This post is an excerpt from the Q1 2026 Forisk Research Quarterly (FRQ), which includes forest industry analysis and timber price forecasts for North America.

Introduction

2025 was a tough year for lumber manufacturers. Lumber prices dropped 8% and housing starts declined 1% in the U.S. Firms shuttered mills in all major regions and North American softwood lumber capacity fell 2% from 74 BBFT to 73 BBFT. Despite this, firms are planning and making investments in strategic mills and wood baskets.

Forisk tracks over 2,300 forest industry mills, including planned capacity changes, to publish the North American Forest Industry Capacity Database and generate industry research and projections in the Forisk Research Quarterly. From the mill database, Forisk annually publishes a list of the top 10 softwood lumber producers in North America, along with notes on changes.

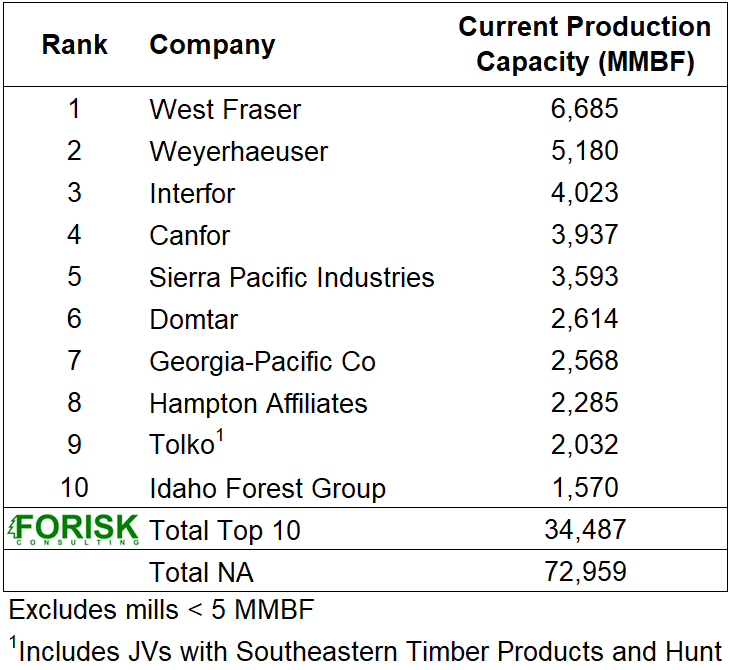

Top 10 North American Lumber Firms

The largest lumber firm in North America is West Fraser, followed by Weyerhaeuser, then Interfor. The top 10 lumber manufacturing firms in 2025 are the same firms and ranking as 2024 and represent 47% of North American capacity. Top 10 firms have 34 BBFT of capacity, down by 1.4 BBFT (-4%) from 2024.

West Fraser expanded the Henderson, TX sawmill in 2025 and shuttered sawmills in Augusta, GA and 100 Mile House, BC in 2025. Weyerhaeuser completed a modernization project at Dodson, LA. Interfor closed the Ear Falls, ON mill and reduced shifts at Dequincy, LA; Grand Forks, BC: and Gogama, ON. Canfor closed the Darlington and Estill sawmills in SC and completed an investment at the Fulton, AL sawmill. Domtar closed the Maniwaki, QC sawmill and the Glenwood, AR mill. Tolko advanced the expansion at the Jasper, AL sawmill and completed the expansion at the Ackerman, MS mill with STP.

Interfor, Sierra Pacific, Canfor, Weyerhaeuser, and Hampton Affiliates have ongoing investments and expansions in the next three years. Also, Domtar plans to close two mills in eastern Canada (Ignace and Outardes) early this year.

Data Source: Forisk North American Mill Capacity Database

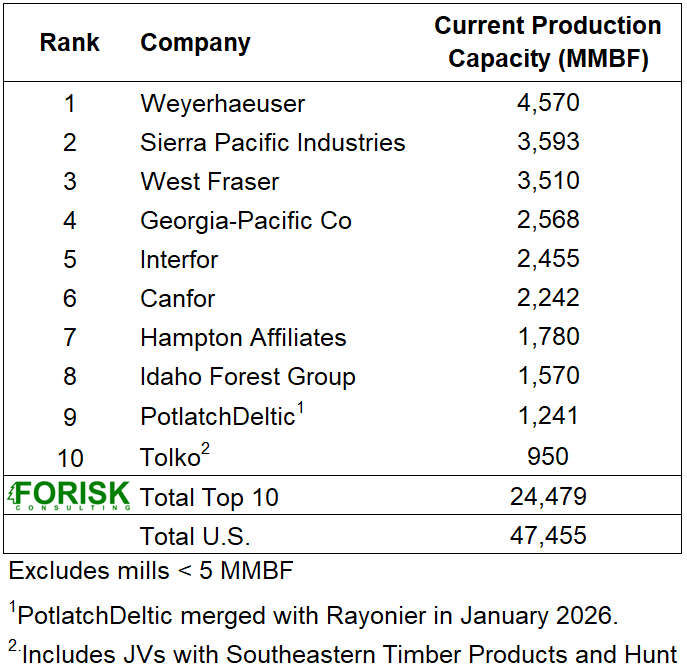

Top 10 U.S. Lumber Firms

The largest lumber producer in the U.S. is Weyerhaeuser, followed by Sierra Pacific Industries, and West Fraser. Top 10 firms have 24 BBFT of capacity, down by 0.2 BBFT (-1%) from 2024. Relative to 2024 rankings, Sierra Pacific Industries inched up to gain the number 2 spot on the list, knocking West Fraser to number 3. Tolko replaced Biewer as number 10 on the list. Top 10 firms represent 52% of U.S. softwood lumber capacity.

Data Source: Forisk North American Mill Capacity Database

To learn more about the Forisk Research Quarterly (FRQ), click here or email Nick DiLuzio at ndiluzio@forisk.com. To produce custom reports and maps, check out Forisk’s North American Forest Industry Capacity Database. Discounted rates available for companies that also subscribe to the Forisk Research Quarterly (FRQ).

Leave a Reply