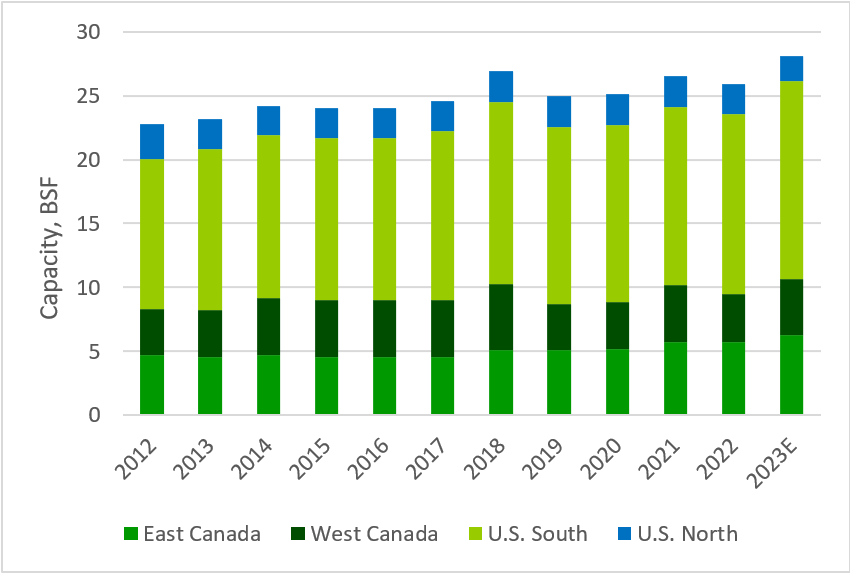

Oriented strand board (OSB) is a structural building product like plywood that is made from layers of wood strips (or strands) that are glued together and compressed with heat and pressure. Builders use OSB in subflooring and wall and roof sheathing. Mills manufacturing OSB in North America expanded over the past ten years. Since 2012, North American OSB mill capacity increased 14% to 26 billion square feet (BSF). During this time, housing starts nearly doubled in the United States and increased 22% in Canada. Also, OSB gained market share from plywood, jumping from 55% of structural panel production in North America in 2012 to 71% in 2022.

Mills added the most production capacity in the U.S. South with an increase of over 2 BSF. RoyOMartin built the newest OSB plant in the South in Corrigan, Texas in 2018. In addition, three OSB facilities started (or re-started) operations in the region. Farther north in East Canada, mills in Quebec added 1 BSF, the second largest volume regionally. West Fraser reopened the Chambord mill in 2021, and Forex opened the Amos mill in 2018. Georgia-Pacific closed the Mount Hope, WV mill, and in the absence of new mills, the U.S. North was the only region to lose capacity.

Looking ahead, announced mill projects will lift North American OSB capacity 8% (+2 BSF) in 2023. RoyOMartin is building a second mill in Corrigan, Texas expected to start this year, West Fraser plans to upgrade and restart the Allendale, South Carolina plant, and Georgia-Pacific is expanding the Clarendon, South Carolina mill. Tolko plans to reopen the High Prairie mill in Alberta that was damaged in a fire last year. Wawa OSB, planned for Ontario, is in our projections this year, but the project may be in jeopardy as the company filed for creditor protection under the Companies’ Creditors Arrangement Act (CCAA). OSB capacity will decline in the U.S. North as Louisiana-Pacific is converting the Sagola, Michigan plant to produce siding instead of OSB. While the mill will still purchase wood and provide jobs, it will no longer produce a structural panel.

For details on recent mill investments and timberland transactions, consider subscribing to the Forisk Market Bulletin. To produce custom reports and maps, check out Forisk’s North American Forest Industry Capacity Database. Discounted rates available for companies that also subscribe to the Forisk Research Quarterly (FRQ). Email hsclark@forisk.com for pricing information and to place an order.

Leave a Reply