This post is the third in a series related to the Q4 2023 Forisk Research Quarterly (FRQ) which includes forest industry analysis and timber price forecasts for North America.

U.S. South

Southern pine inventories increase 10% in ten years to a level 2.3 billion tons higher than 30 years ago.

Forisk uses the Sub-Regional Timber Supply (SRTS) model as a member of SOFAC to generate forward-looking supply estimates. SRTS is a simulation tool―based on recent U.S. Forest Service FIA data―that allows us to project the growth and removal cycle of the Southern forest resource. Forisk forecasts pine inventory to increase 10% in the next ten years. Supply forecasts project 1% more inventory growth than models last year due to higher inventories as measured by the U.S. Forest Service and revised product specification assumptions. We assume timber product specifications based on diameter classes and cull from sawtimber products to pulpwood. We changed our product spec assumptions earlier this year after talking with several clients and comparing FIA removals data to mill demand data. We learned that mills are buying more pulpwood from larger trees than previous assumptions implied. This change puts less pressure on the pulpwood resource in general.

Pine sawtimber inventories grow 1.7% per year for the next ten years in the updated model. Southern pine pulpwood inventory is projected to be flat in ten years.

Pacific Northwest

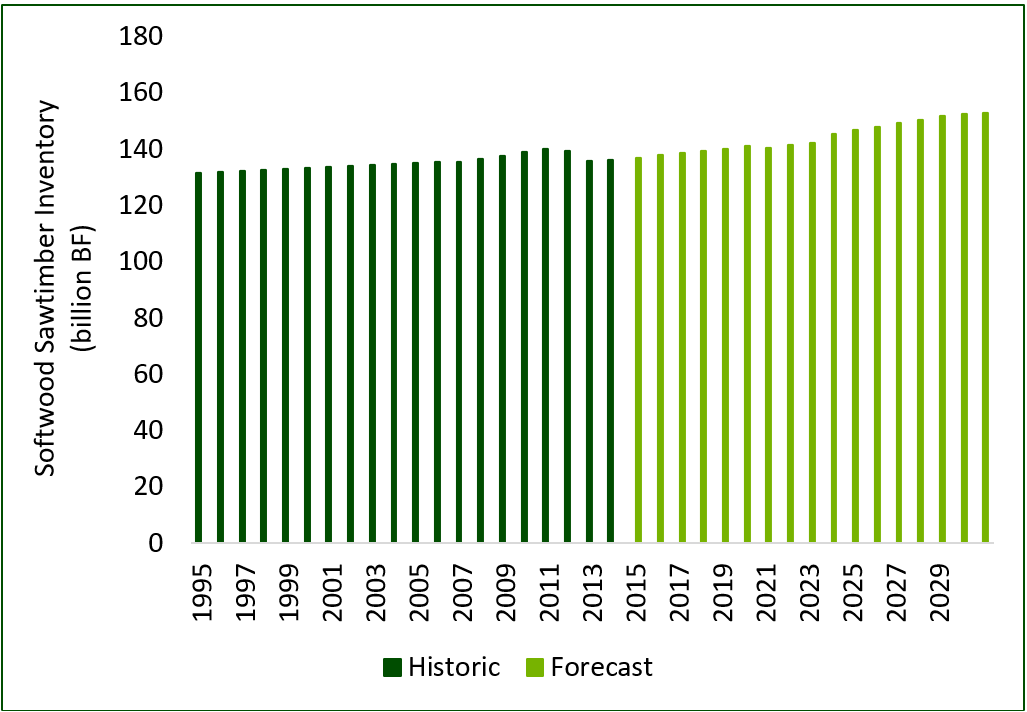

Pacific Northwest softwood sawtimber inventories increase 9% in ten years to a level 22 BBF higher than inventories in the 1990s.

Forisk models timber inventories in the Pacific Northwest by tracking the age class profile of the forest as it matures over time and correcting for losses to harvesting, land use conversion, and natural disasters. Updated supply forecasts project 4% more inventory growth than models last year due to lower lumber production and mill demand. We model inventory on private timberlands as private lands supply 80% of the timber harvested in Washington and Oregon even though they cover only 40% of the timberlands. Pacific Northwest softwood sawtimber inventory increases 1% per year for the next ten years in the updated model.

To learn more about the Forisk Research Quarterly (FRQ), click here or email Heather Clark at hsclark@forisk.com.

Leave a Reply