Sawmill expansions continue amid supply chain constraints. Stoltze completed an automated grading line at their lumber facility in Columbia Falls, MT. West Fraser in Henderson, TX announced a $255 million investment to build a new sawmill complex around the existing mill with an estimated start-up in Q2 2024. Interfor reached an agreement to purchase Chaleur Forest Products’ two sawmills in New Brunswick from the Kilmer Group for $255 million. This would add more resources under ownership in eastern Canada. Binderholz in Enfield, NC is making regular lumber sales but also having difficulty finding labor. Much of the new sawmill site has been poured for Roseburg’s Roanoke Valley Lumber mill in Weldon, NC and some equipment is there waiting to be installed. In addition, Mission Forest Products officially opened the sawmill in Corinth, MS in November 2022.

Mill managers shared that many sawmill projects started after the Coronavirus pandemic added time to account for supply chain issues and delays. Most projects are not experiencing issues getting general construction products, such as structural steel or concrete, but are reporting issues with increased lead time in procuring specialized equipment such as motors for slab chippers or other electrical equipment. For example, one manager noted, “The lead time for a 300 hp motor used to be a month, now it’s nine.”

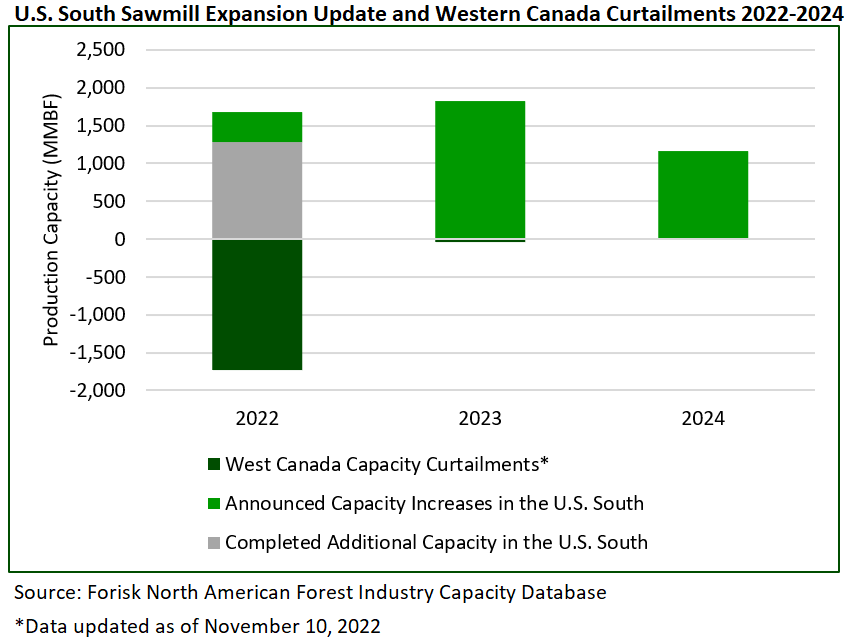

Based on data from Forisk’s North American Forest Industry Capacity Database, 1.3 BBF of sawmill capacity came on-line in 2022 via greenfield and capacity expansion projects in the U.S. South, with an additional 395 MMBF of capacity planned to begin commissioning by the end of the year. In contrast, across the continent in Western Canada, there has been at least 1.7 BBF of announced capacity curtailments in 2022, mostly motivated by increased log prices and falling lumber prices, which reduces or eliminates margins, and persistent infrastructure challenges stemming from the late 2021 floods. In 2023, Forisk anticipates an additional 1.8 BBF of Southern sawmilling capacity to come on-line, with another 1.2 BBF of capacity to be completed by the end of 2024.

Stephen Wright, Forest Industry Analyst and Associate Editor of the Forisk Wood Fiber Review, and Pat Jolley, Forest Industry Analyst and Consultant, contributed to the research in this blog post.

For market intelligence and tracking of timberland and mill investments, consider the Forisk Market Bulletin. To produce custom reports and maps, check out Forisk’s North American Forest Industry Capacity Database. Discounted rates available for companies that also subscribe to the Forisk Research Quarterly (FRQ). Email hsclark@forisk.com for pricing information and to place an order.

Leave a Reply