This post is the fourth in a series related to the Q3 2021 Forisk Research Quarterly (FRQ), which includes forest industry analysis, timber price forecasts, and featured research on forest management practices.

Pulp & paper production increased in the U.S. by 2% in Q2 2021 and was up 0.6% year-over year, according to AF&PA. Strong packaging production lifted the sector, rising 3% for the quarter and 4% year-over-year. Tissue production continued to fall relative to record 2020 levels, dropping 4% for the quarter. Both printing and writing (-13%) and newsprint (-26%) are down considerably year-to-date relative to 2020.

Despite the overall increasing trend, wood-using pulping capacity in North America is poised to decrease 1% from 2020 to 2022. Mills are using more recycled fiber, and they are investing in infrastructure to use even more recycled fiber – including building new facilities that will exclusively purchase recycled fiber instead of wood. Wood-using capacity is decreasing slightly in North America, with the largest declines expected in Eastern Canada and the U.S. North where shifts from wood-using to 100% recycled capacity are challenging pulpwood markets. The U.S. West gains expansions at mills that plan to increase the use of recycled fiber at wood-using plants.

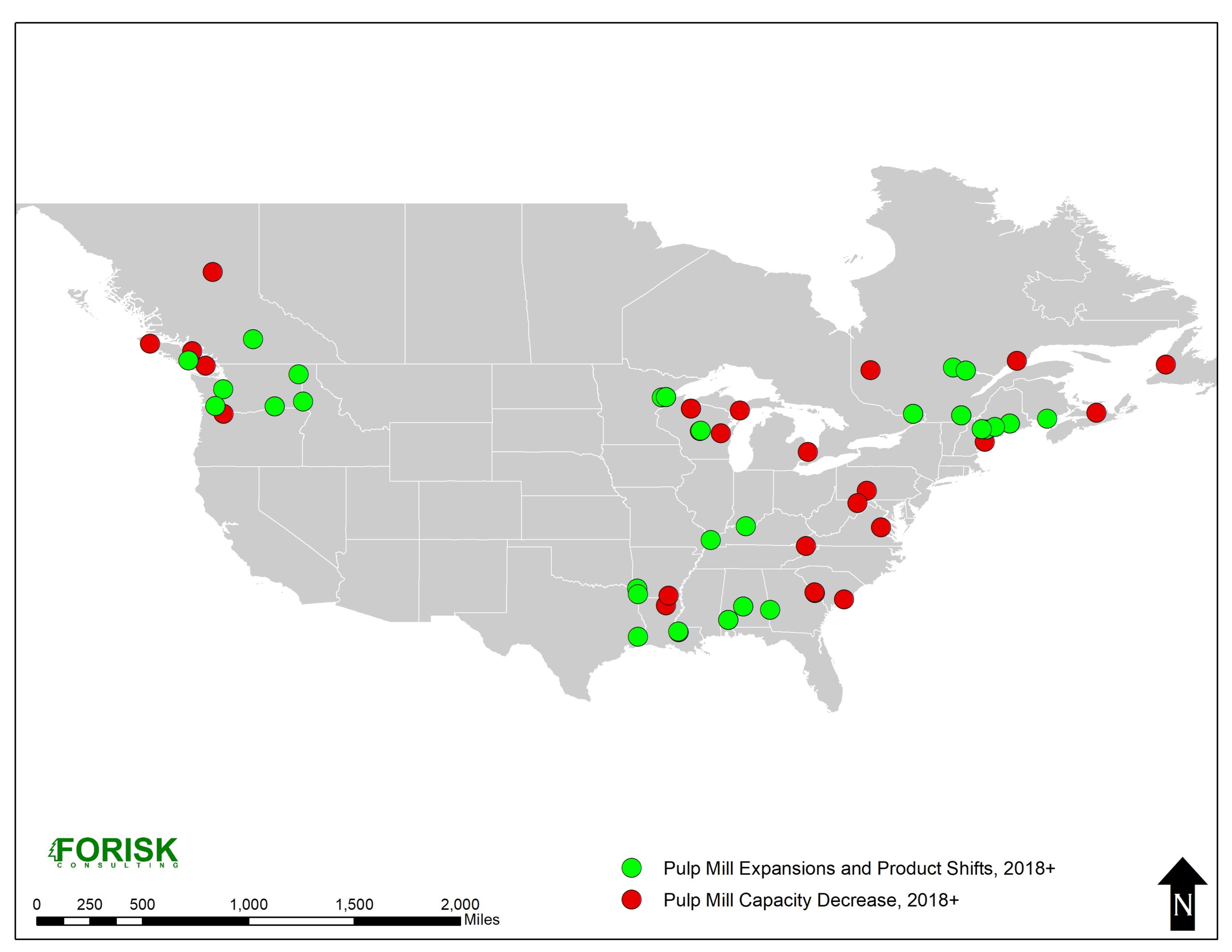

Figure. Expansions, Closures, and Product Shifts at Pulp Mills, 2018-2024. Data source: Forisk. Note: excludes mills that are 100% recycled.

A map of pulp mill capacity changes planned since 2018 shows a mix of closures and expansions across regions, with net closures in the Appalachian region of the U.S. South and in the Lake States. Expansions in Eastern Canada and the U.S. North include investments in tissue, packaging, and in recycled containerboard capacity. Mill investments in Western Canada and the U.S. West also included packaging, household products, and increased use of recycled containerboard at wood-using mills. Investments in the U.S. South primarily focused on packaging capacity.

For forecasting and tracking of forest industry sectors, to the Forisk Research Quarterly. To produce custom reports and maps, check out Forisk’s North American Forest Industry Capacity Database. Discounted rates available for companies that also subscribe to the Forisk Research Quarterly (FRQ). Email hclark@forisk.com for pricing information and to place an order.

Leave a Reply