Co-authored by Pat Jolley

This post is an excerpt from the Q3 2025 Forisk Research Quarterly (FRQ), which includes forest industry analysis and timber price forecasts for North America.

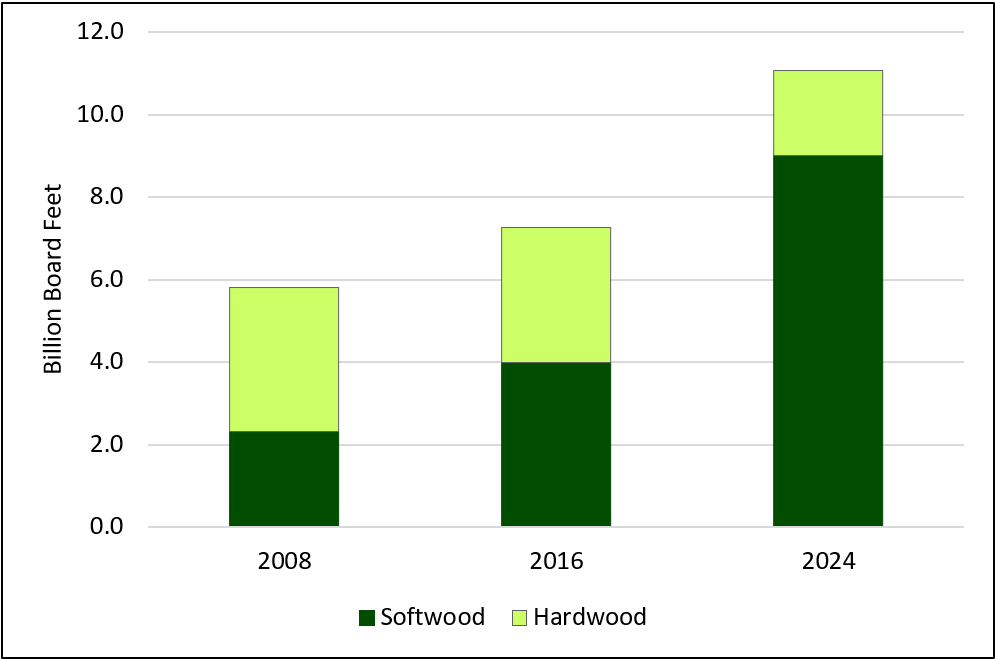

The U.S. pallet industry produces an estimated 600 million new pallets annually. Over the past 16 years, the industry has transitioned from predominantly hardwood to using mostly softwood. Pallets account for about 1 out of every 3 hardwood lumber boards consumed in the U.S. and about 1 in 6 for softwood lumber.

In 2008, hardwood species comprised 60% of the lumber used in pallet manufacturing, with softwood at 40%. By 2016, the balance shifted to 45% hardwood and 55% softwood. As of 2024, softwood accounts for over 80% of pallet lumber use at approximately 9 BBFT annually, while hardwood usage has declined to approximately 2 BBFT. The shift to softwood lumber sources is from a combination of favorable economics and physical properties, including plentiful supplies of cost-effective softwood timber, its lighter weight, ease of processing, and compatibility with heat treatment protocols that enhance durability and phytosanitary compliance.

From 2008 to 2016, total lumber consumption by the pallet industry grew by 25%, followed by an additional 53% increase from 2016 to 2024. In total, the sector has added over 5 BBFT of lumber consumption over the past 16 years, becoming a sizeable industry in the U.S. forest products sector.

Data Sources: Hardwood Market Report, U.S. Census, Hobbs, S. et. al.*, Forisk.

*Hobbs, Sean, Laszlo Horvath, and Brad Gething. “Investigation of the Status of the Wooden Pallet Market during the COVID-19 Pandemic.” BioResources, vol. 20, no. 2, 2025, pp. 3047-3074. https://doi.org/10.15376/biores.20.2.3047-3074.

To learn more about the Forisk Research Quarterly (FRQ), click here or email Nick DiLuzio at ndiluzio@forisk.com.

Interesting, looking forward to reading the full report this weekend.