The physical facts of nature help us, at times, reconcile contradictions in the marketplace. Consider the disparity between sky-scraping softwood lumber prices and the pedestrian prices received by forestland owners in the U.S. South for their logs.

I hear from folks in forestry who are convinced that the failure of timber prices to rise during this frenzied lumber market is evidence that “something is going on”, that Canadian firms “infiltrated” the South, that the lumber industry is “over consolidated.” While multiple reasons may help explain the dynamics of timber prices by local market, the bottom line remains that, in the U.S. South, we are swimming in wood.

We have been studying this issue for years. Literally. For example:

- 2011: Forest Growth Far Exceeds Wood Demand

- 2012: Forest Supplies and Market-Specific Stumpage Prices

- 2013: Assessing Forest Supplies and Price Elasticities

- And so on, year-by-year….

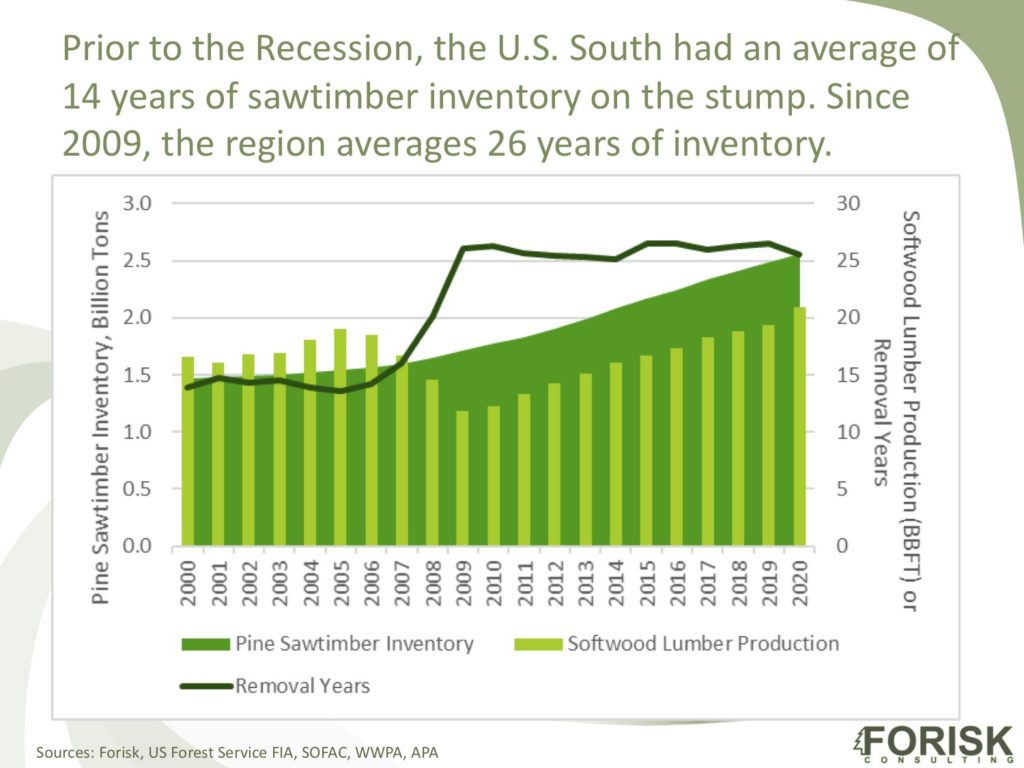

While this situation is frustrating for some, the natural order cannot sustain contradictions, so we go to the physical facts to review our assumptions. Consider a summary of Forisk research in the figure below, which applies the “removal years” metric introduced in the 2012 link above. Twenty years ago, the South averaged 14 years of pine grade on the stump on private timberlands. Now, the region averages 26 years, even as billions of board feet of new, cutting-edge sawmill capacity has come online. Demand is still chasing supply.

People get tired of this story but think about the day-to-day reality. Does any given mill really care whether or not a given forest owner is in the market right now selling timber? In the South, the answer is no UNLESS you are a major owner or have wet weather tracts. Otherwise, the forest warehouse is full and still growing. This is not that complicated. We “CRP’d” and fertilized our way to massive, genetically improved forests, and it takes time for forests to cycle and for mills to get built to bring back balance.

However, there is more to the story for investors. As Aunt Fanny learned, timber prices provide an incomplete view of timberland investments. Consider a comparison of South-wide pine sawtimber prices from Timber Mart-South (TMS) compared to South-wide average private timberland values from NCREIF over time (below).

| 2020 | 2010 | 2000 | 1990 | |

| TMS pine sawtimber $/ton | $23.34 | $28.05 | $39.10 | $18.17 |

| South, timberland $/acre* | $1,792 | $1,526 | $1,027 | $593 |

*As of Q4 from NCREIF

While, as a forest owner, you may not like the timber prices, your timberlands are worth more than ever. Potential buyers are plentiful. These lands produce and generate cash, with improved mixes and volumes at harvest over shorter rotation ages.

In the end, while the relationship between softwood lumber and log prices in the South is “tenuous” at best, the conditions for attracting forest industry capital and supporting long-term healthy markets for wood are captured in the South: available, accessible and sustainably managed forests.

Very informative article.

Facts, data, math and economics usually win out. Well written.

Thanks Brooks. Note too that the discount rate in 2020 was much lower than in the other years, pushing up all asset prices including timberland. This would compensate somewhat for the low timber prices.

I hear you Sam, but I doubt that’s a DR response to low timber prices. I recall in 2007 as the Great Recession was beginning, we watched incredulously as timberland values continued to climb even as sawtimber prices were dropping. Court Washburn, borrowing from Alan Greenspan, attributed it to irrational exuberance. Many anticipated a rational correction. It never came and DR continued to compress. After 15 years, we’re awash in supply and wood prices remain low. And yet, the article states, “your timberlands are worth more than ever.”

So what’s going on? I would love to see a deep dive into who is buying timberland and what motivates them. If they are farsighted wealthy individuals or institutional investors who see value beyond “mere” timber, then good on them. I’ve long felt that the true value of timberland can’t yet be seen on a spreadsheet. If it’s offshore investors looking for PR value in the voluntary carbon market, well, that could be a pretty ephemeral view and that rational correction could (still) be just around the corner.

Hey Jim, where have I heard that before 😉 One thing we have to remember with respect to the NCRIEF data: they reflect the supply/demand for institutional properties. With some liquidity stickiness due to fund terms, as well as a physical shortage of say $10mm packages, I think there is not enough supply to meet the modest demand. The demand partially results from a bunch of nonsense with respect to ESG, reliance on ancient history, etc. that goes into the marketing of timberland as an asset class. And by the way, you can’t buy the asset class, you can only buy a property. So I agree with you, head scratcher. People also buy negative-yield government bonds.