Year-to-Date Housing Activity

Amid a historic spike in economic policy uncertainty, first quarter housing growth remained seasonally resilient. Building permits authorized through March totaled 343 thousand units, down just 4% from last year’s Q1 totals. Year-to-date housing starts through March were 316 thousand units, in line with Q1 totals over the past 2 years. The total number of housing units under construction decreased 15% since last year, down from a high in Q3 2022. Housing completions totaled 355 thousand units, up only 1% from last year’s Q1 totals.

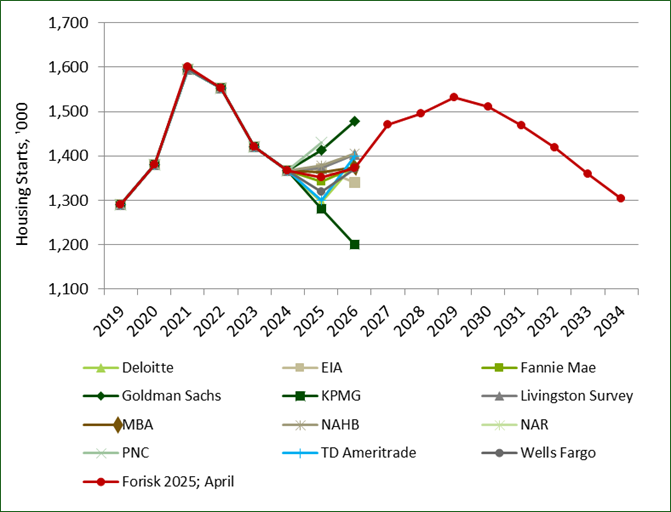

Housing Outlook

Forisk’s updated U.S. housing outlook reinforces our longer-term view, which is determined primarily by major demographic shifts: lower birth rates, higher death rates, and lower rates of immigration. Our near-term outlook, however, has shifted down slightly since last quarter. We now expect housing starts to total 1.35 million units in 2025 and 1.37 million units in 2026. This is informed in part by our survey of professional forecasters who revised their near-term outlook downward. Of the 11 surveyed forecasts, 9 revised their 2025 outlook for housing starts downward. While the spread across 2025 housing forecasts remains similar to last quarter, the range of 2026 forecasts shrunk from 313 thousand starts to 279 thousand starts, reflecting more consensus around a slowing housing sector over the next two years. The changes come as economic growth outlooks have also slowed, with many forecasters predicting a recession this year. Our expectation of a recovery in annual starts to 1.47 million units in 2027 is driven by the underlying housing shortage, which remains prevalent in the U.S. economy.

Data Sources: Deloitte, EIA, Fannie Mae, Goldman Sachs, KPMG, Livingston Survey, Mortgage Bankers Association (MBA), National Association of Home Builders (NAHB), National Association of Realtors (NAR), PNC Bank, TD Ameritrade, Wells Fargo.

Near-Term Risks to the Housing Sector

While longer term risks to Forisk’s housing outlook relate to demographic shifts, near-term risks arise from volatility in U.S. treasury markets. Recent policy developments have placed upward pressure on treasury yields, with which mortgage rates are closely related. Federal debt issuance is to increase beginning in the next fiscal year, and investor reservations about the stability of the US dollar have lowered the demand for U.S. treasuries over the past month. These two shifts in the treasury market, if sustained, should raise bond yields and consequently also mortgage rates. The result would slow the pace of annual housing growth.

This post reports on Forisk’s Base case housing scenario for the Q2 2025 Forisk Research Quarterly (FRQ). To learn more or to subscribe to the FRQ, please contact Nick DiLuzio (ndiluzio@forisk.com).

Leave a Reply