This post is third in a series related to the Q3 2025 Forisk Research Quarterly (FRQ), which includes forest industry analysis and timber price forecasts for North America. To learn more or to subscribe to the FRQ, please contact Nick DiLuzio (ndiluzio@forisk.com).

By David Rossi

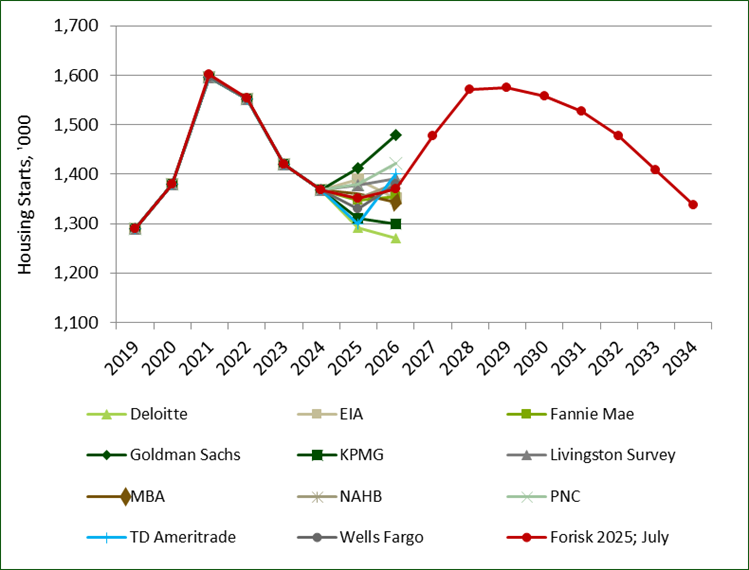

YTD Housing Activity

Halfway through the year, the housing sector remains in line with our expectations. Through June 2025, U.S. housing starts totaled 367 thousand units, down only 1% from last year’s totals through June 2024. This represents an average annualized pace of 1.36 million units, down 2% from our outlook at the start of the year and within 1% of our reported outlook in April. As shown in the chart below, our updated survey of housing forecasts reveals a similar consensus on 2025 housing starts. The survey re-affirms our near- and longer-term views on the housing sector.

The Near-Term Outlook and Beyond

Forisk’s updated outlook for 2025 U.S. housing starts is 1.35 million units, in line with last quarter. As before, we project a slight recovery to 1.37 million units in 2026. The range between the highest and lowest forecasts for 2026 housing starts has remained steady since last quarter at 279 thousand units. This reflects a growing consensus around slower economic growth and similar levels of housing activity as this year. Starts are then expected to grow to 1.57 million units per year by 2029. This is supported by strong underlying demand for new homes and a relatively low housing inventory for sale. Beyond 2029, we expect higher death rates, lower birth rates, and lower rates of immigration to eventually weigh on household formation rates. These factors are expected to pull annual starts back below 1.35 million units per year by 2034.

Data Sources: Deloitte, EIA, Fannie Mae, Goldman Sachs, KPMG, Livingston Survey, Mortgage Bankers Association (MBA), National Association of Home Builders (NAHB), PNC Bank, TD Ameritrade, Wells Fargo.

Leave a Reply