill offer examples of firms and facilities that modified or extended outages or maintenance schedules. During the quarter, in talking with industry contacts and updating prices for the Forisk Wood Fiber Review (FWFR), we noted how executives started thinking and speaking more in terms of strategy and less in terms of tactics.

Given all of the adjustments at mills, how did pricing look? In the U.S. South Central, softwood and hardwood residual chips remained flat, while softwood and hardwood roundwood prices fell. Fiber prices in the Southeast declined again, as they did in Q1: softwood and hardwood roundwood fell nearly 4%, while softwood and hardwood residual chip prices dropped less (though down 5% year-over-year). In the Lake States, softwood roundwood and hardwood chips remained relatively unchanged from 2019 levels, while softwood chips and hardwood roundwood were down. In the Northeast, softwood chip prices were unchanged through, while other fiber prices fell. Softwood and hardwood chip prices in the Pacific Northwest increased for the quarter, while softwood roundwood fell.

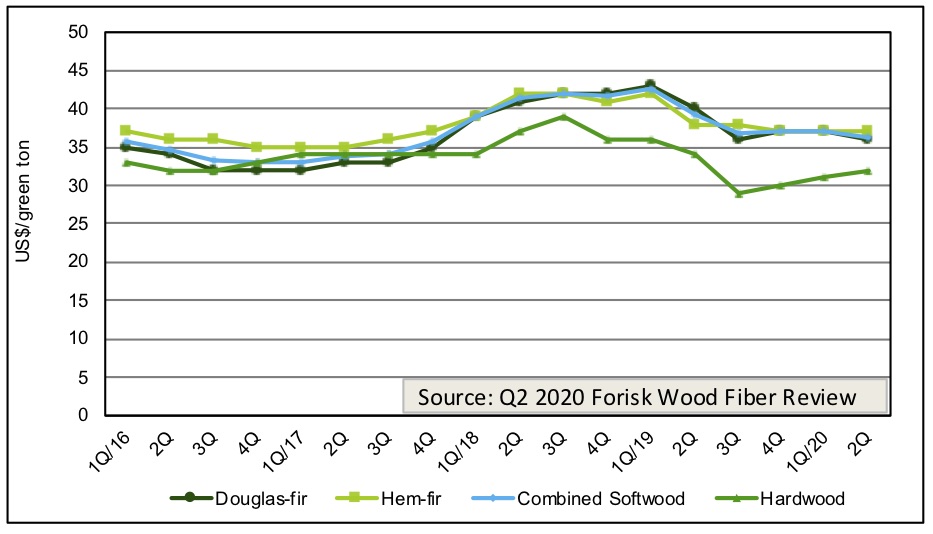

Figure: U.S. Northwest Pulplog Prices

Eastern Canada fiber prices, as in Q1 2020, experienced substantial turmoil in Q2 2020. Softwood residual chips in Eastern Ontario/Quebec decreased 6% and roundwood fell even more. All products, including fiber prices in the Maritimes, declined for the quarter and year-over-year. Western Canada also showed price declines across products, with softwood roundwood down for the quarter (while up 4% year-over-year). In Alberta and BC, softwood chips declined 4 to 5% for the quarter.

This “snapshot” of moving fiber prices reminds us that one firm’s pain is another firm’s profit. Production in the pulp and paper sector tends to follow economic growth (GDP) subject to their product lines, whether ‘under pressure’ newsprint and copy paper, or profitable tissue and packaging. As FWFR Editor Tim Gammell notes, the volatility in Q1, adequately summed by the adage, “we’re all in this together” might best be revised for Q2 2020 to “well, we’re all in the same storm, but we’re riding it out in different boats.” Sinking boats were made of newsprint and writing paper while boats made of tissue and linerboard weathered the initial waves with fewer problems.

Click here to learn about the Forisk Wood Fiber Review (FWFR), tracking pulpwood, wood chip and biomass markets in the U.S. and Canada since 1983.

Leave a Reply