This post is the first in a series related to the Q4 2022 Forisk Research Quarterly (FRQ), which includes forest industry analysis, timber price forecasts, and featured research on southern silviculture.

The U.S. housing market fell in September, with both single and multifamily starts declining. The seasonally adjusted annual rate (SAAR) of 1.439 million units represents an 8.1% decrease from August. Single family starts fell 4.7% to a SAAR of 892 thousand units; multifamily starts declined 13.1% to a SAAR of 530 thousand units. While seasonally adjusted housing permits rose slightly in September (+1.4%), this was largely a result of an increase in multifamily permits, rising 8.2% to a rate of 644 thousand units. Single family permits declined 3.1%. The sector continues to show signs of tapering as builder confidence sits at the lowest level since May of 2020.[1]

Methodology

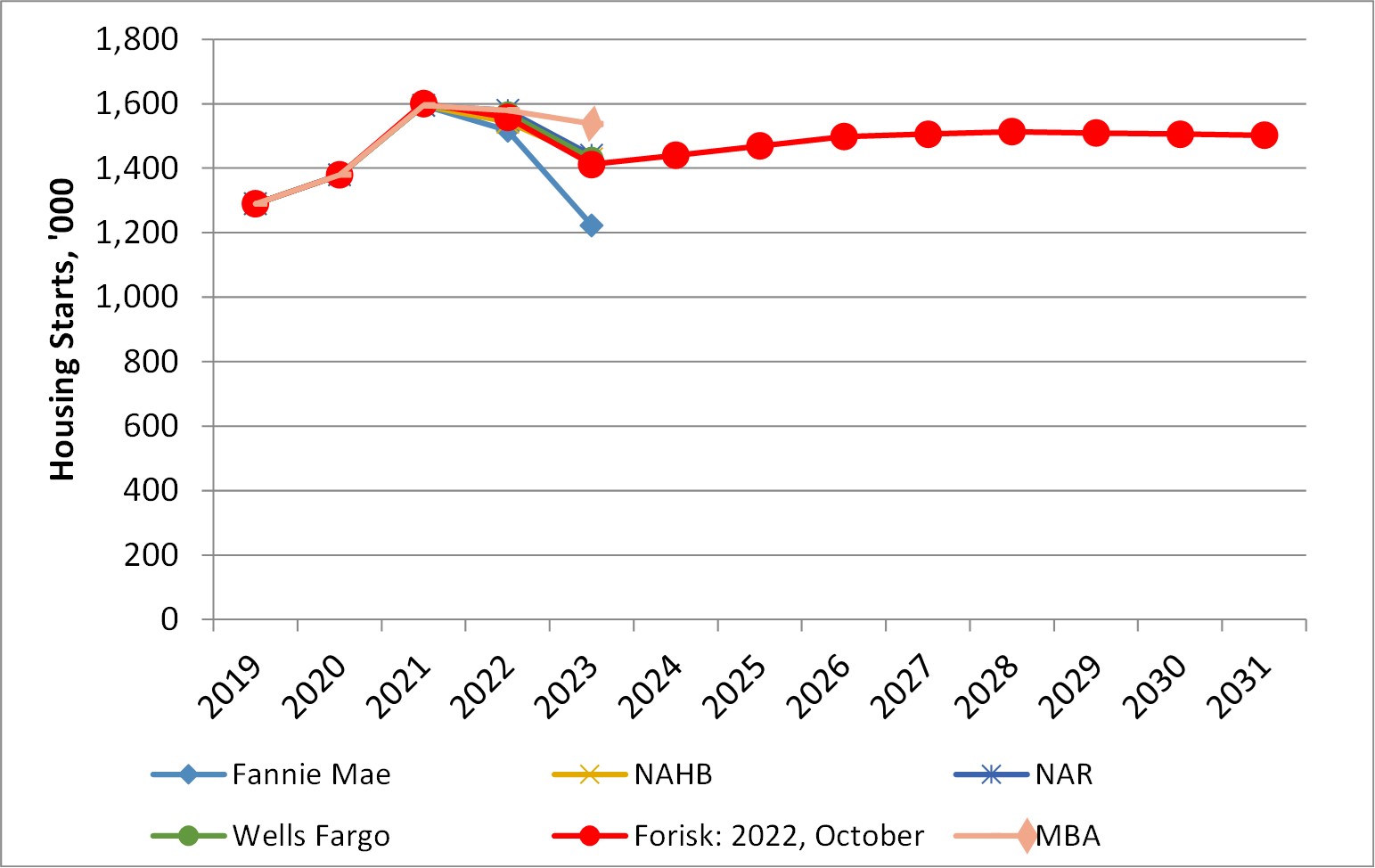

Each quarter when updating our Forisk Research Quarterly (FRQ) forecast models, we revisit prior projections and review applied research on business and economic forecasting. Forisk’s Housing Starts Outlook combines independent forecasts from professionals in the housing industry. Currently, these include Fannie Mae, the National Association of Realtors (NAR), the Mortgage Bankers Association (MBA), the National Association of Home Builders (NAHB), and Wells Fargo. Forisk applies long-term assumptions from the U.S. Energy Information Administration (EIA) and Harvard’s Joint Center for Housing Studies to establish the peak and trend over the next ten years (Figure).

Projection

Forisk projects 2022 housing starts of 1.56 million, down 2.7% from 2021 actuals. This represents a 4.1% decline from our July 2022 estimate as consensus forecasts dropped to end the year. Forisk’s Base Case peaks at 1.51 million housing starts before tapering off towards the end of the forecast. Despite widespread consensus that housing starts are trending lower for 2022, estimates vary widely for 2023. For example, Fannie Mae forecasts a bearish 2023 with an estimate of 1.223 million starts. Meanwhile, MBA posits a much more bullish 2023, with only a slight decline to 1.538 million starts. This represents a range of 315 thousand starts.

Interested in learning a process for tracking and analyzing the price, demand, supply and competitive dynamics of local timber markets and wood baskets? Register here for Forisk’s 2022 “Timber Market Analysis” class, offered virtually via Live Zoom on November 16th and 17th. Early registration ends November 2nd!

[1] https://www.nahb.org/news-and-economics/housing-economics/indices/housing-market-index

Leave a Reply