At Forisk, we often evaluate our past performance to learn from, and improve, our work. Our forecast scorecards, published in every issue of our Forisk Research Quarterly (FRQ), are the most visible evidence of this practice. However our team often revisits past analysis to review how it performed. In our upcoming FRQ, we will repeat a Q3 2022 evaluation of the logging industry in which we matched recent changes in wood demand to changes in logging employment.

That analysis categorized counties into one of four groups, based on whether logging employment increased or decreased in the preceding three years and whether wood demand increased or decreased over the same period. The result produced a heat map which highlighted areas of concern, where employment was falling despite increasing wood demand, or where both employment and demand were falling. It also highlighted areas where employment appeared less worrisome. How meaningful was the 2022 analysis relative to changes we’ve seen in the industry since?

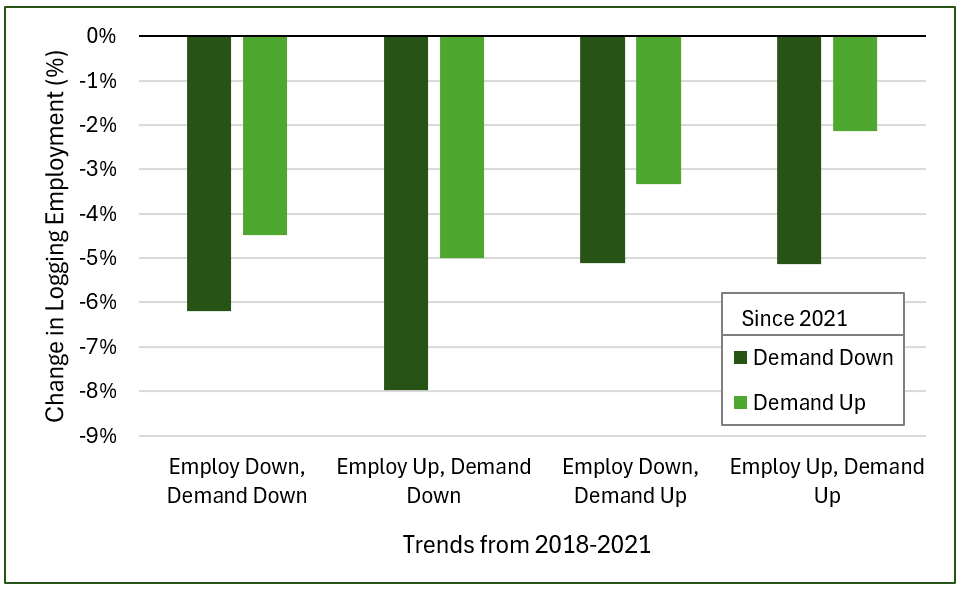

Trends in Logging Employment Since 2021

Looking just at the number of counties where employment fell since 2021 (the vintage of employment data for the previous analysis), you could argue the results were not terribly meaningful. Across each of the four categories, employment since 2021 fell in 71-72% of the counties. Wood demand increased in 23% of the counties, with little variation across categories. Neither the employment nor wood demand changes in the preceding three years provided a meaningful predictor of which counties would see employment increase or fall in the following two years.

The scale of employment changes, however, varied materially (Figure). Employment fell across all county types whether demand increased or not since 2021, falling 5.6% in total. Employment fell more where demand declined, as we would expect. Where demand declined prior to 2021, logging employment losses were greater in the following years. Counties where employment increased despite falling demand recorded the greatest drop in employment since 2021, falling 7% in total. Recent employment declined least where both employment and demand increased prior to 2021.

None of these trends are encouraging. The Southern U.S. continues to grow as the major timber producing region in North America, yet year-over-year logging employment has fallen for 16 consecutive quarters. Understanding where logging jobs could be most imperiled can help the industry prepare for and, ideally, mitigate future losses.

To learn more about the Forisk Research Quarterly (FRQ), click here or email Nick DiLuzio at ndiluzio@forisk.com.

Leave a Reply