This post is second in a series related to the Q3 2025 Forisk Research Quarterly (FRQ), which includes forest industry analysis and timber price forecasts for North America.

Logging is a tough business. Like so many production-based industries, it relies on consistent production at low cost to generate a profit. Firms face competition, the work can be dangerous, and finding skilled, willing workers remains difficult. Yet tens of thousands of capable loggers across the country contribute to a strong and competitive wood supply chain. Their success is critical to the smooth functioning of the forest industry.

Timber Harvesting magazine, a national trade publication dedicated to the logging industry, recently continued a decades-long survey of the logging industry to capture current sentiments. The 2024 survey provides useful insights into loggers’ primary concerns, with two of the top three related to markets and production quotas[1]. When Forisk considers the financial challenges facing loggers, we often focus first on production before thinking about costs and pay rates. Quotas can be more impactful to loggers than rates.

Profits and Production

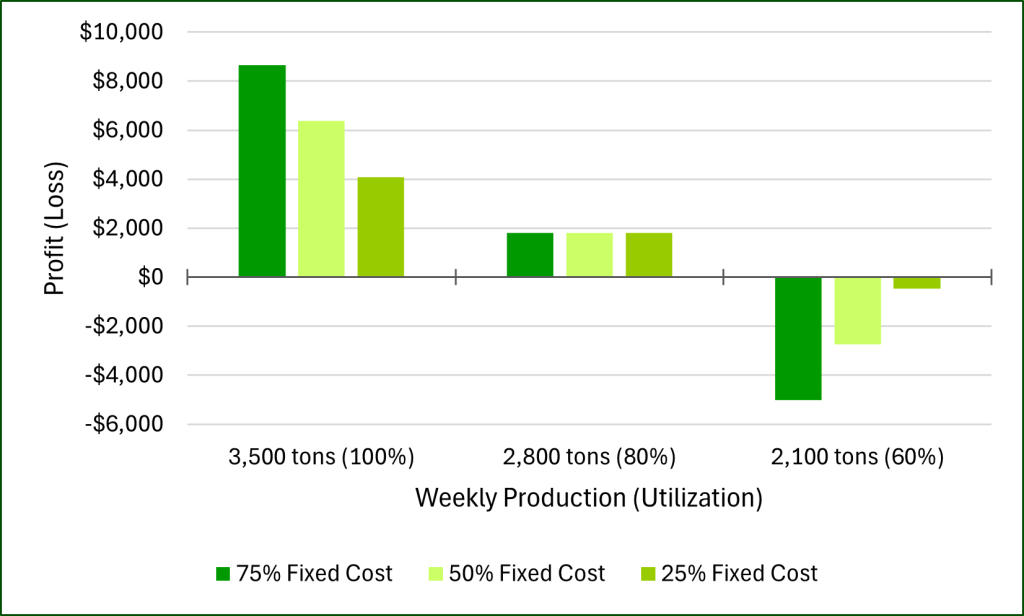

Consider the simple example below. Assume a logging business sets their rate based on the expectation of operating at 80% of their maximum production, which accounts for weather, worker issues, breakdowns, markets etc. After calculating their breakeven cost at this level, they add 5% profit[2]. In this exercise, an 80% utilization delivers around 100 loads of wood per week (2,800 tons) and just under $2,000 of profit. Depending on how their costs are structured, a shift to higher or lower production directly impacts their actual profits. If they have a higher proportion of fixed costs (lots of equipment loans, salaried employees, etc.), quotas limiting their production to 60% utilization would result in losses of $5,000 per week (Figure 1). The business would require three weeks operating at 80% utilization to offset one week running at 60%. Alternatively, this example business would need a 5%-20% higher logging rate (depending on the cost structure) to offset the slower production.

The Timber Harvesting survey provides the clearest evidence of this effect in action. When asked their 2024 operating rates:

- 18% of logging business reported operating between 60-70% utilization

- 27% reported operating below 60% utilization

When asked their 2024 financial performance:

- 20% of businesses reported operating at break-even

- 25% reported operating at a loss

In summary, 45% of business responding to the survey operated under 70% utilization in 2024 and 45% were either break-even or in the red.

To learn more about the Forisk Research Quarterly (FRQ), click here or email Nick DiLuzio at ndiluzio@forisk.com.

[1] July/August 2025 issue of Timber Harvesting magazine

[2] These assumptions are a hypothetical example and are not intended as suggestions or industry standards.

Leave a Reply