This is the fifth in a series related to the Q4 2020 Forisk Research Quarterly (FRQ), which includes forest industry analysis and timber price forecasts for North America.

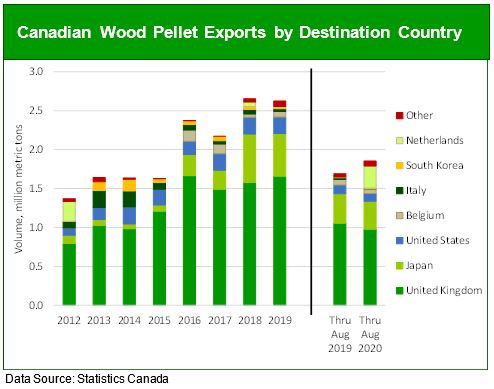

Canadian wood pellet exports rose 9.6% year-over-year through August 2020.

Canadian wood pellet exports to the Netherlands offset declines to the UK and Japan, among others. Despite a 7.1% year-over-year decline, the UK imported 978 thousand metric tons and remained the largest importer of Canadian wood pellets with 53% of the market share. Exports to Japan, the second largest importer, fell 5.5% year-over-year. The Netherlands returned to co-firing in 2018. Exports picked back up in March 2020, surpassing 282 thousand metric tons this year. Future exports to the Netherlands are in question, however, as the Dutch government has pledged to reduce coal power; industrial wood pellet demand in the country is from co-firing at existing coal plants The government recently announced an offer for a company to voluntarily close a co-fired power plant. In an effort to reduce emissions, further closures or operating restrictions may take place. Current subsidies to co-fire wood pellets in the country end between 2026 and 2027.

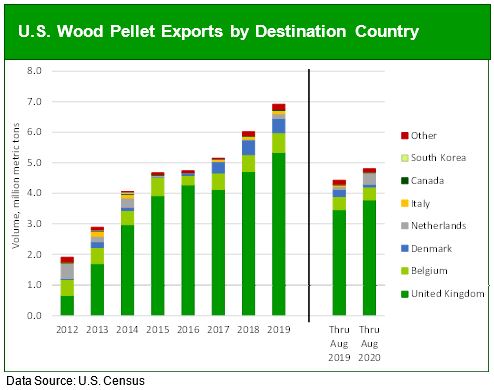

Through August 2020, U.S. wood pellet exports increased 8.6% year-over-year.

The UK remained the largest importer of U.S. wood pellets through August 2020. The 3.8 million metric tons imported, representing 79% of total U.S. volumes, was a 9.3% year-over-year increase. Export volumes to the UK are expected to continue to rise with the completion of MGT Power’s 299 MW CHP facility though construction has been delayed as a result of the coronavirus pandemic. U.S. export volumes to the Netherlands continued to increase; year-over-year volume more than tripled, reaching 381 thousand metric tons through August. For the year, the Netherlands was the third largest importer of U.S. wood pellets with 7.9% market share. As noted, the future of the Dutch market is in question as the government pledged to further reduce emissions, which may eliminate co-firing.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447. To sign up for Forisk’s annual conference, Wood Flows and Cash Flows, click here or email Heather Clark at hclark@forisk.com. To download the most recent Wood Bioenergy Summary, click here.

Leave a Reply