This post is the fourth in a series related to the Q2 2022 Forisk Research Quarterly (FRQ), which includes forest industry analysis, timber price forecasts, and featured research on regional pulpwood price dynamics.

The U.S. housing market maintained its momentum in Q1 2022 from a strong 2021. The seasonally adjusted annual rate (SAAR) of 1.753 million units represented a 2.0% increase from February’s forecast. Over the quarter, single family starts rose 2.5% with multifamily increasing 8.8%. The first quarter rate of 1.753 million starts represents the highest quarterly value in sixteen years. For 2021, U.S. housing starts increased 16.1% to 1.601 million starts. Single family starts rose 13.8% while multifamily gained 21.8%.

Despite a torrid level of housing starts over the past year, housing completions were more muted. Housing completions rose 4.2% compared to a 16.1% increase in starts. What could be causing this divergence? Did Bart break into the construction site again? Part of the difference may be attributable to supply chain issues. A shortage of truck drivers, low inventory levels, and clogged ports all made headlines in the past year. These supply chain issues magnified rising inflation rates and resulted in numerous product shortages, including building materials.

Figure 1 presents a rolling 12-month average of U.S. housing starts versus completions. Historically, completions slightly lag starts but track closely. Challenges during the pandemic altered the historical dynamics as starts and completions diverged. As of March 2022, 1.778 million new houses were started in the preceding 12 months compared to 1.444 million completions. Worse still, since August of last year, average completions fell 2.7% despite housing starts rising 4.5%. Our softwood lumber forecast reflects this divergence. Softwood lumber production increased only 0.7% in 2021 despite a 16.1% increase in housing starts. Building material and labor shortages, among other issues, hindered home completions. How long will this continue? Forisk’s lumber production forecast increases 8.5% in 2022 representing the lumber necessary to complete the backlog of starts in addition to forecasted growth. It remains to be seen if the gap between starts and completions will tighten over time via fewer starts, increased completions, or some combination of both.

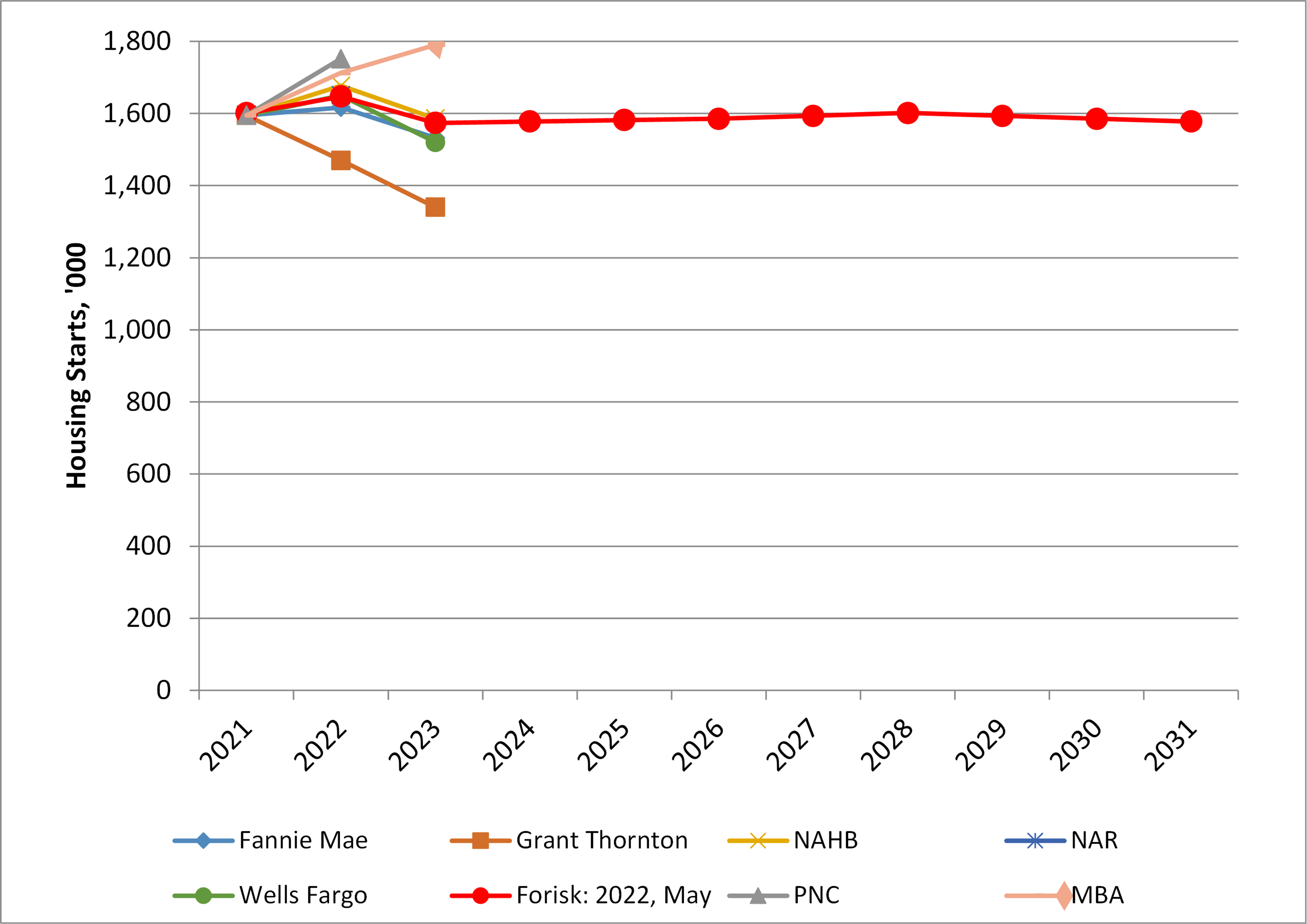

Each quarter when updating our Forisk Research Quarterly (FRQ) forecast models, we revisit prior projections and review applied research on business and economic forecasting. Forisk’s Housing Starts Outlook combines independent forecasts from professionals in the housing industry [1] and applies long-term assumptions from the U.S. Energy Information Administration (EIA) and Harvard’s Joint Center for Housing Studies to establish the peak and trend over the next ten years (Figure 2).

Forisk projects 2022 housing starts of 1.647 million, up 2.9% from 2021 actuals. We assume that underlying demand – based on demographics and household growth, second home ownership, and net replacement of existing housing stock – brings Base Case housing to a long-term trend of ~1.56 million starts. Our current forecast peaks in 2022 at 1.647 million starts before moderating in 2023. The independent housing forecasts captured in Forisk’s Housing Starts Outlook reflect the range of expectations for 2022. For example, PNC leads with a 2022 forecast of 1.75 million while Grant Thornton trails with its most recent forecast of 1.47 million. Current housing start levels are above the long-term average of 1.5 million and are forecast to, on average, remain so throughout the next decade. We are mindful, however, to remember the history of housing starts and expect volatility.

[1] Currently, these include Fannie Mae, the National Association of Realtors (NAR), Grant Thornton, the National Association of Home Builders (NAHB), the Mortgage Bankers Association (MBA), PNC Financial Services Group (PNC), and Wells Fargo.

Leave a Reply