This post is the third in a series related to the Q2 2024 Forisk Research Quarterly (FRQ), which includes forest industry analysis and timber price forecasts for North America.

Introduction

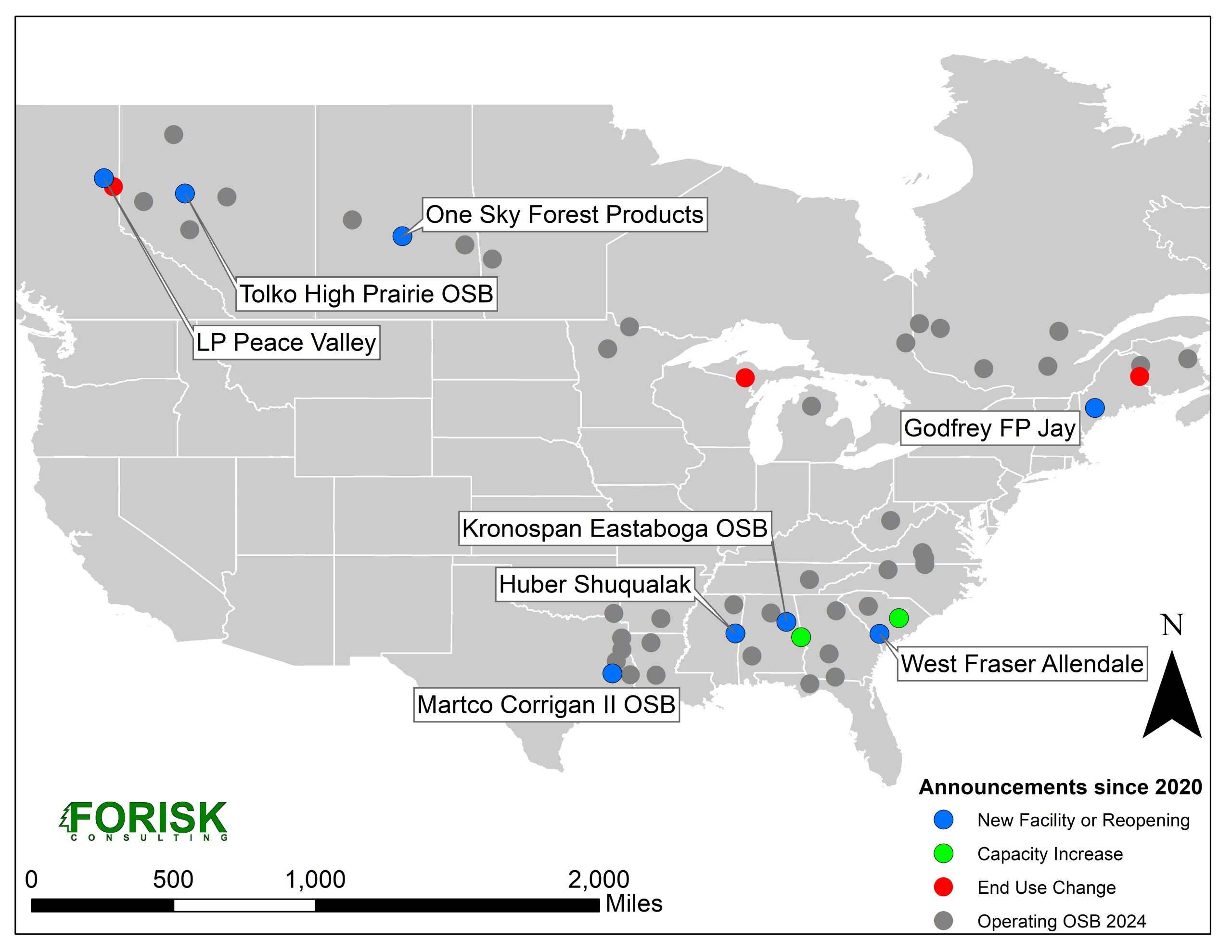

Oriented strand board (OSB) is a building material made from small diameter trees that continues to erode market share from plywood. OSB, which “orients” wood flakes (chips) from cheaper pulpwood, has lower raw material costs than plywood, which relies on veneer from larger, older, and more expensive grade logs. OSB producers have expanded mill production capacity by 5% (1.3 billion square feet (SF)) over the past five years in North America, and firms are building more mills in the region. The OSB sector produces 26 billion SF of panels and uses about 50 million tons of wood a year, which is 16% of the nearly 315 million tons of wood that the pulp/paper sector uses annually. OSB mills buy smaller pulpwood logs and are important local customers for timberland owners, particularly considering recent pulp mill closures.

Mill Investments

Two OSB mills plan to start up in 2024: RoyOMartin’s second OSB mill in Corrigan, Texas and Tolko’s reopening of High Prairie. In addition, GP is expanding the Clarendon OSB mill in SC. Kronospan and Huber are building OSB mills in the U.S. South (planned to be complete in 2025), One Sky Forest Products plans a mill in eastern Canada, and Godfrey Forest Products just announced an 850 million SF mill in Maine. Combined, these mill openings and expansions would add 4 billion square feet of capacity by 2026 in North America, a 15% increase from today’s level. These firms disclosed almost $1.5 billion of investments in announced facilities; 78% of investments are in the U.S. South ($1.1 billion). Mill expansions will maintain the U.S. South’s regional OSB market share of 56% through 2026.

Predictions

Five years ago, we examined the OSB sector in the U.S. South and our forecasts indicated that the region could support 3-4 new OSB mills. Since that time, four (4) OSB mills have been announced in the region or restarted others planned expansions. Looking forward now, and expanding our focus to the U.S., we expect OSB production to increase nearly 30% in the next ten years in the country. This forecast implies that existing OSB mills (including the ones in development) would operate at utilization rates higher than 90% to produce the OSB needed by the end of the forecast. Since mills rarely run consistently at rates higher than 90% utilization for long time periods, the U.S. needs another 2-3 OSB mills to meet the forecast, or existing facilities would expand.

Pat Jolley, Product Manager of Forisk’s Mill Capacity Database, contributed to the research in this blog post.

To learn more about the Forisk Research Quarterly (FRQ), click here or email Nick DiLuzio at ndiluzio@forisk.com.

Leave a Reply