This post is the first in a series related to the Q4 2021 Forisk Research Quarterly (FRQ), which includes forest industry analysis, timber price forecasts, and featured research on forest carbon.

The U.S. housing market dipped slightly in September, largely due to a decline in multifamily starts. The seasonally adjusted annual rate (SAAR) of 1.555 million units represented a 1.6% decrease from August. While multifamily housing starts fell 5% from last month, single-family starts remained flat. Total building permits dropped 7.7% from August, led by multifamily permits (-18.3%) and a small decline in single-family permits (-0.9%). The sector continues to suffer from shortages in building materials and labor. This was further compounded by the disruption from Hurricane Ida in the South and Northeast.

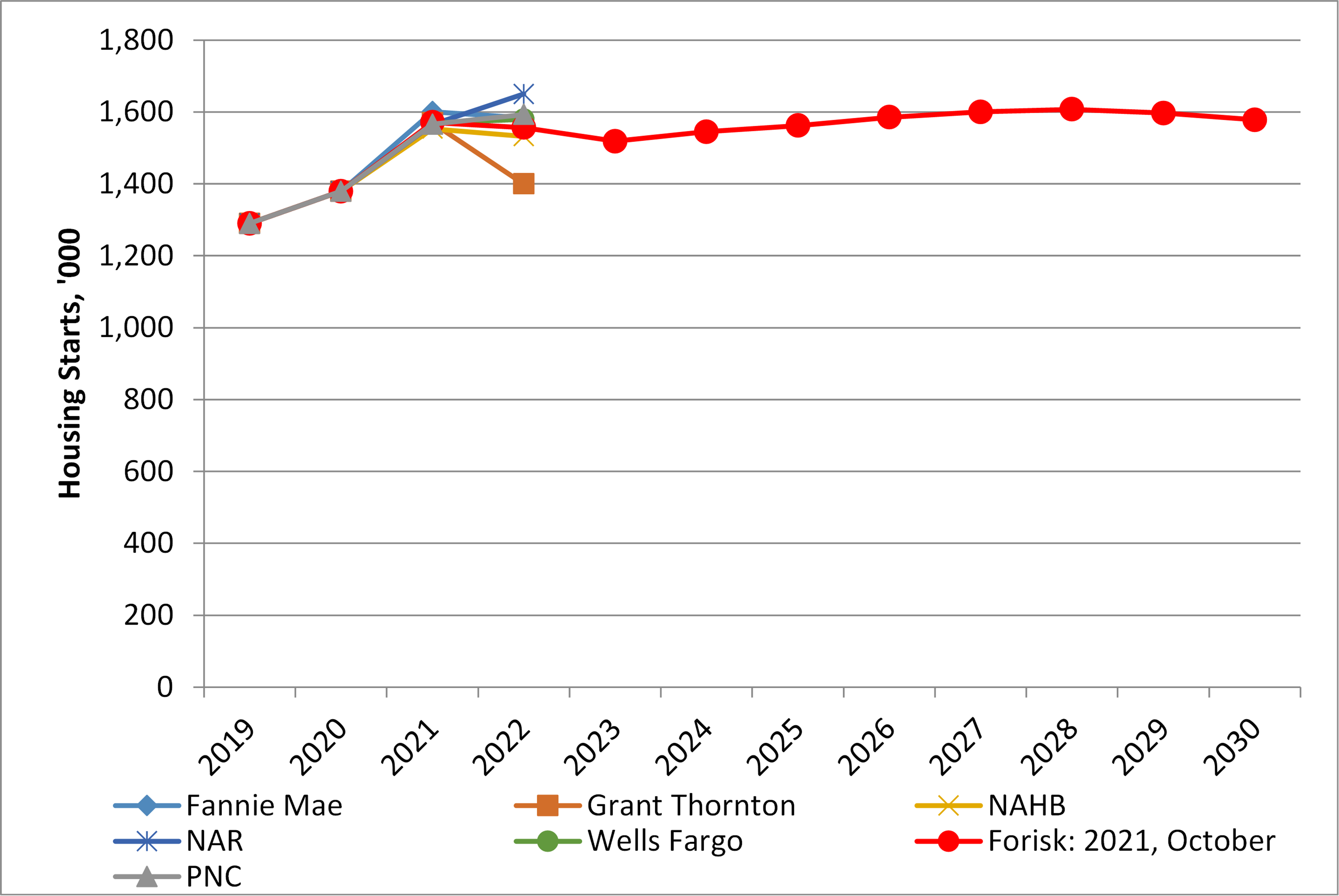

Each quarter when updating our Forisk Research Quarterly (FRQ) forecast models, we revisit prior projections and review applied research on business and economic forecasting. Forisk’s Housing Starts Outlook combines independent forecasts from professionals in the housing industry. Currently, these include Fannie Mae, the National Association of Realtors (NAR), Grant Thornton, the National Association of Home Builders (NAHB), PNC Financial Services Group (PNC), and Wells Fargo. Forisk applies long-term assumptions from the U.S. Energy Information Administration (EIA) and Harvard’s Joint Center for Housing Studies to establish the peak and trend over the next ten years (Figure).

Forisk projects 2021 housing starts of 1.57 million, up 13.9% from 2020 actuals. This represents a 1.2% decline from our July 2021 estimate as forecasts dropped slightly to end the year. Forisk’s Base Case peaks at 1.61 million housing starts before tapering off towards the end of the forecast.

Despite relative consensus that housing starts are trending higher for 2021, estimates vary widely for 2022. For example, NAR posits a bullish 2022 with a forecast of 1.65 million starts while Grant Thornton forecasts a more muted 1.40 million. This represents a range of 250 thousand starts.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Leave a Reply