This post is the first in a series related to the Q2 2022 Forisk Research Quarterly (FRQ), which includes forest industry analysis, timber price forecasts, and featured research on regional pulpwood price dynamics. Below is an excerpt from that featured research.

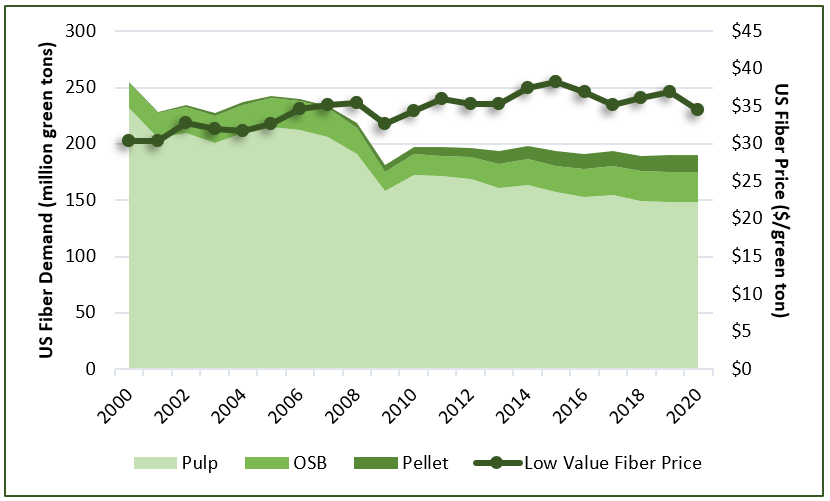

Markets for lower-value, pulp-quality fiber provide an important outlet for landowners across North America to thin their stands and utilize the mixture of timber sizes and qualities common in natural forests. Pulp and paper production remains the primary consumer of low-value fiber, though other industries such as OSB and wood pellets are meaningful consumers as well. Since North American pulp and paper production peaked at the end of the 1990’s, loss of demand for pulp-quality fiber began to challenge sound forest management regionally. Markets for pulpwood stems disappeared, impeding silvicultural harvests. Despite these regional dynamics, total fiber costs in the U.S. increased 15% from 2000 to 2021 as measured by the Forisk U.S. Pulp Fiber Index (Figure 1). Over the same timeframe, US consumer inflation increased 50% and wood pulp prices increased 33%. Declining total demand did not lower wood costs (per ton) in nominal terms, but low-value fiber costs increased at a slower pace than either the economy or the primary end-product produced from pulp-quality wood.

Supply Drivers

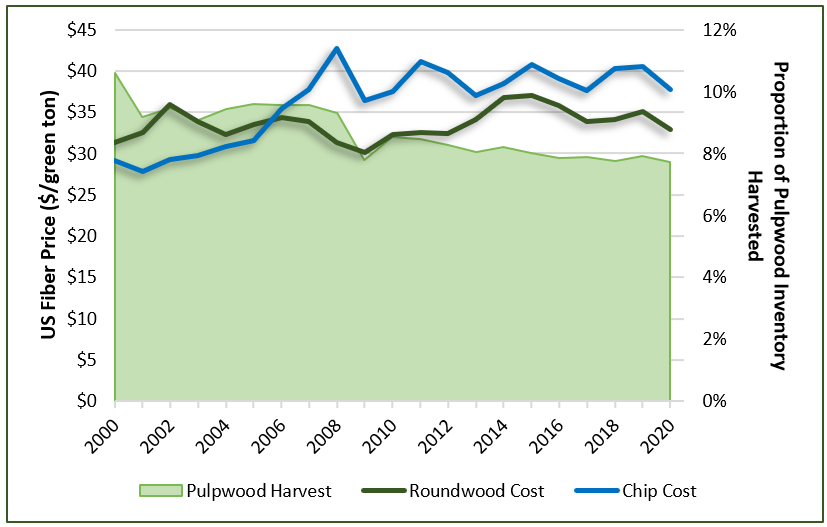

Demand is an important driver of costs, but supply is also a key component. Forest Service inventory data show standing inventories of pulpwood-sized material (trees 5-9” in diameter) increased through the early 2000’s on privately-owned timberlands. Forisk projections indicate volumes of pulpwood-sized trees peaked and are now declining nationally. As the forest inventory of pulpwood-sized trees grew over the past two decades, the proportion of that small-tree inventory harvested each year fell from 11%[1] in 2000 to just under 8% in 2020 (Figure 2). The relative drain on inventory of pulpwood-sized trees is lower because of the combination of increased inventory and lower demand compared to the start of the 2000s.

Wood chips from sawmill residues also comprise an important supply of pulp-quality fiber. These chip supplies are often a convenient source of material and are the primary pulp raw material in western North America where the costs of harvesting smaller-sized trees historically limited the supply of pulplogs. Comparing pulplog costs to chip costs highlights the contrasting impact on these two supplies over the last two decades. Pulplog costs fluctuated between $30-$35 for the past twenty years (5% growth from 2000-2020). Growing inventory and shrinking demand held prices comparatively flat. Chip costs, in contrast, increased from under $30 per ton in the early 2000s to $38-40 later in the period (30% growth). Contraction of the sawmill industry during the Great Recession pushed prices higher, and the lumber recovery following 2009 provided increasing residual volumes in step with the growth of the wood pellet industry (a consumer of residuals).

Regional vs. National Trends

The story remains nuanced. Markets are inherently local. A national analysis speaks to larger trends, but low-value fiber markets in the South are quite different from those in the Pacific Northwest. We will look at these regional differences in greater detail to unearth local drivers of fiber markets and better understand how prices for roundwood and chipped pulp-quality fiber respond regionally.

[1] This a conservative estimate that underestimates the contribution of top wood from larger stems and larger cull trees to total roundwood pulpwood demand.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Leave a Reply