This post includes data and market intelligence from the Forisk Wood Fiber Review and the “Market Update” in the Q2 2025 Forisk Research Quarterly.

Forisk tracks domestic and export log prices in the Pacific Northwest as part of the Forisk Wood Fiber Review (WFR) research program, which reports on pulpwood, chip, and fiber prices for major regions in North America. Unlike timber prices in the U.S. South, which are typically reported on a stumpage basis and do not include the cost of logging and hauling, log prices in the Northwest are typically quoted on a “delivered” at-the-mill basis.

The distinction between stumpage and delivered meets different needs. In the South, prices reported as stumpage (timber “on the stump”) can feed directly into timberland valuations and appraisals, but wood-using mills must add on logging and hauling estimates to develop their raw material budgets for wood procurement and capital investments. In the Pacific Northwest, delivered prices speak in the “language of mills” while timberland owners and appraisers must subtract estimates of logging and hauling to better understanding the net timber revenues going to the landowner.

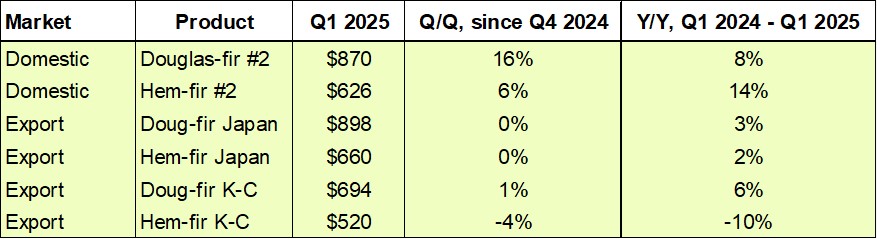

Reporting from the Q1 2025 Wood Fiber Review on Northwest softwood log prices reinforces these regional differences in raw material markets. Delivered prices for #2 Douglas-fir logs in early 2025 showed meaningful upward movement in the region, increasing 16% in Q1 2025, and 8% year-over-year (Figure). “Pretty good markets,” said one log seller. “Log prices have been coming up on the domestic side since November (2024) in Oregon and more recently in Washington.” At the time, several managers spoke to how they saw domestic log pricing as “disconnected from the fundamentals” and “driven by fear” over policy.

Pacific Northwest Softwood Log Prices, Q1 2025, $/MBF

Data source: Forisk Wood Fiber Review

More recently during Q2 2025, delivered prices for #2 Douglas-fir logs remained stable after the sharp climb in Q1 quarter. In talking with sawmill log buyers, they noted the strong competition for logs, but the continued disconnect with lower softwood lumber prices. That said, prices small logs (chip-n-saw) and white woods did soften.

More broadly, regional log consumers continue to manage real constraints. Sawmillers in the Northwest “struggled to find people” to fill second shifts, and labor issues were a theme related to logging and forest management activities. While domestic prices surged, the export market is “in a doldrums”, especially for the China log sort, a casualty of current trade and tariff policies.

To learn more about the Forisk Wood Fiber Review, please contact Nick DiLuzio (ndiluzio@forisk.com).

Leave a Reply