Forestry is an industry of long time horizons. We often measure our performance over decades. Even in the comparatively fast-growing stands of the Southern U.S., forest rotations stretch to three decades or more. In that light, short-term disruptions feel less significant over the life of a forest. Yet, fourteen years ago the country suffered the Great Recession, a nearly two-year downturn in economic activity which continues to reverberate through the forest industry, particularly because of it’s long time horizons.

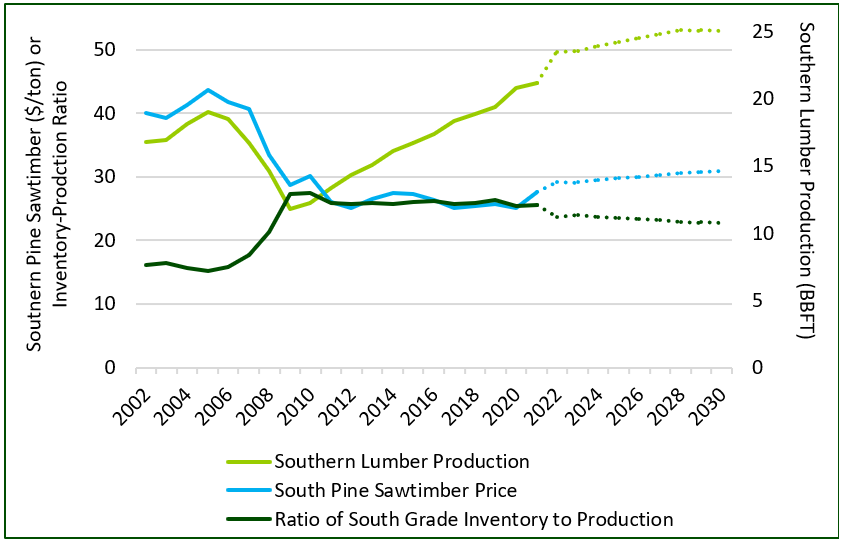

We often highlight the substantial impacts of the Great Recession’s slowdown in sawtimber harvest on the expansion of southern sawtimber inventories. Harvesting declined in the face of reduced demand for housing just as an historic acreage of planted pine trees were reaching economic maturity, the echo of government-supported planting efforts from decades earlier. The resulting sawtimber accumulations largely contributed to flat sawtimber prices over the past decade despite a surge in southern lumber production (Figure 1). Continued sawtimber accumulations held the ratio of inventory to lumber production constant and prices moved little despite surging demand, though 2021’s high lumber prices and supply chain woes pushed prices higher in a number of localized markets.

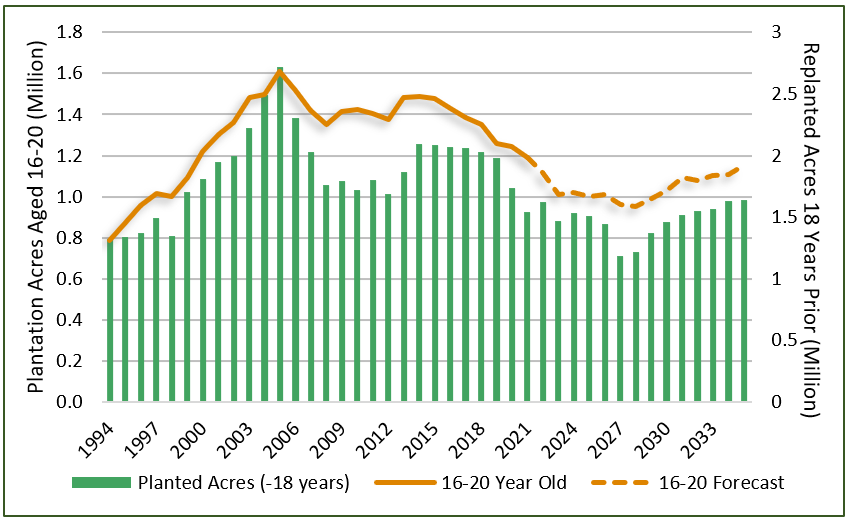

It may seem arbitrary to reflect on the Great Recession 14 years after it’s start (according to the Federal Reserve, the Recession began in December 2007). However, 14 years is the average age of first thinning on intensively managed southern pine plantations, based on our most recent Southern silviculture survey. So, the echoes of the Recession may now be reverberating across pulpwood markets, as well. Reduced sawtimber harvests during and following the Recession reduced the number of replanted acres. Planting and inventory data suggest acreages of stands available for first thinnings could be reduced for a decade or more (Figure 2). While our forest inventory measurements are always backwards looking, we know the acres planted over the past decade will represent our future pulpwood inventory, and, eventually, our sawtimber. Overlaying acres planted in the South 18 years ago over the acres of 16-20 year-old planted pine reveals that acres peaked in 2014 and are on track to trend lower through 2028 before beginning a steady pace of recovery. While thinnings are only a part of the Southern pulpwood picture, it will be important to watch how pine pulpwood prices react over the coming years.

Despite ending over a decade ago, the Great Recession continues to affect the forest industry. Direct impacts on wood demand translated into indirect impacts on timber supply, first through a surplus of sawtimber and now declining pulpwood. As the economy moves on and other trends influence timber supply and demand, the scale of the Great Recession remains visible in the forests of the U.S. like aberrations in the rings of a tree.

The Forisk Research Quarterly publishes analysis of sawtimber and pulpwood prices as well as timber supply in North America. The Forisk Wood Fiber Review tracks prices for pulp-quality fiber and biomass feedstocks across North America. Email bmendell@forisk.com or call 770.725.8447 for pricing information and to place an order.

This is a good article, you talk about thinning of timber which I am for this . Here in south Ark. they don’t thin they clear cut I mean everything , there has been several thousand acres in Columbia and Nevada county that has been clear cut this year and still cutting as fast as they can also cutting every hard wood tree they come across. You can’t replace a hard wood tree it takes at least 80 years for a hard wood tree to get to full size.

They don’t think about the wild life, taking away their food source , deer and squirrels will have to keep moving to find food.

You see truck loads of little pine trees no bigger than your leg don’t understand this, cut the trees which is good logs leave the small trees they are already there which will grow . Timber people are telling me they can clear cut and remove everything replant will be ready to cut again in 10 to 12 years no way if trees were able to be cut in that length of time the Lumber would not be fit to use, I just don’t understand this line of thinking years ago you just did not see this timber was thinned , in the last 3 to 4 years it has become a timber glut , one thing about this the way timber is being cut when it is gone it is gone will cut them selves out of something to do.