This post is the fourth in a series related to the Q1 2022 Forisk Research Quarterly (FRQ), which includes forest industry analysis, timber price forecasts, and featured research on forest carbon.

The U.S. housing market maintained its strength to close out the year in December, driven by growth in multifamily construction. The seasonally adjusted annual rate (SAAR) of 1.702 million units represented a 1.4% increase from November. Despite single family starts declining 2.3% for the month, multifamily starts rose 13.7%. December’s SAAR of 524 million housing starts represents the highest level of multifamily starts since January 2020, making it the second largest monthly rate in twenty years. For the year, U.S. housing starts rose significantly, up 15.6% to 1.595 million starts. Single family starts rose 13.4% while multifamily gained 21.3%. The housing market shifted to slightly lower levels of single family construction, down to 70.4% from 71.8% in 2020.

The strength of the U.S. housing industry over the past two years has been an unexpected (but welcome) surprise. At the outset of the pandemic, housing starts were forecast to decline by as much as 14.0% in 2020. Instead, starts rose 7.0% in 2020 and an additional 15.6% in 2021. In fact, housing starts consistently rose over the past decade, from 609 thousand in 2011 to 1.6 million in 2021 (Figure 1). When looking at the history of housing starts over the past sixty years, it becomes apparent just how unusual this decade-long trend is.

Over the past six decades, housing cycled between periods of growth and decline, with longer periods of uninterrupted growth or decline being rare. Prior to 2010, no period of consistent growth or decline lasted longer than five years. However, in our current cycle of growth, housing starts increased every year over the past decade at a compound annual growth rate (CAGR) of 10.1% per year. This doubles the length of the previous longest growth period and represents the largest absolute 10-year change since 1959. That makes our current period of expansion as unprecedented as the scale of decline that preceded it during the Great Recession.

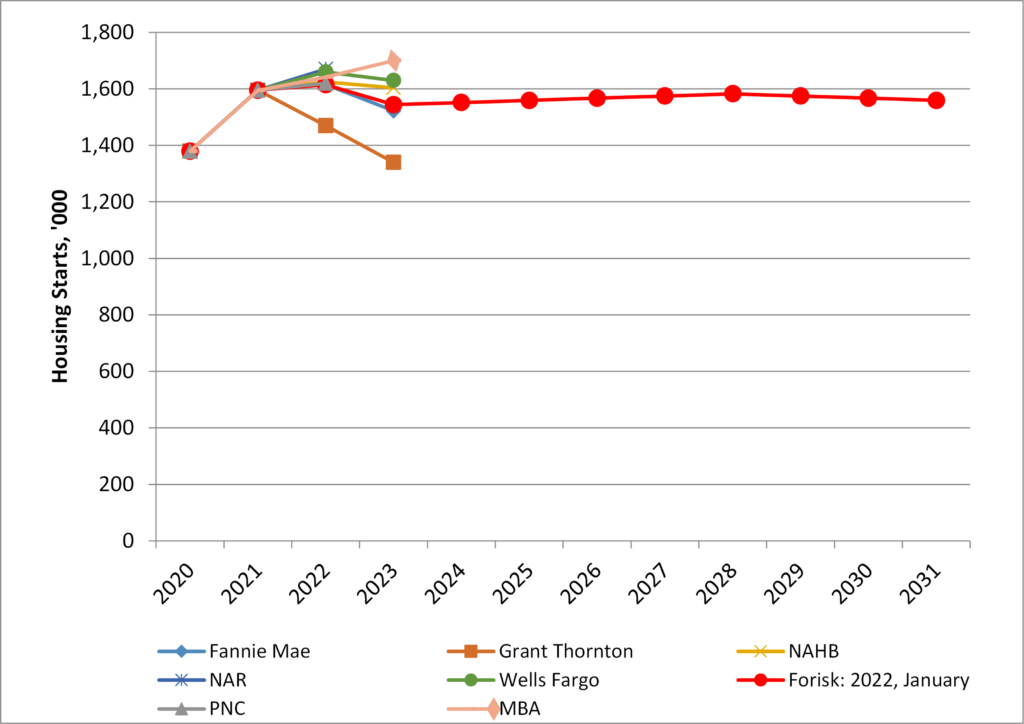

Each quarter when updating our Forisk Research Quarterly (FRQ) forecast models, we revisit prior projections and review applied research on business and economic forecasting. Forisk’s Housing Starts Outlook combines independent forecasts from professionals in the housing industry[1] and applies long-term assumptions from the U.S. Energy Information Administration (EIA) and Harvard’s Joint Center for Housing Studies to establish the peak and trend over the next ten years (Figure 2).

Forisk projects 2022 housing starts of 1.615 million, up 1.2% from 2021 actuals. We assume that underlying demand – based on demographics and household growth, second home ownership, and net replacement of existing housing stock – brings Base Case housing to a long-term trend of ~1.56 million starts. Our current forecast peaks in 2022 at 1.615 million starts before moderating in 2023. The independent housing forecasts captured in Forisk’s Housing Starts Outlook reflect the range of expectations for 2022. For example, NAR leads with a 2022 forecast of 1.67 million while Grant Thornton trails with its most recent forecast of 1.47 million. Current housing start levels are above the long-term average of 1.5 million and are forecast to, on average, remain so throughout the next decade. We are mindful, however, to remember the history of housing starts and expect volatility.

[1] Currently, these include Fannie Mae, the National Association of Realtors (NAR), Grant Thornton, the National Association of Home Builders (NAHB), the Mortgage Bankers Association (MBA), PNC Financial Services Group (PNC), and Wells Fargo.

Leave a Reply