This post is the first in a series related to the Q3 2024 Forisk Research Quarterly (FRQ), which includes forest industry analysis and timber price forecasts for North America. The post includes excerpts from the Feature Article.

Introduction

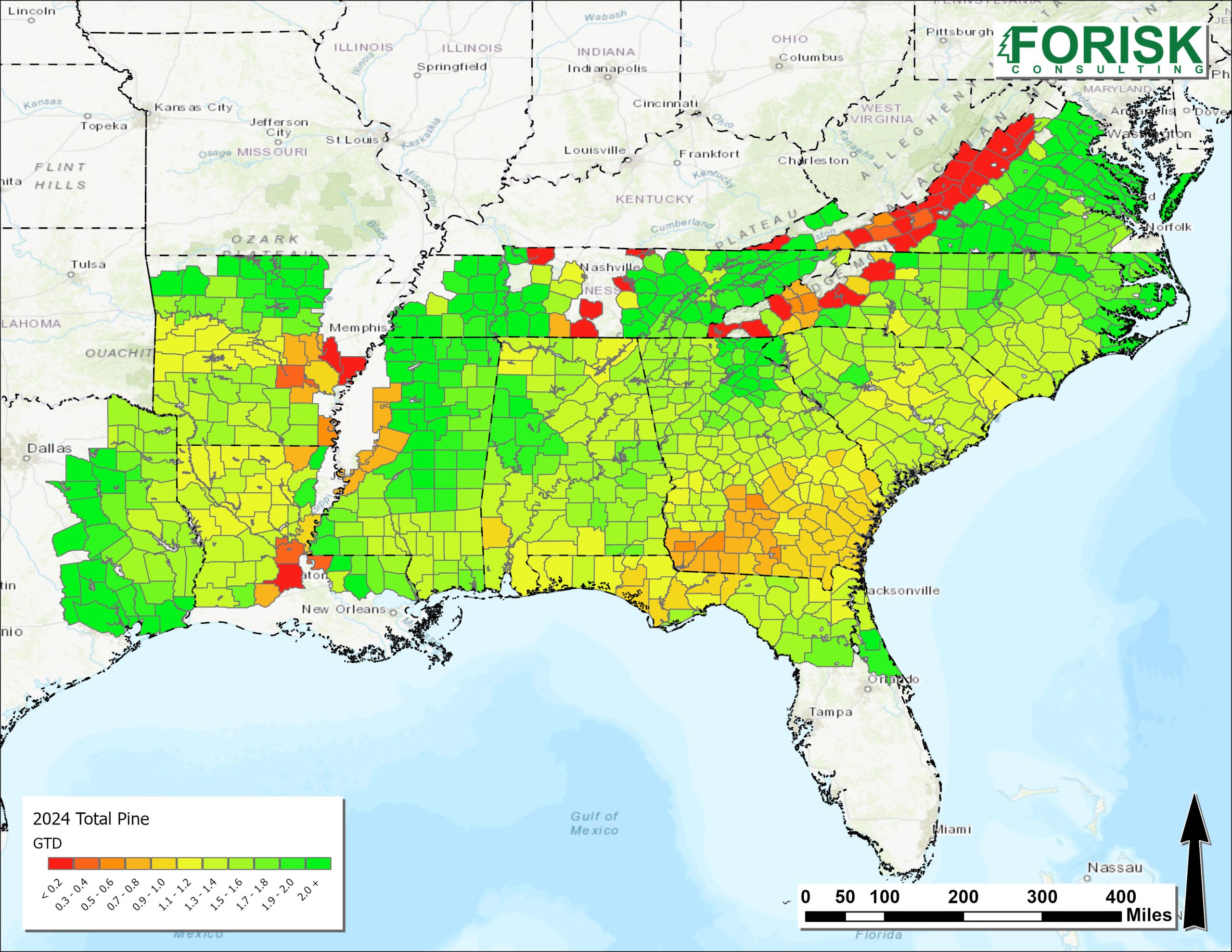

Forisk’s clients have asked for an updated county-level assessment of growth-to-drain for pine in the South. In the past five years, 27 new sawmills opened (or reopened) along with 17 pellet mills, 2 OSB mills, and numerous mill expansions, increasing wood demand in those local markets. However, closures (or conversions) of 11 pulp/paper mills and 21 sawmills reduced wood demand in other areas, along with capacity decreases. What is the status of Southern market supply given these mill changes?

Growth-to-drain analysis compares the annual growth of timber to annual harvest volumes to provide a measure of market demand relative to supply. A growth-to-drain ratio of 1.0 indicates a balanced market that harvests timber at the rate of growth. Growth that exceeds demand by a large margin indicates oversupply. Conversely, annual removals that exceed growth indicate competitive markets for raw materials.

Forisk conducted an analysis of growth-to-drain in the U.S. South by forecasting timber supplies to bring the U.S. Forest Service (USFS) FIA estimates forward to today. The USFS FIA data includes a partial state sample each year, so it represents a rolling five-year average. This analysis uses Forisk’s mill capacity database to distribute mill demand to the county level based on assumed procurement distances.

Timber Supply Today

The average pine growth-to-drain for the South in 2024 is 1.4, indicating a general oversupply of timber in the region. A heat map by county highlights local variations, with tight markets in north Florida and south Georgia (Figure 1). Areas of south Alabama, central South Carolina, and northern Louisiana also have relatively balanced timber supply with demand. Northern Mississippi, northeast Georgia, northern North Carolina, and Virginia have an oversupply of pine growth relative to demand.

Future Timber Supply

Fast-forward five years to 2029, and the timber supply profile will be less oversupplied, with an average pine growth-to-drain of 1.2. During this time, 5 sawmills, 3 OSB mills, and 3 pellet mills are expected to expand or come online in the region. South Georgia and North Florida, northern Louisiana, and central Alabama forecast to be constrained or in balance. North Mississippi, northern North Carolina, and Virginia forecast more timber growth than drain.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447. To learn more about the North American Mill Capacity Database, click here or email Nick DiLuzio at ndiluzio@forisk.com.

Leave a Reply