This is the first in a series related to the Q3 2020 Forisk Research Quarterly (FRQ), which includes forest industry analysis and timber price forecasts for North America.

Through the first half of 2020, U.S. housing starts increased 0.7% year-over-year; single-family starts decreased 1.3% while multifamily starts gained 5.2%. U.S. housing starts continued to trend higher in June, following declines in March and April 2020 due to the economic impacts of the coronavirus. The seasonally adjusted annual rate (SAAR) of 1.186 million units represented an increase of over 17% from May. Permits also increased 2.1% from the previous month; single-family permits rose 12% while multifamily permits declined over 13%. With the exception of the West, all U.S. regions showed increased activity in June.

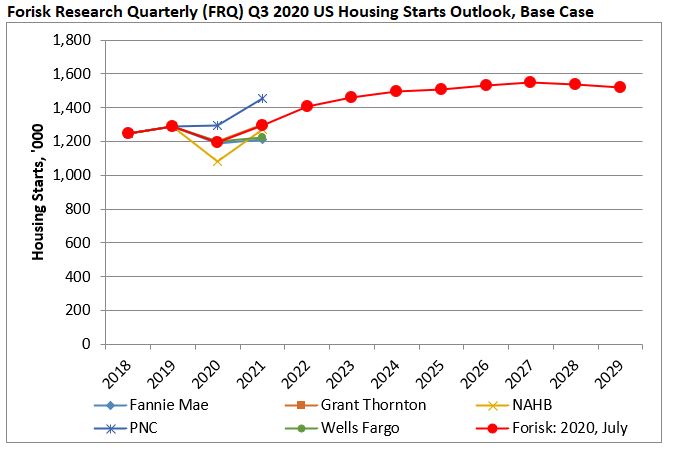

As of July, Forisk projects 2020 Base Case housing starts of 1.192 million, down 7.6% from 2019 actuals (Figure). Our current forecast represents an upward revision from our previous expectations. Forisk’s 2020 Base Case still stabilizes around its long-term trend of 1.50 million housing starts. This is due to the underlying demand based on demographics and household growth, second home ownership, and net replacements of existing housing stock. Forisk’s Housing Starts Outlook combines independent forecasts from professionals in the housing industry. Currently, these include Fannie Mae, Grant Thornton, the National Association of Home Builders (NAHB), PNC, and Wells Fargo. Forisk applies long-term assumptions from the U.S. Energy Information Administration (EIA), the Congressional Budget Office (CBO), and Harvard’s Joint Center for Housing Studies to establish the peak and trend over the next ten years.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Leave a Reply