This post is the third in a series related to the Q4 2020 Forisk Research Quarterly (FRQ), which includes forest industry analysis and timber price forecasts for North America. The post includes excerpts from our Forisk Facts and Figures section. Tyler Reeves, Timber Market Analyst for Forisk, contributed to this research.

Forisk examined the impacts of increased timber growth per acre on timber supply projections. How does increased growth from genetics and silviculture change the outlook of timber supplies in the South?

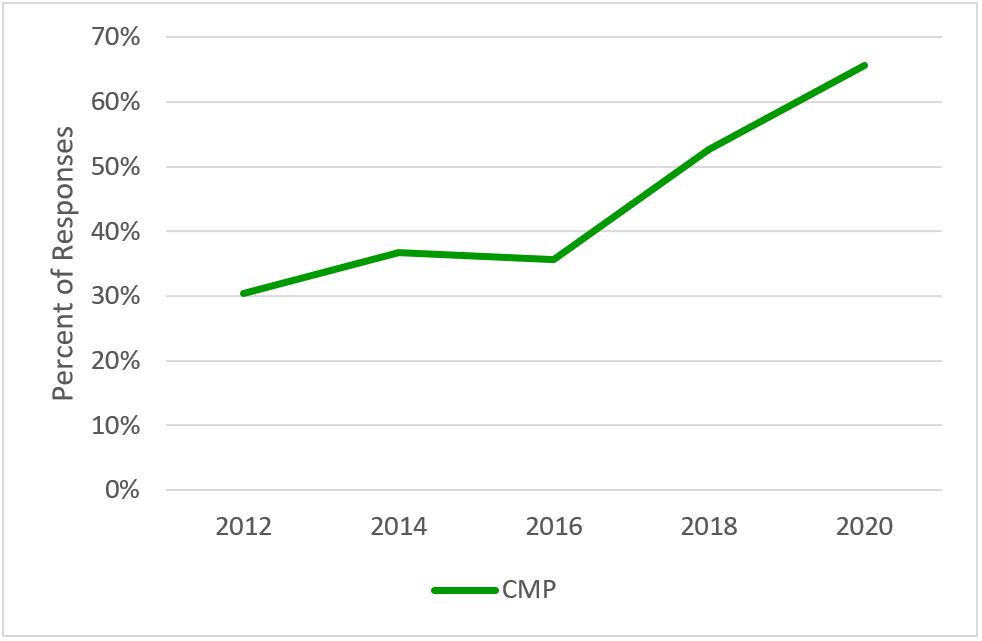

Timberland owners and managers are planting more seedlings with advanced genetics. According to Forisk’s silviculture surveys for the U.S. South, 30% of survey respondents in 2012 planted controlled mass pollinated (CMP) seedlings. This percentage increased to 66% of respondents in 2020 and represented 43% of acres planted by survey participants. The use of “other” seedlings also increased in recent surveys, including third generation, open pollinated Elite seedlings, and varietals.

Source: Forisk Southern Silviculture Surveys

Improved genetics and silvicultural practices have increased timber growth rates on plantations in the region. On average, plantations have increased growth by 1% per acre per year for the past ten years. Increased growth yields more volume per acre, which increases revenue per acre at the end of a timber rotation for a timber stand or property. In aggregate, however, faster growing timber can increase timber supplies and could impact supply/demand dynamics regionally and in local timber markets.

Increased timber growth rates lift timber supply forecasts by 2% in ten years and 6% in twenty years. Forisk worked with SOFAC to add 1% growth per acre per year to timber supply forecasts to model continued improvements in genetics. Genetic gains impact newly planted stands more than growing inventories, so there is a ten-year time lag before the genetic gains take full effect in the supply forecast. Without the increased growth rates from genetics, total pine timber supplies peak in 2025 and then decline. The growth rate increases push the inventory peak out three years to 2028 and result in a flatter trend.

Sources: Forisk, SOFAC

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447. To sign up for Forisk’s annual conference, Wood Flows and Cash Flows, click here or email Heather Clark at hclark@forisk.com.

Leave a Reply