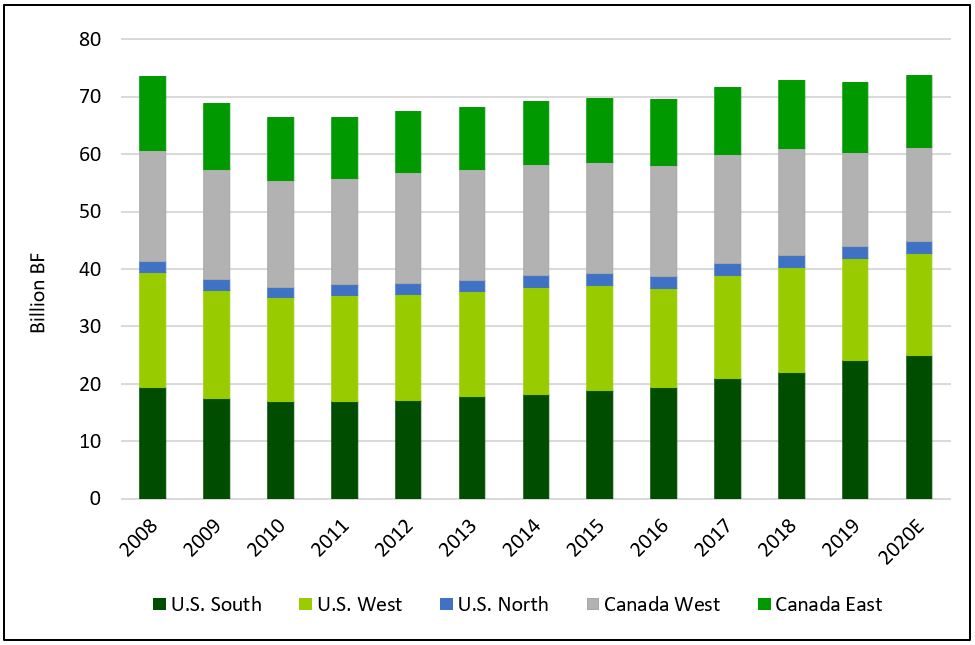

Mill capacity in North America has shifted South since just before the Great Recession of 2007-2009 for softwood lumber. Reduced timber supplies in Western Canada from the mountain pine beetle made it hard to get wood in the region. The U.S. South has ample timber supply and a solid infrastructure to move wood to mills. Softwood lumber capacity in North America is on-par with levels back in 2008 (12 years ago), with shifts regionally. Capacity increased in the U.S. South starting in 2012 and the region is projected to reach 24.9 billion board feet of capacity soon. The South surpassed Western Canada to become the largest region in North America for softwood lumber capacity a few years ago, and the shift continues. Mills closed in Western Canada and the region lost over 2 billion board feet of softwood lumber capacity in the last two years.

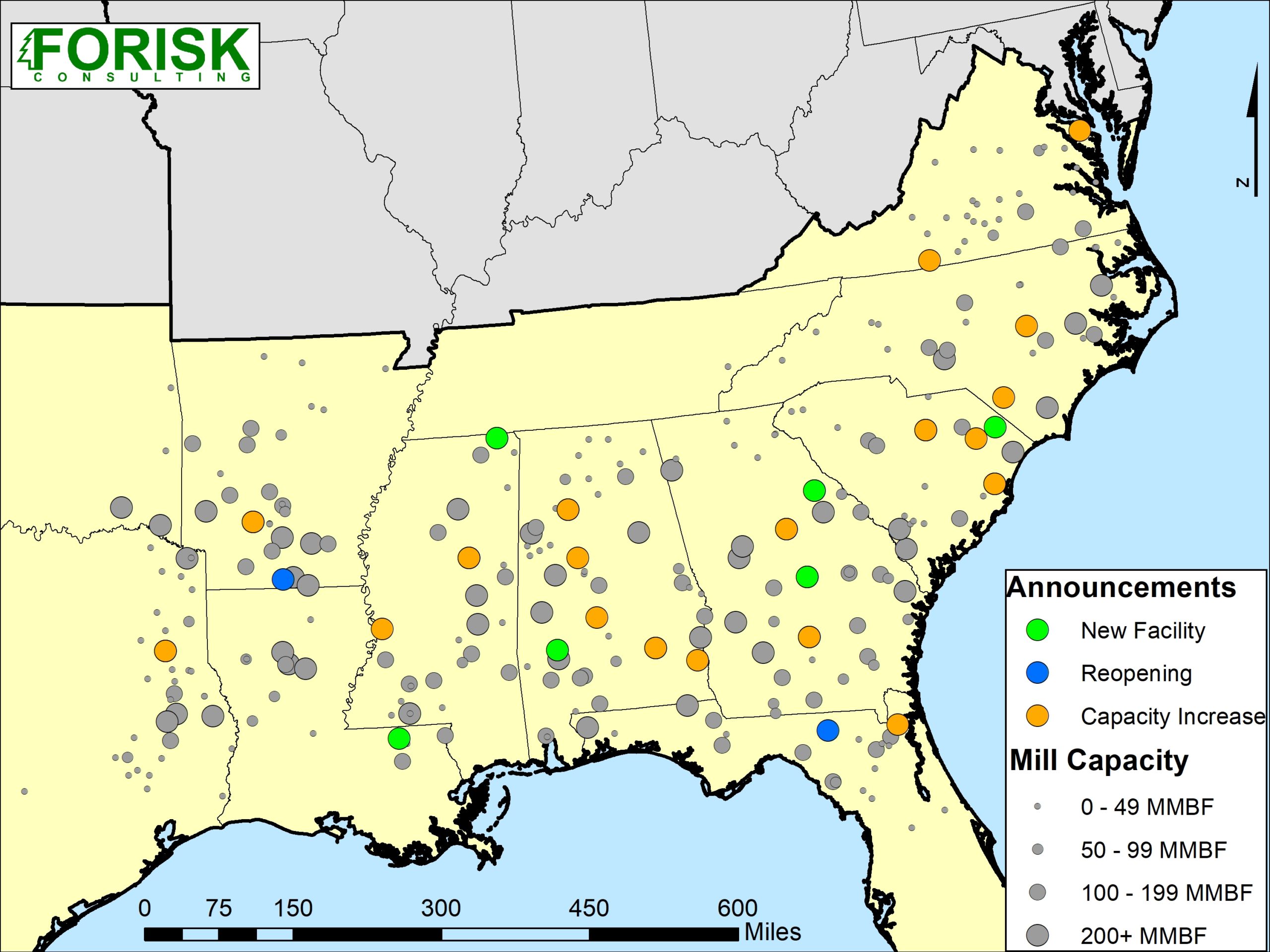

Growth continues for Southern U.S. sawmills with ongoing expansions, reopenings, and greenfield projects. Increases from these projects total nearly 3.0 billion board feet. Resolute Forest Products in El Dorado, Arkansas had a soft start-up in November 2020 and are producing test loads. The mill plans to be running one shift in January 2021 and two shifts by the spring. Westervelt’s new mill in Thomasville, Alabama is operational. They plan to start producing lumber in January. Binderholz purchased the Klausner sawmill in Live Oak, Florida and plans to start in Q1 2021. They are investing in mill upgrades. Mission Forest Products, a subsidiary of Timberland Investment Resources (a TIMO), plans to build a 250 MMBF pine sawmill in northern Mississippi by 2022. This is a new player in the Southern sawmill space.

Firms are also rationalizing capacity across their portfolios. Several sawmills closed since early 2019. GP closed the Sterling sawmill in southeast Georgia last year and closed the McCormick sawmill in South Carolina. This year, GP closed the Dequincy sawmill in Louisiana.

To learn more about the Forisk North American Forest Industry Capacity Database, click here or call Forisk at 770.725.8447. To learn more about the Forisk Research Quarterly (FRQ), click here.

Leave a Reply