The video game Tetris became so popular and widespread in the 1990s and 2000s that it inspired a verb meaning “to fit or arrange different shapes together” in a limited space, just as you might pieces of a puzzle or clothes in a suitcase or, wait for it, numerous private forest tracts into a larger timberland portfolio. Earlier this week, two publicly traded timber REITs, PotlatchDeltic (PCH) and Rayonier (RYN), announced their intent to combine firms in Q1 2026. The new to-be-named company would own 4.2 million timberland acres in the United States while accounting for 29% of the timber REIT sector’s market capitalization per the FTR Index.

While PotlatchDeltic and Rayonier each hold diversified portfolios of timberlands, the public timber REIT sector itself will become condensed-milk concentrated, going from three firms to two (the new entity and Weyerhaeuser (WY)). That’s it. Scaling these timberland-owning firms to the overall public REIT sector provides additional context, as the timber REITs comprise just over 1.6% of the total REIT sector’s ~$1.47 trillion market cap.

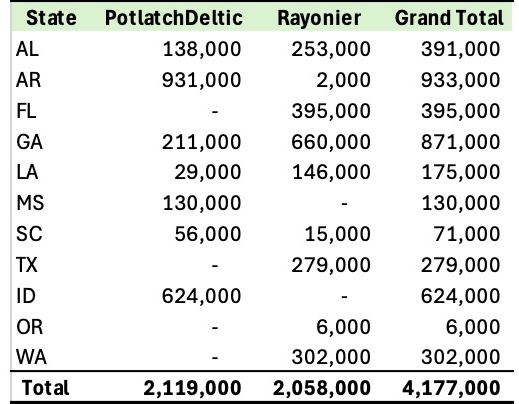

The implications of the announced merger on timberland investors generally and wood-buying firms locally differ. Many “spatial” synergies exist. Of the 11 states involved, both firms previously overlapped in five (Alabama, Arkansas, Georgia, Louisiana, and South Carolina). Three states – Arkansas, Georgia, and Idaho – account for 58% of the total combined acreage, with Arkansas alone holding over 933,000 acres, or 22% of the total footprint.

Figure: State Concentrations of Timberlands Owned by Post-Merger PotlatchDeltic and Rayonier, acres

For timber REIT investors, the analysis of such a merger begins with tracking what can be measured publicly, and this starts with synergies. In addition to a larger timberland footprint, this deal combines Rayonier’s healthy balance sheet with PotlatchDeltic’s manufacturing business.

Strategically, the firms took a page from the past by reintegrating the largest pure-play public timberland owner (Rayonier) with PotlatchDeltic’s recently expanded wood-using mills. In effect, the deal embraces the potential for generating value over the cycle through vertical integration, while seeming to acknowledge the challenge of simply finding, fitting, and acquiring private timberlands that fit the portfolio in the current market.

Further analysis of the announced merger will appear in the Q4 2025 Forisk Research Quarterly (FRQ), which includes forest industry analysis and timber price forecasts for North America. To learn more or to subscribe to the FRQ, please contact Nick DiLuzio (ndiluzio@forisk.com).

Leave a Reply