This is the third in a series related to the Q2 2021 Forisk Research Quarterly (FRQ), which includes forest industry analysis and timber price forecasts for North America.

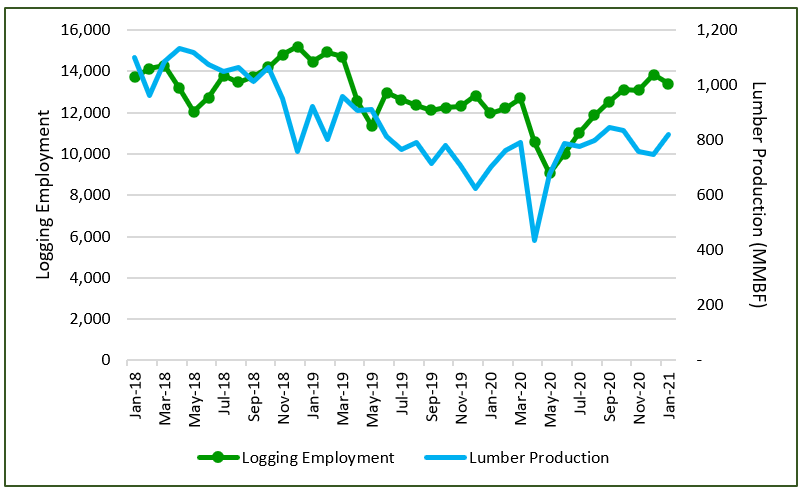

The recovery we are witnessing in Western Canada logging employment may be the best logger rebound since Karl Malone left the NBA. The narrative on Western Canada’s forest industry has been negative for years, as the repercussions of the mountain pine beetle infestation loomed over the lumber industry. In 2018 and 2019, a number of sawmills closed or down-sized as supply constraints finally became untenable. The impact on employment rippled out into the supply chain as well. By January of 2020, logging employment was down 17% year-over-year while lumber production was down 24% (Figure 1).

In this context, the pandemic dealt a cruel blow to a struggling industry. April lumber production fell 52% year-over-year in Western Canada. The shutdowns hit as loggers headed into spring breakup, but many loggers must have been contemplating whether summer would offer any work. Yet Western Canada’s forest industry enjoyed a tremendous recovery. Record lumber prices fueled higher lumber production and the logging industry rebounded. At its nadir in May, year-over-year logging employment fell 20% from 2019. By October 2020, however, employment was 7% higher year-over-year on the strength of the surging lumber industry. Lumber production in late 2020 was still far below 2018 levels and it remains to be seen if lumber prices will retain enough strength to justify sawmill operations where supplies are so limited. Still, the speed of the logging industry recovery in Western Canada offers hope to other regions fearing logging capacity shortages.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Leave a Reply